It’s volume today is over 2X total shares outstanding

Hahaha

Curious are you pointing and laughing at them or you threw lottery ticket money into it (or are you shorting it)?

BB is on the same trajectory.

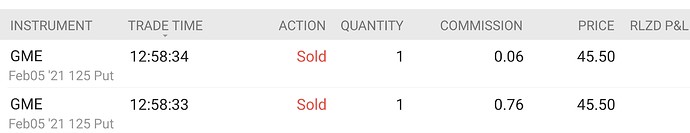

After the big move on Friday, I shorted just a little GME and bought just a few OOTM puts for this coming Friday. Both are somewhat underwater at the current levels. I thought about being long the squeeze upside to FIZZ and AMCX, and am short some AMC despite their favorable creditor update as of this morning.

How’s it work when the short interest is more than total shares outstanding (or is not, since that sounds impossible, but I’ve seen that claim didn’t bother to verify) and people buy a ton of calls and shares and refuse to sell any shares? (Can’t picture the logistics)

WSB has someone with ~$10M gains. They keep buying calls

If you can borrow shares to short initially, none of that other stuff matters. Sure the price can go up or down, and clearly there’s no one “refusing to sell” given this traded $15B in volume today. The price risk and return profile is obvious; the less obvious ones are paying high borrowing costs (75% annually each day), the risk that your broker might double or triple the margin requirements to hold the short, and the risk that you lose your located shares and have to buy back the shares at a bad time.

Seeing as that is more than twice (as of 2pm when I looked, unless I made an error, fully possible) the shares outstanding, it’s really a small subset of shares that were all traded multiple times, right? I wonder how many times on average the same shares were traded back and forth the same day today? 10? 20? 50? More?

What’s a realistic percentage of shares owned at the start of the day that were actually “sold” by the original owners as of the start of the day?

On a day like today, more I would guess. Contrary to what you might think, shares are not a conserved quantity - people can borrow them and create new ones (together with new short loan obligations), just like I can take $1 and loan it to you and you can loan it to some other guy and now there’s $3 running around and $2 in debt. Short interest and trading volume are definitely not limited by the float or the shares outstanding.

Well, more transaction volume but the same shares. New shares would be limited by whatever shares are approved already for issuance and/or company issued options? They’d have to approve and/or(? I dunno regulatory requirements) announce in advance approval to issue new shares, right?

I wasn’t thinking this through. Obviously possible. It’s like fractional reserve banking and the money factor (with a required reserve of 0%, and the fiat currency being “stonks”). So I suppose you could theoretically have an infinite amount of short-interest.

It doesn’t sound like a “good idea” though.

GME

That’s the one I was referring to

I’m too cautious now. I should’ve picked up the AAPL leaps when I posted I was thinking about it. Then I’d have sold them this morning for a quick $50k gain, and been happier holding onto my shares. Instead I’m starting to stress about setting some price target to sell some AAPL shares, still having nothing I’ve found to replace them…

In my experience, losing loaned shares always comes at bad time … only three times ever for me, but painful times they were.

I’m officially in a meme stock with no actual value. I’m way late to the party though.

I’m currently at $69 unrealized gain on it after 4 minutes.

BB seems less insanely overvalued (~double “price targets”, anyways as opposed to 10x), maybe should have bet there instead.

I also picked up 1k T shares @ $29.68.

Still have $70k cash in taxable and $30k liquidity in ira.

And $150k(don’t remember exactly) cash in 403b.

GEO and CXW not liking these kinds of headlines, and I expect there will be plenty more where those game from.

The stocks are cheap, but maybe not cheap enough. I had some of their debt, which I sold.

Any BB thoughts?

GME halted at +60% (at ~+90% now).

I went short 6 10 BB puts as well. Guess today’s my one day at the casino this year. (Or the first one, anyways…)

~$10k at risk (if it goes to $0). Realistically, more like $5k $8k at risk on BB and ~$10k on GME.

GME at $200 AH?

It was $243, now it’s at $219.

Yay, maybe I can close in the morning and take my unearned $5k in the Roth