Gas prices have been down this past week around here. I see it at below $3/gal at most places now where it was virtually impossible to find 1-2 weeks ago.

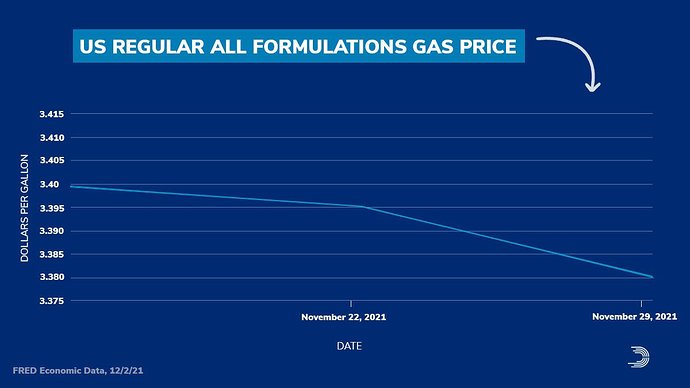

And the Democrats aren’t missing the opportunity to tout the recent decline in a great example of misleading chart layout.

https://twitter.com/dccc/status/1466494036630544394

That’s a 1 week long chart showing a $0.02 decline.

Shows that you can make graphs say anything you want them to say. Dems can try to claim the reserve release has already had an impact and it’s completely misguided. Just as misguided as GOP claiming the gas prices are the result of Biden’s policies.

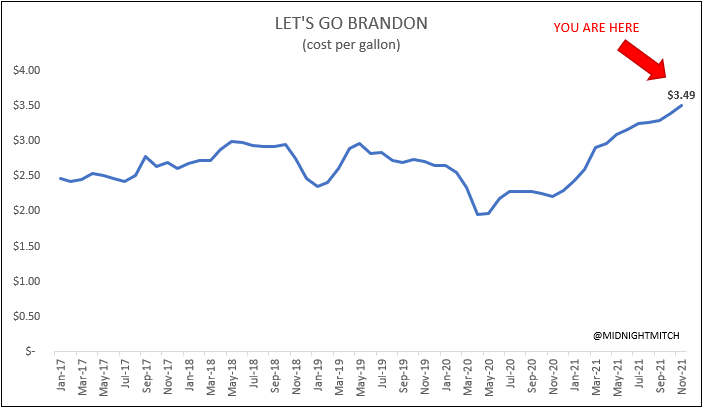

Simple reality is that it’s a global supply market. Crude contracts were north of $80 in November. Now slightly down around $70. Price at the pump lag the contracts trends a bit but still reflect the decrease. A year ago contracts were in the $40s for Brent or WTI and around $50 for the past few years hence the relatively stable gas prices at the pump around $2.50 before that.

Sometimes the tea leaves are just a bunch of herbs in water…

I’ve been waiting for someone who is not me to write this. Thank you for that.

Blog article on inflation from an economist’s perspective

My summary:

What happened, at least through the lens of the simple fiscal theory models in this book? Well, from March 2020 through early 2021, the U.S. government – Treasury and Fed acting together – created about $3 trillion new money and sent people checks. The Treasury borrowed an additional $2 trillion, and sent people more checks. M2, including checking and savings accounts, went up $5.5 trillion dollars. $5 trillion is a nearly 30% increase in the $17 trillion of debt outstanding at the beginning of the Covid recession.

Why did this stimulus cause inflation, and that of 2008, or the deficits from 2008 to 2020, did not do so? Federal debt held by the public doubled from 2008 to 2012, as inflation went nowhere. (Figure 5.6.) From the fiscal theory point of view, the key feature is that people do not believe this debt will be paid back. So why, this time, did people see the increase in debt and not infer higher future surpluses?

First, we can just look at what politicians said. In 2008 and following years, the Administration continually offered stimulus today, but promised deficit reduction to follow. One may take those promises with a grain of salt. But at least they bothered to try. This time there was no talk at all about deficit reduction to follow, no policies, no plans, no promises about how to repay this additional debt.

Second, much of the expansion was immediately and directly monetized and sent to people as checks. The previous stimulus was borrowed, and funded government spending programs that have to gently work their way into people’s incomes.

Whether inflation continues depends on future fiscal and monetary policy, and whether people have changed their expectations of future repayment and the underlying monetary-fiscal regime. If people regard the stimulus payments as emergency budget’’ expenditures that will not be repaid, but the existing 100% of GDP debt still to be repaid, and the additional borrowing of the years ahead back to the ``regular budget,‘’ that will be repaid, fiscal inflation need not continue. If, however, having changed their expectation that greater debts, especially those that finance cash transfers, are now not to be repaid, additional deficits will lead to additional inflation, and additional debt issues will just raise nominal interest rates.

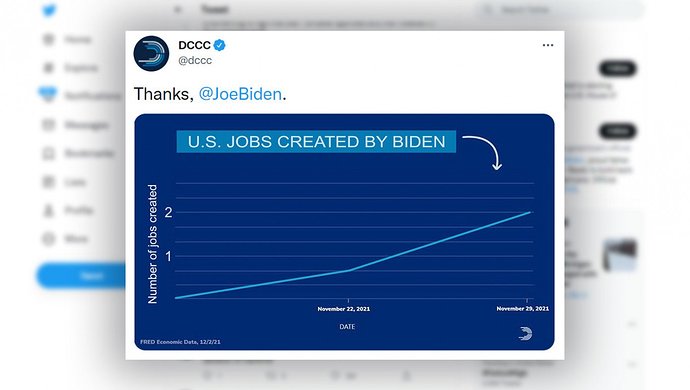

Speaking of charts, some well deserved satire. Read on to find out more about the jobs that were created ![]()

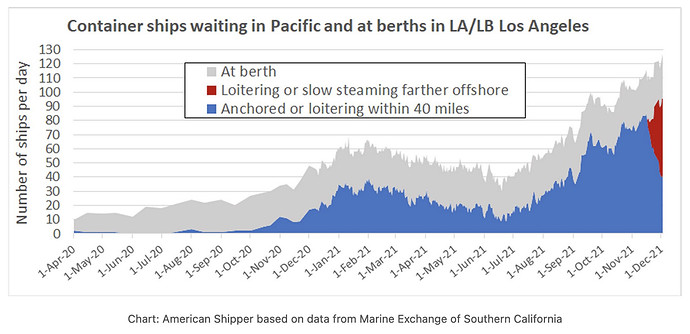

If you heard that the port congestion in LA was getting better, they were mistaken (or in the case of the press, probably lying to you). They just have the ships farther offshore, piled up and waiting.

Joe Biden is the kind of man who deliberately would steer his car into a ditch, crawl from the wreckage, and then probe the ditch for criminal conduct.

Biden shared with CNN anchor Wolf Blitzer his plan to cut gasoline costs: “As president of the United States, use the Justice Department to go in an investigate this whole issue of price-gouging.”

When Biden uttered such baseless paranoia in September, the Associated Press put him in his place. “THE FACTS: There actually is little evidence something nefarious is behind the higher gasoline prices, as Biden suggests.”

It takes profound naivete for Biden not to recognize how his and his team’s anti-oil animus has driven fuel costs skyward. In fewer than 11 months, this administration has:

• Killed the Keystone XL Pipeline

• Threatened to plug the Canada-to-Michigan Enbridge Line 5 pipeline

• Halted oil leases in a sliver of Alaska’s Arctic National Wildlife Refuge

• Stopped oil and gas leases on federal lands

• Proposed a methane tax that could cost this industry up to $10 billion annually

• Encouraged Left-wing activists to pressure financiers to defund oil companie

What an original idea … or plagiarism of an idea we’ve heard before … the Summer of Recovery where “jobs created” became “jobs created … or saved.”

This is just out:

Forecast: Core inflation up 6%, economic growth down

Business economists expect inflation to increase in the fourth quarter and stay elevated for years, according to a new survey.

Nearly three-quarters of the economists surveyed by the National Association for Business Economics said that they don’t expect annual inflation to fall below the Federal Reserve’s 2% target until the second half of 2023 or later.

NABE Vice President Julia Coronado, the founder and president of MacroPolicy Perspectives, said in a news release that the survey panelists have “significantly” ramped up their inflation expectations since September.

“The core consumer price index, which excludes food and energy costs, is now expected to rise 6.0% from the fourth quarter of 2020 to the fourth quarter of 2021, compared to the September forecast of a 5.1% increase over the same period,” she said.

NABE panelists also downgraded their economic growth forecasts for the second NABE survey in a row. The median prediction of inflation-adjusted gross domestic product growth from the end of 2020 to the end of 2021 is now at 4.9% — down from a 5.6% forecast in September and a 6.7% prediction back in May.

You can read this piece, in its entirety, here:

Business economists expect high inflation through 2023

I certainly hope these economists are full of prunes with their forecast. 6% core inflation is destructive and is very challenging to survive.

Bruh it’s just transitory

That made no sense. Here is the US production volume chart: https://www.macrotrends.net/2562/us-crude-oil-production-historical-chart

Compare the volume in November 2020 to the volume of Crude Oil produced by the US in November 2021: 11.1M BRL/day in Nov 2020 vs 11.6M BRL/day in Nov 2021. I don’t see how that volume increase from 2020 to 2021 results in a spike in prices by itself. Current level is about identical to that of the Trump administration in 2018.

That’s the supply side. This far into the pandemic, is demand much higher now than in 2018? I’d think that demand has not fully recovered from 3 years ago but let’s assume it’s about the same. If the US is producing about the same amounts as in 2018 and demand has recovered back to the same levels, why are prices higher (about $2.50/gal in 2018)?

Here’s OPEC production volumes: OPEC Crude Oil Production

Looking back at Nov 2018, OPEC was producing 15% more Crude than now (although they are ramping up production slowly now). That seems enough of a squeeze on supply side IMO to explain the higher prices all other things being equal.

Is it price gouging? I think so but that’s basically the whole purpose of OPEC to create an anti-competitive production landscape to keep prices artificially high. No investigation really needed on their practices. They’ve been doing this forever which is why the US is thankfully not in that cartel of crooks.

@xerty you can’t LIKE both the original post and the one (just above) that calls it out for not making sense! ![]()

*Adobe Digital Price Index: Online Inflation Hits Record High

*Online prices increased 3.5% year-over-year

*November marked 18th consecutive month of online inflation

Gas prices and Brandon administration collusion with the media.

I guess low ethical standards are par for CNN (Cuomo), and Lemon especially.

Interesting that online prices are basically not that much higher than normal inflation levels. +3.5% vs. a very low inflation month around the peak of the pandemic does not seem out of line.

I’m wondering if it’s because of different supply chain for online sales or if it’s simply because much of the online purchases are not tied to gas or food.

Either way, that could explain some difference in perception between people shopping in stores primarily vs. those shopping online much more.

What a clown show over there. These in the space of 10 minutes this afternoon

WHITE HOUSE ECONOMIC ADVISER DEESE SAYS SHIPPING COSTS HAVE COME DOWN ABOUT 25 PCT IN THE PAST FEW WEEKS

WHITE HOUSE ECONOMIC ADVISER DEESE SAYS WILL NOT PREDICT WHETHER PRICE RISES WILL LAST THROUGH NEXT YEAR

WHITE HOUSE ECONOMIC ADVISER DEESE SAYS BIDEN HAS MADE CLEAR ALL OPTIONS SHOULD BE ON TABLE TO ADDRESS CHALLENGES IN ENERGY MARKET

U.S. OIL EXPORT BAN IS NOT ON TABLE AND NOT UNDER ACTIVE CONSIDERATION AT THIS TIME -PERSON FAMILIAR WITH BIDEN ADMINISTRATION’S THINKING

The shipping costs in question are a very specific route (from China to West Coast, off the highs), while most other routes remain elevated, and in any event that’s well over a month too late to impact any pricing this year and is a seasonal decline to be expected.

I’m not saying Adobe is the end-all be-all of online price metrics, but I’m not sure who else is offering those stats.

ETA: I didn’t realize that @xerty quoted all of those stats initially.

Uh, well you’re partially right, and so is whoever you quoted.

However, what they fail to mention is what you pointed out about it being a specific route from China to LA.

The missing tidbit of data is that the 25% shipping cost reduction is due to the ships only being allowed to make 75% of the trek. They then have to drop a mile of anchor and wait in line to get to the port. ![]()