I bonds are already up to 3.3% annualized for the next period and that’s with 4 months to go. At this rate, we’ll get 10% annualized for the next block, but I don’t think it’ll come in quite that high.

For I Bonds. The May number is the second in a six-month string that will determine the I Bond’s new variable rate, which will be reset on November 1 based on inflation from March to September. So far, just two months into this rate-setting period, the I Bond would get a variable rate of 3.34%. Since four months remain, a lot will change before the November reset.

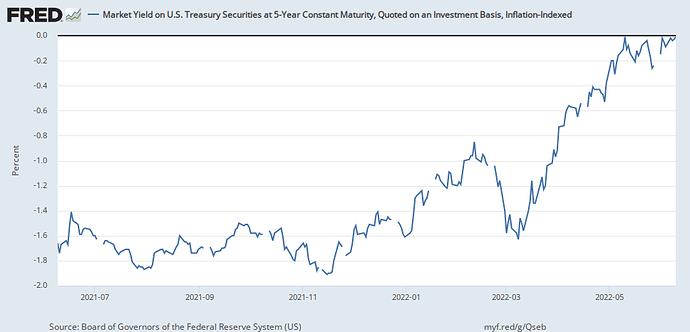

- BREAKEVEN INFLATION RATES ON FIVE-YEAR TIPS RISE TO 3.14%, HIGHEST SINCE MAY 18

On the subject of TIPS, I saw this good comment elsewhere, which cast a bit of doubt on the role of TIPS in protecting against inflation.

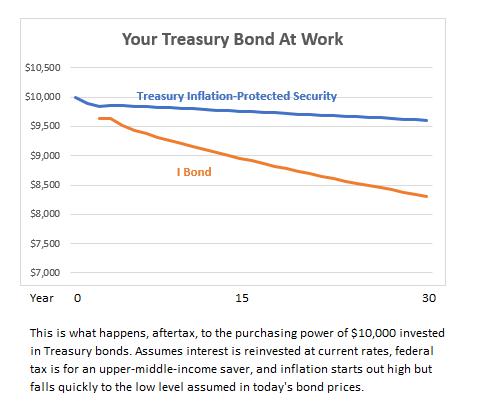

Bad yields and bad taxes -

In terms of yield, TIPS are actually the worst instruments to hold. This is because the way they work is that, say, a Treasury bond is issued at a 3% coupon at the same time that inflation is expected to average around 3%. What will happen is that the TIPS coupon will be set at right around zero (the latest 10Y TIPS auction I’ve seen had a coupon of 0.125%). And the way the inflation bit works is that the principal gets adjusted upward based on the move in CPI. So if inflation is 8% then your coupon in effect increases from 0.125% to 0.135% from the principal multipliers. I guess that’s something but it’s a long way to 8%. What’s worse is that the uplift to the principal is treated as currently taxable income (even though you don’t get that principal uplift for 10 years)…

And lots of interest rate risk too, confounded with your inflation protection can lead to losses -

The other thing to keep in mind is that TIPS don’t always give you the performance of inflation. For example, inflation has been running around 7-8% year-on-year. What would you guess is the performance of the iShares TIPS Bond ETF year-to-date? Well, it’s 8.5% except with a minus sign in front of it. WTF? Well, just like nominal Treasuries are a function of nominal Treasury yields (or the other way around if you prefer), TIPS are a function of real yields. 10Y real yields have increased from -0.5% to +0.7% year-to-date and higher yields are bad for bonds and TIPS are bonds. Specifically, they are bonds with a long duration so they are down. Real yields are much more reasonable now so I don’t expect TIPS bonds to keep dropping if inflation stays here but they aren’t the usual slam dunk in a period of high inflation – you need to look at the starting point of real yields too.