Will this lead to another attempt to leave the borders open?

Shipping costs are high and staying there for a couple years at least

This is a really good article

Brandon setting more records every day, or in the case of inflation, every month I guess.

The energy part in that chart is known and clear. It’s in lock-step with the Crude and Natural Gas price increases. Expected and explanable. The re-opening part seems a bit random. Looks like an initial surge in late Spring then kinda random up and down. To me that looks like impact of re-opening is largely done and we have random seasonal adjustments now.

But the non-reopening components is growing slowly and steadily. That’s troubling because it’s not as easy to tackle as the other causes. In this case, I’m thinking this is the growing impact of supply chain issues (especially shipping but also distribution within the US) and shortages to demand unmet by supplies. That last part won’t go away until supply chain issues are resolved and it’s not looking that promising for a resolution soon.

I deliberately left out forex effects. If anything this year has not seen a weakening of the USD despite all the COVID stimulus money being thrown around in 2020 and 2021. As high as inflation is lately, if forex had been unfavorable, it could have been worse.

Most of the stuff you buy online is imported from China so there is minimal inflation.

The stuff that can’t be imported from China has inflation out of control… housing, rent, food, energy, healthcare, college tuition, etc.

That’s an interesting graph but really two different worlds. Previously there was a free market where private investors would buy bonds based on a reasonable coupon rate.

Now the Federal Reserve has essentially socialized the treasury market. They are buying up a lot of the issuance and manipulating interest rates. The bond market buys based on the expectation of front running the Federal Reserve.

rates lagging due to fed?

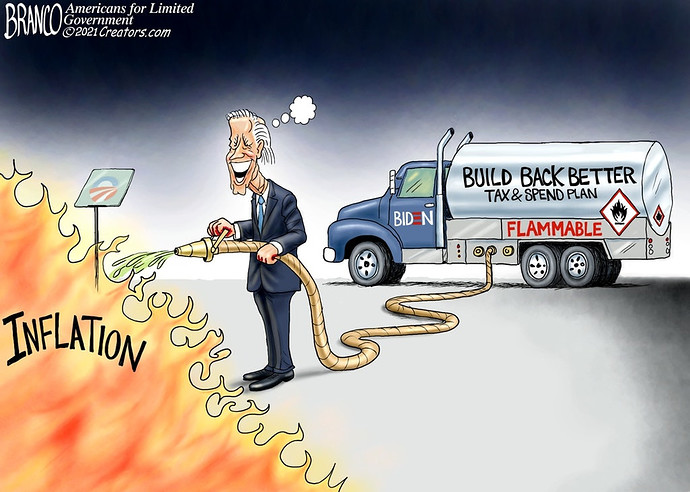

I love the cartoon, but think that image of Uncle Joe is incorrect. I haven’t seen him laugh hard, or stand that straight in a couple of years.

Some random guy on Twitter says inflation is high and undercounted by the Feds, esp on the housing side.

https://twitter.com/BillAckman/status/1469438745791410183

The largest owners of nationwide single family rentals are reporting 17% YoY rent increases. OER is 30% of the Core CPI calculation and 24% of reported CPI. Using the more empirical measure in the calculation increases today’s Core CPI from 4.9% to 9.0% and CPI from 6.8% to 10.1%

Owner’s equivalent rent is a scam. They call homeowners up and ask them to guess what they think their house would rent for. It is a non-market price that does not involve real renters or landlords. It takes them 6 months to complete the survey.

A data scientist could easily pull rental data from millions of properties using modern databases and APIs in a few hours from sites like Zillow or Apartment list (that’s exactly how they determine rent increase data). No need to survey people.

The only reasons they do the survey is to 1) employ a lot of make-work federal employees doing needless surveying and 2) try to hide real inflation

Durable Goods Inflation Breaks All-Time 1970s High as Prices Jump 14.9%

Some of the categories making big moves up in just the last month:

- Furniture prices jumped 11.8 percent compared with a year ago.

- Bedroom furniture is up 9.9 percent .

- Living room, kitchen, and dining room furniture are up 14.1 percent .

- Major appliances up 5.5 percent.

- Indoor plants and flowers up 6.4 percent .

- Tools and hardware up six percent .

- New vehicles up 11.1 percent .

- Used cars and trucks up 31.4 percent .

- Car parts are up 10.2 percent .

- Tires are up 11.1 percent .

- Televisions , which had been falling in price for years, saw prices rise 7.9 percent .

- Bicycles and other sports vehicles up 9.4 percent .

- Sports equipment up 6.7 percent .

- Computers and smart home assistants up 4.8 percent

So what remains inexpensive?

Money

The cost of money, relative to the above-reported outcomes, is still low for now. Interest rates have not yet climbed into the stratosphere. So if you are able to borrow money on the cheap, do so, buy right away any of the above mentioned items you need or will need in the next year, and then pay off your loan with tomorrow’s less valuable inflato dollars.

ETA

The cost of (borrowed) money is obviously variable. You have to shop for the most favorable interest rate. But speaking in general:

The longer you are able to borrow, provided the cost (i.e., the interest rate on your loan) is reasonable, the better off you will be. Inflation is a friend of the borrower, and an enemy of the saver. In general with inflation, if you are able to do so at acceptable cost:

Spend short, borrow long

But that does not mean it undervalues housing cost inflation. I mean, if you asked me how much my house would rent for, I’d have utterly no clue so I’d be equally likely to underestimate rent than overestimate it.

Actually I’d probably be more prone to overvalue it just like when I receive random calls asking me to sell my house. I quote them a price that’s around twice the Zillow estimate just in case…

But yeah the methodology doesn’t sound very effective to me either. If they only polled landlords and/or renters or look at current offerings, that’d make sense but random calls to homeowners sounds like a waste of time and money.

I suspect even people who generally knew what their house was worth and what rents were generally in their area could well be out of date with home prices and rents rising a lot, especially if you’re asking someone who has no particular reason to care - like some older person who isn’t interested in selling their home and has time to answer dumb government survey calls…

So yeah, I expect it lags reality.

Interesting…

Found this about who he is: Bill Ackman - Wikipedia

(published just a few hours ago)

Consumer inflation rises at fastest pace in nearly 40 years — five experts weigh in

There is way too much detail for me to copy and paste, so I’ll just provide a link. However:

Executive summary:

The five experts all seem to think interest rates will rise in 2022 more aggressively than was perhaps previously contemplated.

Here is a link to the entire CNBC piece:

Given the existing size of the national debt, and given the additional red ink contemplated or already approved, and considering the debt service on all that debt, if interest rates do rise this is gonna become interesting. ![]()

Since you didn’t already know, turn in your FWF card.

![]()

Not that interesting – we’ll just borrow more to pay the interest.

I suppose I’m the weird one for regularly (~monthly) checking property value and estimated rental income on zillow and redfin. I could answer that question better than anyone! ![]()