That’s what I’m wondering. Inflation slows as demand slows - but a lot of what’s fueling today’s inflation are “essentials” for which demand isnt going to shift drastically no matter how much it costs. The only solution for that would seem to be boosting production to eliminate the shortages.

Continuing xerty’s post above, more supply chain problems in the future

The law, AB5, was passed by the Democrats to help the Teamsters union.

The I-bond rate for this next six month period is going to be very interesting.

This isn’t the only factor. I agree energy prices play a big role in what we’re seeing, but runaway government spending and the handouts of the pandemic are coming back to bite us. I think those are the factors that can be moved the quickest and to the greatest effect. Americans typically think the GOP does a better job with the economy - you see this in Biden’s dismal approval ratings.

The problem is that the GOP can’t stop drinking the Trump Kool-Aid. He is kryptonite in suburbia and that’s a demographic they need to win if they want to take back the House and Senate. Get people like Youngkin and Sasse in front of the camera and get the lunatics peddling crazy conspiracy theories back in the asylum.

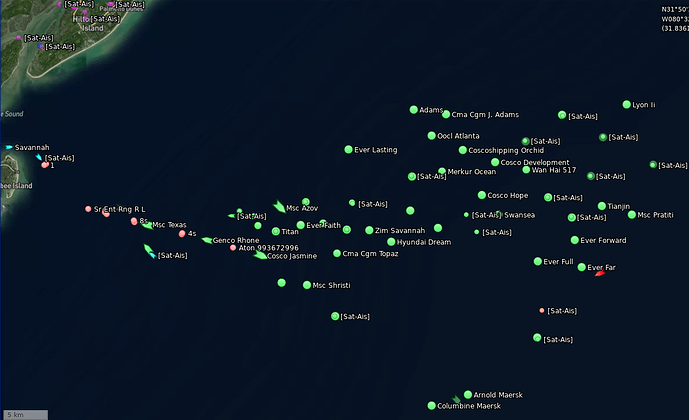

Here is what the backup at the port of Savannah looks like, and it’s not a huge port. From Hilton Head, I rarely saw ships at anchor awaiting dock time at the port. Now, it’s constant.

ETA: The circles are anchored.

So much for the oil begging tour, but I guess the Fed talk about recessions has brought down the oil price a fair bit anyway, at least for now.

U.S. NOT EXPECTING SAUDI ARABIA TO IMMEDIATELY BOOST OIL PRODUCTION, EYEING NEXT OPEC MEETING - US OFFICIAL

Fed watch. first the dove -

- BOSTIC: 75 BPS WAS A “BIG MOVE” IN POLICY, FED WANTS POLICY TRANSITION TO BE ORDERLY

- BOSTIC: MOVING “TOO DRAMATICALLY” COULD UNDERMINE POSITIVE ASPECTS OF THE ECONOMY, ADD TO UNCERTAINTY

- BOSTIC: APPROACH FED IS TAKING NOW GIVES “HIGHEST LIKELIHOOD” OF SUCCESS

And now the hawk

- BULLARD: THIS WEEK’S INFLATION REPORT WAS “HOT”

- BULLARD: BASED ON THESE INFLATION NUMBERS, CORE PCE INFLATION HASN’T PEAKED YET

- BULLARD: WE HAVE A WAYS TO GO ON INFLATION

- BULLARD: I THINK MOST RECENT INFLATION REPORT MEANS FED SHOULD NOW TARGET 3.75% POLICY RATE BY END OF 2022

- Bullard: Fed May Have To Get Funds Rate To 3.75% To 4% By Year End

- Bullard: Open To Debate Tactics Of Rate Rise

- Bullard: Inflation Proving Broader And More Persistent Than Expected

- Bullard: Stronger Dollar Will Mean Less Inflation in the U.S.

- Bullard: Is Revising Upward Amount Of Rate Increases For This Year

- BULLARD: AM AN ADVOCATE OF FRONTLOADING RATE HIKES

- BULLARD: FED HAS BEEN TRYING TO NOT DO TOO MUCH AT ONCE

- BULLARD: IT DOESN’T MAKE TOO MUCH DIFFERENCE TO DO 100 BPS OR 75 BPS AT JULY MEETING; CAN ADJUST REST OF YEAR ACCORDINGLY

Or maybe he’s an optimist too? Or just an example for the dire need for 1 handed economists?

- BULLARD: FED TODAY HAS LOT MORE CREDIBILITY THAN VOLCKER FED

- FED’S BULLARD: INFLATION CAN COME DOWN RELATIVELY QUICKLY DOWN TO 2% OVER THE NEXT 18 MONTHS IF FED “PLAYS ITS CARDS RIGHT”

- BULLARD: BASE CASE IS STILL THAT WE CAN GET A RELATIVELY SOFT LANDING

- Bullard Says Over Next 18 Mos., Inflation Could Go Back to 2%

- BULLARD: GDP NUMBER IS LIKELY CURRENTLY MISLEADING

- BULLARD: GDI A BETTER MEASURE AT THE MOMENT

- BULLARD: DON’T THINK RECESSION MODELS ARE PARTICULARLY ACCURATE

- Bullard: ‘Skeptical’ U.S. Is Going To Fall Into Recession

Lol

- BULLARD: I TAKE YIELD-CURVE INVERSION SERIOUSLY AS A SIGNAL

- BULLARD: I THINK THIS TIME IS DIFFERENT ON YIELD CURVE

- Bullard: Yield Curve Inversion Less of Recession Signal Now

And now with the latest inflation numbers, if you have a constant paycheck for the last year, you have now just worked more than a month for free. That’s what they took from you.

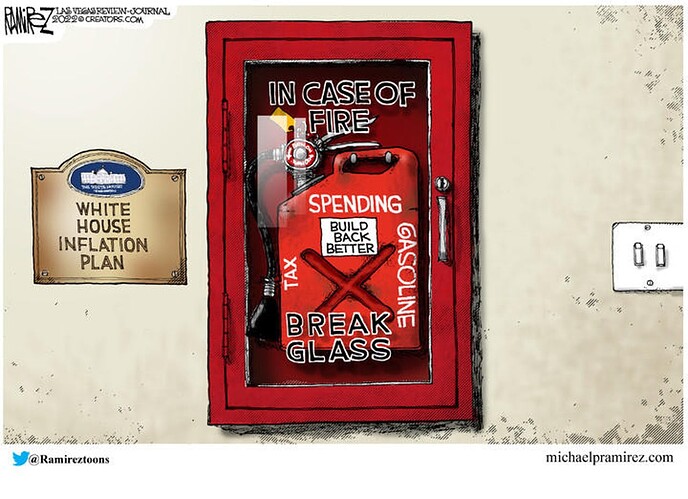

Working without pay; an interesting way to look at Biden’s inflation.

At least Build Back Bigger looks to be dead. Manchin proving not everyone in his party lacks common sense.

He’s being demonized in social media. Manchin has demonstrated conviction and fortitude.

Manchin is a national treasure. Thank God for him. Thank God for West Virginia and the sensible people who live there.

And maybe the Saudi’s will export more of their oil and give Biden something he can sell to the credulous public. But if so, it’s only because they doubled how much cheap Russian oil they’re buying for domestic use, so they can free up more of their locally produced oil for foreign export. Shell games making a mockery of our sanctions…

I might give the slightest bit of credence to these often bass ackwards comments if the speakers had to put up bonds that they would lose if their predictions failed to materialize.

We warned that inflation was large, understated, a huge problem, and not transitory back last November, and yet, every month it seems that people are surprised that inflation is an issue. To give you a sense of the level of surprise, when we wrote our initial piece on inflation, many economists and Wall Street analysts expected the Fed to raise rates by a TOTAL of .75% in 2022. We got that amount last month alone, and are going to get at least that much again later this month.

Shelter (housing) which makes up 32% of the index was officially up 5.7%. That’s not accurate. The Case-Shiller U.S. National Home Price Index is up 20.4%. The Case-Shiller Index is always reported a couple of months late, but that’s a big difference. There are two reasons for this. First, in an issue we’ve discussed many times on this blog, there was a change to the CPI in the late 1990s to shift from actual cost of housing to something called “Owners Equivalent Rent” which routinely understates the increase in housing prices. Second, because most rental contracts are for a year, the actual rent that people pay hasn’t fully adjusted to the new higher prices yet. If we were to calculate the CPI using the same methodology the US Bureau of Labor Statistics used in the 1970s and 1980s, the CPI would be 13.8%.

Even if commodity prices stay lower than they were a month ago, there’s a lot of inflation in the services part of the economy, and that’s not tied to commodities. We spoke with a former hospital CEO today who talked about how higher labor and materials cost had made many hospitals unprofitable.

Maybe this belongs in the equities thread, but I thought this was on point. A good article on the history of central banking and how much QE has happened beyond the emergency needs, and how much inflation that represents that was until now suppressed.

a little bit of egregious wealth inflation wouldn’t spur inflation in the real economy. So long as inflation stayed tamped-down in the real economy, so long as it wasn’t persistent, so long as everyone knew that everyone knew that inflation wasn’t a problem … we could party on. But once that common knowledge shifts, once everyone knows that everyone knows that inflation IS a problem , it all goes poof.

Lots and lots of pretty charts related to inflation, demand, supply, wages, CPI, etc. stagflation, here we come.

Not so deep, this knowledge. None of that is relevant, because (1) rents have not increased nearly as fast as home prices, and (2) increased home prices do not affect the cost of housing for everyone, only for new home purchases.

I disagree. It seems pretty relevant if you know your rent is going up 20% on your next annual renewal, even if you’ve got 6 months left before that happens. If that were my situation, I’d start changing my budgets, wage demands or job searches, moving plans, etc.

Not admitting it’s up is like pretending you’re not down in the market because your quarterly brokerage statement hasn’t told you that yet, or that you don’t owe anything for those credit card charges yet until the bill arrives in the mail.

I keep an eye on rental estimates for two SoCal counties, and I’m telling you they haven’t gone up nearly as fast as home prices here. Also the estimates have been flat for > 6 months. I’ve also looked at a few areas in more affordable states and the gross rent multiplier (ratio of rent to price) is up everywhere, indicating that rents have not gone up as fast as prices.

Also in many areas it’s not going to be possible to raise rents 20% due to rent control, which allows only a few percent above inflation. And since wages definitely didn’t keep up with real estate prices, rents can’t possibly all go up that much across the board.

I’m sure you’ve got a perfectly logical reasoning behind this, but I need help figuring it out. Why only for new home sales? Wouldn’t resales have the same effect?

Many is kind of a nebulous term, but it appears that only 5 states have any cities with rent control. Additionally, some forms of rent control allow the rent to be increased to market rate upon a unit’s vacancy.

I don’t mean “new homes”, I mean “new purchases”.