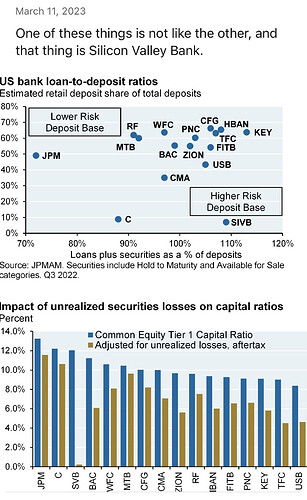

High losses relative to equity, low levels of insured depositors (who therefore might be worried), etc.

Here’s the JPM research piece those charts are from

We could have more runs on the bank this week. Any educated guesses what the FDIC, Fed, and Treasury Department would do to soothe fears/avoid panic?

I think we have to allow people and companies to pay the consequences for their poor decisions.

The bank apparently bought long term bonds during the fed’s quantitative easing. Even at the time, any reasonable person could see the historically low long term rates were unsustainable. They should have accepted the slightly lower yields of short term tbills for part of their portfolio instead of taking the risk with all longer-term securities.

The venture capital backed firms who deposited hundreds of millions of dollars in the bank without doing their due diligence also need to pay the consequences for their mistakes.

The parties to these mistakes need to bear the consequences instead of expecting the rest of us to bail them out at the expense of higher inflation for the whole economy. The FDIC should fulfill its commitment to insure up to $250,000 but no more. If other banks lose deposits then it so be it. Savers need to do their diligence to be sure they invest in sound banks.

FRC getting run, not sure it’s big enough to take them down. They’re at risk tho.

They put out a defense saying everything’s fine.

https://ir.firstrepublic.com/static-files/295faa27-f208-4936-81ff-6c8bfa0fb6b5

There won’t be a bailout for SVB, as per Secretary Yellen:

If the public panics, the bank is toast whether or not they’re indeed solvent.

I have some (small amounts) with Ally in their money market, and no penalty CD. Do you know whether their MM is covered by FDIC? I’m unsure about the status of MMs in general.

Politics at work. I don’t necessarily disagree with this decision, but you can bet that if the clientele wasn’t a combination of tech unicorns and wineries, that the calculus of the decision might be a bit different.

Agreed. If the contagion spreads to other regional banks that serve average people, there might be a change in policy. But how bad does it have to get first? Reminds me when Treasury implemented rescues after Lehmann went belly up and markets began to freeze.

Checking the FDIC insurance status of an account needs to be part of opening it. If you do not have the terms and conditions you probably received when you opened the account, it is worth a visit to their website. If that does not clear it up, give them a call but be sure you get whether the account is insured in writing. If it is not insured, I suggest you pull your money out.

Average people dont have accounts that exceed the insurance limits and need to be bailed out.

Generally, money market accounts are insured no differently than savings. Money market mutual funds are not. Not sure how many, if any, exceptions there are to that ‘rule’.

This was my thought as well… but a bank run on a community bank could impact small businesses with deposits in excess of $250,000. As I said before, the political impact of that looks a lot worse if it’s an independent auto repair shop or a mom and pop restaurant versus a winery or tech startup.

Politically, at least in this context, a business with a $500k cash bank balance is one of the evil rich, no matter how “small” the business may be.

Do business accounts/entities receive FDIC coverage at all? I’d assume those opened with a SSN would be covered under the owner’s standard coverage, but what about corps using TINs?

Let’s try to move the “run on the bank” discussions here.

Interesting insight into cash reserves of small businesses.

Median cash reserves across all sectors of small business is just over $12,000.

And 75th percentile in high-tech manufacturing is only $142k (sector with highest typical cash reserves in the report)

I suspect the percentage of small businesses at risk from exceeding FDIC insurance limits is much much smaller than the percentage of small businesses at risk from being under-capitalized ![]()

I’ll try to make this relevant to “individual stock discussions” rather than bank failures ![]() .

.

Holy crap that is a lot lower than I would have thought. I would be on pins and needles trying to make payroll twice a month with that kind of money. Perhaps I am more risk averse than average… but a median of 12k, really? What happens when the water heater goes out? Or when rent is hiked up?

I get that idle cash on a balance sheet means those are dollars that can’t be used for growth… but a rainy day fund is a necessity, no?

These are all small businesses and the absolute amount is not relevant. Maybe the median business doesn’t have a water heater or rent? The only thing relevant, I think, is that the median cash buffer is enough for 27 days of expenses for that median business. Doesn’t seem unreasonable to me.

Also these are all Chase Business customers. I wouldn’t keep any reserves at Chase either – their interest-bearing accounts are barren.

And for many small businesses, the owner continuously siphons off free cashflow. And considers their own pocket to be the rainy day fund, should it be needed.

SIVB-now-SIVBQ and SBNY resumed trading otc today, having been kicked off Nasdaq. I covered my shorts. They are $0.30 and $0.13 per share respectively as I write this, down 99.x%.