Congrats on a very nice move. I’ve given up on (been scared off of) shorts and now only buy puts. I misread Amazon terribly, and while rewarded in the end, Zitel bent me over more than expected before finally paying off.

2023 Q1, total returns

I guess banking crisis really are good for gold, but moreso for Bitcoin. Let’s hear it for the crypto bulls, back to mid '22 levels but up nicely off the lows.

| ticker | type | Q1’23 |

|---|---|---|

| BTC | bitcoin | +73% |

| QQQ | tech | +14% |

| EFA | foreign (developed) | +14% |

| SPY | large caps | +10% |

| GLD | gold | +7% |

| JNK | junk bonds | +5% |

| IWM | small caps | +5% |

| CPI | inflation (est) | +2% |

| BND | bonds | +2% |

| USD | cash | +1% |

| PFF | preferreds | -0% |

| EEM | foreign (emerging) | -2% |

Woulda been better to just be long SPY, but where’s the fun in that?

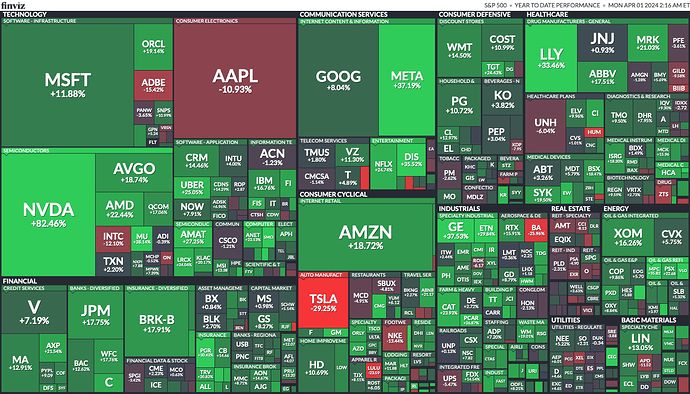

S&P500 stocks YTD - big tech, big winners; others up more modestly overall.

The total Stock market Index ETF, VTI, is up 7.2%

FRC, the most troubled of the non-bankrupt banks, looks to be headed for zero. They ran up into earnings and then have been collapsing every since. Layoffs, half their deposits left, trying to fire sale half their assets, and the Feds making noises like maybe they won’t let them keep borrowing lots of Fed money to make up for their lost deposits for much longer.

When a bank loses their customers’ (or regulators’) confidence, its game over. I was short some and now I’m short a lot more.

BBBY is down to 12c or so, bankrupt, with the business headed for liquidation and the stock headed for delisting. I’m no longer short as much, but this was pretty obvious unless you joined a cult of supportive meme stock “bagholders” trying to relive their glory days of GameStop.

Here’s a nice recap. BBBagggY

this is an article for nobody. Perhaps some large language model AI will eventually ingest it, and it will make the the internet a slightly less baggy place one day. But it is not this day. Look at the below, and weep for humanity

And some of the sad stories of misguided investors

Last week

Oh, and

Gift Cards . Use em’ or lose em’ folks. The debtors will accept them for fourteen days!

FRC - It’s dead, Jim.

https://www.reuters.com/business/finance/first-republic-shares-gain-hopes-rescue-deal-2023-04-28/

The U.S. banking regulator decided the troubled regional lender’s position has deteriorated and there is no more time to pursue a rescue through the private sector, the source told Reuters,

Still trading at $2 tho, and overvalued by about $2.

2023 Q2, total returns

Normal intelligence wouldn’t have had you bet big on tech stocks in a rising rate environment, but with Artificial Intelligence, you could have really knocked it out of the park this quarter!

| ticker | type | Q2’23 |

|---|---|---|

| QQQ | tech | +15% |

| SPY | large caps | +9% |

| BTC | bitcoin | +7% |

| IWM | small caps | +5% |

| EFA | foreign (developed) | +3% |

| USD | cash | +1% |

| CPI | inflation (est) | +1% |

| EEM | foreign (emerging) | +1% |

| JNK | junk bonds | +1% |

| PFF | preferreds | +1% |

| BND | bonds | -1% |

| GLD | gold | -3% |

With enough big short bets on some of the bankruptcies mentioned above, this was quite a good quarter!

S&P500 stocks Q2’23 - big tech, big winners; others up decently but less so.

YTD TSLA is up 159%. Up 7% today. Much short covering.

2023 Q3, total returns

AI giveth, and Fed rate worries taketh away. The “higher for longer” view has become more recently and widely accepted, with negative consequences for both equities and bonds. Cash and inflation were the only gainers during this period.

| ticker | type | Q3’23 |

|---|---|---|

| USD | cash | +1% |

| CPI | inflation (est) | +1% |

| JNK | junk bonds | +0% |

| PFF | preferreds | -2% |

| BND | bonds | -3% |

| GLD | gold | -3% |

| SPY | large caps | -3% |

| QQQ | tech | -3% |

| EFA | foreign (developed) | -5% |

| IWM | small caps | -5% |

| EEM | foreign (emerging) | -5% |

| BTC | bitcoin | -9% |

I guess those were some undemanding benchmarks to beat, but with a few uncooperative shorts for me this past few months (CVNA, APRN; since abandoned), I didn’t do particularly well.

S&P500 stocks Q3’23 - energy sector did well, and a few big tech names showed continued strength, but there was a lot of weakness to go around generally.

2023 Q4, total returns. Everyone’s a winner!

Crypto bulls took the prize this quarter with massive gains, but bonds and stocks both did well as higher interest rate fears faded with improving inflation numbers and the Fed’s optimistic comments.

| ticker | type | Q4’23 |

|---|---|---|

| BTC | bitcoin | +57% |

| QQQ | tech | +15% |

| IWM | small caps | +14% |

| GLD | gold | +12% |

| SPY | large caps | +12% |

| EFA | foreign (developed) | +11% |

| EEM | foreign (emerging) | +8% |

| JNK | junk bonds | +7% |

| BND | bonds | +7% |

| PFF | preferreds | +6% |

| USD | cash | +1% |

| CPI | inflation (est) | -0% |

Q4 went reasonably well for me, although not without some fireworks (the bad kind) on the short side.

handy link for these

inflation link

crypto link

S&P500 stocks for Q4 showing lots of green.

Here are the 2023 yearly numbers:

| ticker | type | 2023 |

|---|---|---|

| BTC | bitcoin | +155% |

| QQQ | tech | +55% |

| SPY | large caps | +26% |

| EFA | foreign (developed) | +18% |

| IWM | small caps | +17% |

| GLD | gold | +13% |

| JNK | junk bonds | +12% |

| PFF | preferreds | +9% |

| EEM | foreign (emerging) | +9% |

| BND | bonds | +6% |

| USD | cash | +5% |

| CPI | inflation (est) | +4% |

S&P500 stocks YTD - tech, financials, and related sectors did quite well, while energy, healthcare, and consumer sectors were mixed or weaker.

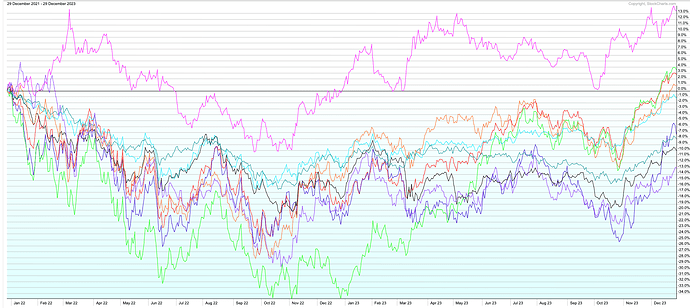

You’d think 2023 was some big win for all investors, but consider it in the context of 2022. Looking at a chart of these major indexes over the last 2 years, many were down around -10% net (EEM, IWM, BND, PFF), and another group were flat or only up a few % overall (SPY, QQQ, JNK, EFA).

Remember if SPY was -18% and then gains +26% that’s only +3% overall due to compounding the second year gains off a lower base value. QQQ and BTC had big losses last year, so their dramatic gains this year resulted in roughly just a recovery for longer term investors. Interestingly, gold was the best by far over the last 2 years, up 13% overall.

These short-term results are interesting but, as always, it’s good to keep a longer-term perspective. Of particular interest to me is AMZN. I hold it along with BRK.b in my California HSA, since they do not pay dividends. I had the bad timing to fund my position in AMZN in 2022. I promptly had my head handed to me as the stock lost about 50%. My good old steady Berkshire Hathaway stock kept gaining throughout the period from 2022 to now. AMZN recovered some of the loss as the graphic illustrates but it’s still about 20% down.

Isnt a HSA where you want income like dividends, since it’s tax sheltered?

California and New Jersey do not recognize HSA’s as tax deferred accounts. They treat them as taxable accounts. The HSA trustee does not report income on them, since they are not federally taxable. This makes doing income tax returns a royal PITA. My approach to simplify this is to minimize the state taxable income. TurboTax is getting a little better at supporting this, but it’s still tricky.

2024 Q1, total returns. Stocks up, crypto way up, fixed income languishes… Risk on, baby!

Another quarter of huge crypto gains, up over +50% for bitcoin, with gold performing among the top of the traditional asset classes as well with a respectable if more staid +8%. With our budget deficits expanding into the trillions and our debt rapidly increasing, it’s tempting to attribute the gains in these inflation hedges to fears about the US dollar and our leaders’ unsustainable fiscal path.

| ticker | type | Q1’24 |

|---|---|---|

| BTC | bitcoin | +58% |

| SPY | large caps | +10% |

| QQQ | tech | +9% |

| GLD | gold | +8% |

| EFA | foreign (developed) | +6% |

| IWM | small caps | +5% |

| PFF | preferreds | +4% |

| CPI | inflation (est) | +2% |

| EEM | foreign (emerging) | +2% |

| JNK | junk bonds | +2% |

| USD | cash | +1% |

| BND | bonds | -1% |

I’m not done counting everything, but it looks like Q1 was pretty friendly to my trading as well.

handy link for these

inflation link

crypto link

S&P500 stocks for Q1 showing lots of green.

(FINVIZ.com - S&P 500 Map)I just had a thought and I suppose this thread is as good as any to ask about it. It’s my understanding that the dividends from ETFs like SGOV and USFR that only hold treasuries are exempt from state and local income tax. Couldn’t one “manufacture” a reduction in state income tax liability by buying them before the ex-dividend date, then selling shortly thereafter? The dividend is not state taxable and would roughly equal or slightly exceed the capital loss and is taxed at the same rate if I’m not mistaken, but the short-term capital loss reduces both federal and state AGI. Am I right or should I take myself directly to jail? ![]()

![]()

Or the loss would exceed the dividend. A dividend payout can influence the price, as can treasury prices, but ultimately the price of an EFT is still based on trader whims. The tax benefit is a small fraction of the dividend, which is a small fraction of the ETF price - there isnt much margin for error before it swings unprofitable. I think it could work, but it’d be barely worthwhile even if it did work out.

There’s very little price fluctuations in the NAV of a short term treasury etf like the ones he mentions. I’m sure the ex-div price drop would be very close to the dividend amount. One problem is sometimes that ETFs don’t declare their dividends predictably, which can make it hard to deliberately buy them (or avoid them).

On the tax side, I think your proposal works with some caveats. If you bought treasuries, you’d pay for the accrued interest (and get an interest paid Sch B deduction) so the net when you sell the next day you’d only net that 1 day’s worth of interest. ETFs are different and consolidate that until it’s paid out, so you do get the whole capital loss. With a monthly payer though, you’d want to be careful of wash sales, since each sale at a loss would be a wash with the next month’s buy. In order to take the capital loss, to reduce your federal capital gains or a little of your ordinary income, you’d want to stop around EOY to avoid delaying the capital losses into the following year. So if you do want the capital loss this year, do the “buy the dividend” in Nov but then skip Dec and start again in Jan.

Right. I’m just wondering if this would be considered legal avoidance by the state tax authority ![]()

I don’t see the problem, because the dividend amount is irrelevant – the share price is reduced by the dividend when the dividend is paid regardless of the actual amount. The only potential problem for other dividend-paying stocks is that dividend influences share price, but for these it doesn’t (shouldn’t?)

The problem I’m referring to is that they don’t tell you until the night it goes ex, so either you can’t sell it (if you don’t want the dividend) or you can’t buy it (if you do want it) since the stock exchanges are closed. But for SGOV, it’s very predictable

https://www.nasdaq.com/market-activity/etf/sgov/dividend-history

I don’t understand why it matters. Whether the dividend is $0.20 or $1.20, the share price will be reduced by that exact amount the night it goes ex.

Example. Day before ex the share is $100.90. The dividend is $0.40. Day of ex the share is $100.50. If I buy before ex and sell on ex, I’ll get a $0.40 dividend and a $0.40 capital loss. Right? The actual amount doesn’t really matter unless I’m trying to generate some exact amount of losses with a single trade.