Posting random videos unrelated to stocks isn’t him tricking anyone. The buyers are tricking themselves.

Does (or should) the process matter if the end result is market manipulation?

Who’s to say why the market moves? Every person who buys or sells influences the market to a small extent. The illegal part comes from public deception.

Would you say Buffett isn’t allowed to say he owns some stock and likes it, just because others are likely to drive it up buying off that revelation? If that’s not allowed, it is still his fault if he has to disclose a 5% stake under the SEC rules?

If you don’t believe me on the law, take it from the retired head of SEC’s market abuse division -

For the SEC to sue Gill for manipulation, it would need evidence that he deceived the market in some fashion. But there is nothing clearly deceptive about Gill’s tweeting of cryptic memes or revealing the size of his GameStop position. It has reached a whopping $260 million in shares and options contracts, according to a post on his Reddit account on Monday afternoon.

“What he’s doing is exploiting a gap in the rules,” said Daniel Hawke, a partner at the law firm Arnold & Porter Kaye Scholer and former head of the SEC’s market-abuse unit. “He is using his celebrity and influence to draw people to buy the stock. The rules that exist do not permit the SEC to prosecute that conduct unless there is an element of deception.”

Gill, a former registered stockbroker, is likely to have a solid understanding of regulations governing stock trading. He holds several securities-industry licenses, and a decade ago he was the chief compliance officer at Lucidia, a New Hampshire-based investment-advisory firm

market veterans say Gill isn’t doing anything wildly different from a Wall Street fund manager who holds a stock and discusses it on television… “He’s hardly the first guy to talk his own book,” Sosnick said.

Any public statement about the market or the economy by anyone with influence could be seen as market manipulation. Trump media could move with a lot of things Trump puts out on social media. Same with Musk and Tesla. Dimon with Chase, etc.

So you either ban any public discussion from anyone about the markets or the economy, or you have to agree on a process that defines what is legal market manipulation and what is not.

The process matters greatly just like it does when we decided to draw a line on deceptive advertising. Marketing is allowed to promote some features of a product while overlooking its downsides. That’s agreed to not be deceptive. Only if they claim something provably false about their product, can they get in trouble with the law.

I believe you, I was also asking on whether the law should be updated. I agree with the above ^.

He’s half way to a billion, and that’s with a $46 stock price. It’s up another 15% to $54ish on the news.

https://old.reddit.com/r/Superstonk/comments/1d9rq9t/gme_yolo_update_june_6_2024/

GME stock hit a high around $67 in the after hours as people look foward to Kitty’s livestream event on YouTube tomorrow at noon. His account is up to a billion valued at the recent highs.

GME the company pulled the rug on the Kitty followers and meme crowd. They pre-announced earnings this morning and filed to sell another 75M shares which would be $2B or so more stock (on top of the $1B they recently sold when it went crazy in May last month). Stock is in the mid $30s, down from mid $60s nearly -50% as of today.

Live by the meme, die by the meme.

bump

In just 3 days, GameStop sold another $2B worth of stock into the market, averaging about $28/share. It’s trading in the $30s again on the news the company has stopped printing stock.

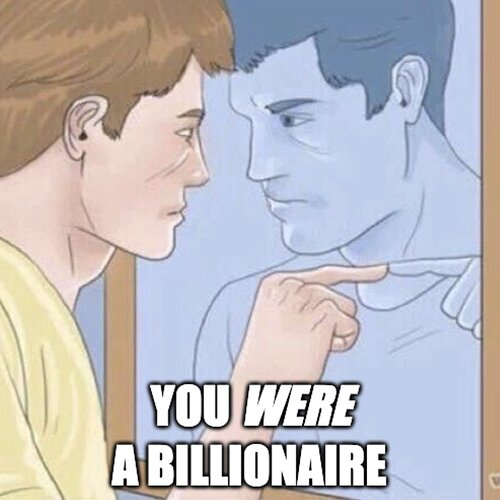

Kitty with some self reflection