huh?

I posted this previously but will repeat it here. The US national debt is about $30 trillion. So every 100 basis point, one percent, increase in the average rate on the debt adds $300 billion in interest. To put that in perspective, the budget of the defense department is 700 billion per year. We will not default but will borrow more to pay the interest and the debt will increase exponentially. This will rapidly lead to hyperinflation.

The United States owes a lot of debt. Some argue that raising interest rates will make the government less able to pay it off. --Not that they seem to want to pay it off…

Edited to add Onenote said it a lot better than I did.

We’re currently getting run-of-the-mill inflation from $5 trillion in pandemic stimulus money printing. I’m as anti-debt as anyone, but isn’t a bit hyperbolic to say that printing $300 billion will lead to hyperinflation?

Looks like Biden’s going to pressure Powell to raise rates. I’m pretty sure they’ll raise another .5 in June and maybe another .5 in July. Anyway it should be interesting.

I just know there’s two websites that I have a lot of respect for (here and another). – Interest rates have been so far in the gutter I haven’t came here for months… but I do spend a lot of time on a political board (not saying which one) and some over there say raising rates will lead to default. They might be alarmists, but they believe the government needs to be more conservative.

I’m not saying it will happen in one year but after the first year if government spending and taxes stay the same, the national debt will be 30 trillion plus 300 billion and the interest on the debt will be $303 billion more. That is the definition of an exponential increase and the exponential function is one of the wonders of the universe.

Edit. I assumed that the interest on the debt was zero before the one percent increase. But that is not the case. If it starts out larger, the exponential coefficient will be larger and the situation gets out of hand even faster.

I love the way that $30T number is being thrown around here. That is merely the current debt.

Lest we forget, the good ole USA has roughly $100T in, promised but unfunded, future debt staring us in the eye.

House of cards? You betcha. It’s a joke!

With him, he is just as likely to pressure Powell not to increase or to reduce rates. Obama famously said, “you can always depend on Joe to fuck it up.”

It is not a joke, it is a plan. The Democrats/Marxists want to bring down the United States government so they can start over again as a socialist paradise.

How reliable is your state’s power supply? We may find out shortly as summer approaches.

America’s Summer of Rolling Blackouts

Summer is around the corner, and we suggest you prepare by buying an emergency generator, if you can find one in stock. Last week the North American Electric Reliability Corporation (NERC) warned that two-thirds of the U.S. could experience blackouts this summer. Welcome to the “green energy transition.”

Illinois Gov. J.B. Pritzker said recently he didn’t expect power outages since the state could buy power from neighbors. He’d better read the NERC report. Most Democrats don’t seem to recog-nize or care that their climate policies are making the grid less resilient and reliable. Instead they’re doubling down.

Yeah and you should stop posting it, because the FED increasing the interest rate does not immediately impact the interest on the existing debt, only on new debt. It will take many years before the cost rises to $300 billion per year. Further, Turkey insists on not raising their interest rates and is living through hyperinflation. Your conclusion that this will rapidly lead to hyperinflation is completely bogus.

How conservative? Are they paying attention to Turkey?

Update

That was 19 hours ago.

Now approaching $124.

Sick

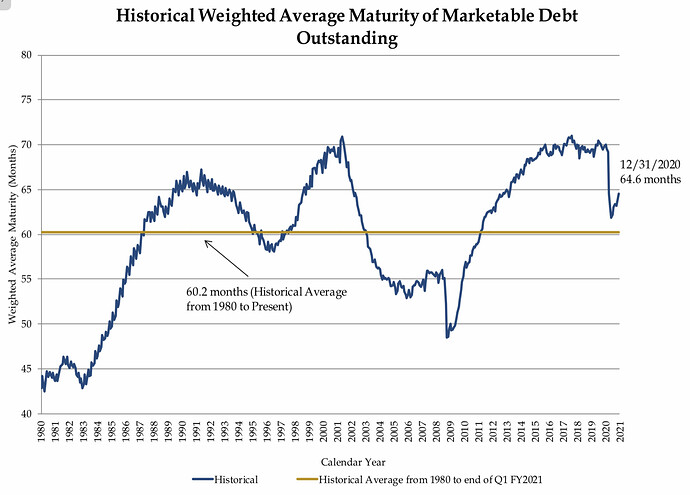

The average maturity of the US national debt is about 5 years, so you see about 1/5 of the headline interest rate increase in interest expense show up each year. From the GAO 2021 audit, they cite expected future rates several times higher than the average interest rate paid currently, which is around 1.5-1.6% currently.

https://www.treasurydirect.gov/govt/reports/pd/feddebt/feddebt_ann2021.pdf

https://www.treasurydirect.gov/govt/rates/avg/2022/2022_04.htm

in its 2021 long-term budget outlook report, the Congressional Budget Office projected that interest rates on 10-year Treasury notes will rise from an average of 1.1 percent in mid-2021 to 3.4 percent in 2031 and 4.9 percent in 2051. Interest rates can also have a compounding effect on the debt, as borrowing to make interest payments adds to the debt.

Absent action to address the growing imbalance between spending and revenue, the federal government faces unsustainable growth in its debt. Once the pandemic recedes and the economy continues to recover, Congress and the administration should quickly pivot to developing an approach to place the government on a sustainable long-term fiscal path.

But the GAO timeline was before the Fed went on the warpath against inflation, so we could see 3% rates by the end of the year if they don’t balk at the market declines, and then we’d be looking at doubling our interest expense over the next 5 years, so 1.2x increase annually more or less.

Is inflation coming to an end?

Warning: “High Floor”

“Many have touted March as the peak in inflation and are looking for inflation to cool from here,” Grant Thornton Chief Economist Diane Swonk said on Friday… “We are not as convinced given the risks we still face due to the war in Ukraine and lockdowns in China. Either way, it is important to note that any cooling we see will have a high floor. Both the overall and core PCE indices remain well above the Federal Reserve’s 2% target.”

Things are bad in Turkey. Erdagon evidently thought lowering rates during inflation and having a large covid-19 stimulus were the way to go.

Of course there’s a shift in the narrative. But as we all know, the narrative doesnt always fairly represent reality.

Energy comments from a hedge fund blog

- I talked to ~5 oil and gas companies last week. Across the board all of them were pretty clear that

- They are seeing zero appetite for growth capex in public companies

- Private companies are proving much more nimble / willing to drill and grow given the current curve.

- The M&A market is mess; buyers are willing to give credit for the near term curve, but go out past 18-24 months, and buyers are applying huge discounts to where the curve currently sits. So sellers are faced with a choice: take the high bid, even though it reflects a huge discount to the case flows the curve implies the assets are worth, or hold on to the assets and milk them for cash flow.

- I liked Bison’s piece on the opp in small cap E&P

So energy is staying expensive and shareholders in these companies either have to be patient to get paid out of dividends / cashflow, or they get bought out for some lowball PE offer if the mgmt will go along with that.

This guy is supposed to be good too, but it’s long and I haven’t watched it.

According to the US treasury (see the link below), in 2021 the interest on the national debt was about $560 billion. So by the GAO model, the interest expense will increase to $1 to $1.5 trillion per year on the current debt.

as I mentioned, this amount is several times the budget of the defense department. The government cannot pay this fron taxesand will just sell more treasury bonds to pay it, leading to an exponential increase in the debt.

https://www.treasurydirect.gov/govt/reports/ir/ir_expense.htm

is a good name for a GoT or LotR character. The IRL character is Erdogan.