How do you know what the “sweet spot” is? How does anyone? The Treasuries indicate market expectations, but they can’t predict the future.

His determination to keep rates high as long as it takes to get inflation down. Instead of stopping quickly, with possible drops in rates after that. The path he looks like he’s taking will be more likely to both 1) lower inflation, and 2) hurt the stock market. High rates are alternatives to stocks, as well as raising the cost of capital and making it difficult for marginal companies to continue to operate.

Well, yeah. And they’re indicating the market expects that they’re going to overshoot.

This is going to constrain the ability of the Fed to fight inflation by raising interest rates

The United States is on pace to spend more to maintain its debt than on its own military. In the third quarter, the federal government spent over $184 billion on interest payments on its debt. That means an annual cost of over $730 billion. Meanwhile, the Department of Defense 2022 budget was about $720 billion.

More news on the US national debt

On Jan. 20, 2021, the day Biden was inaugurated, the total federal debt was $27,751,896,236,414.77, according to the Treasury.

On Oct. 31, 2022, the latest day for which the numbers have been published, the total federal debt was $31,238,301,149,359.52.

That equals an increase of $3,486,404,912,944.75.

How does one put that in perspective?

Well, in 2019, the last year for which the Internal Revenue Service has published its Statistics of Income report, Americans filed 104,005,800 “taxable returns” with the IRS.

“A taxable return,” the IRS explains in its Statistics of Income Bulletin, “is a return on which the taxpayer reports total income tax greater than zero dollars.”

in Biden’s first approximately 21 months in office, the increase in the federal debt of $3,486,404,912,944.75 equaled approximately $33,521.25 per each of those taxpayers.

How about this perspective:

- The author doesn’t know the difference between a tax return and a taxpayer, since one tax return often covers multiple taxpayers.

- The author also doesn’t know that the federal fiscal year doesn’t start when a new president takes office.

You are better than posting this sensationalized crap. The real numbers are also staggering, but perhaps not so bad in comparison with historical precedent.

This is nitpicking. The author defines a “taxpayer” as the filer of a return. That is as good a definition as yours.

Anytime we deal with numbers, it’s important to express them in units that are meaningful. $3,486,404,912,944.75 for the whole country does not mean much to most people but expressing it in terms of the amount per individual makes it much easier to understand.

We both agree that the deficit and the resultant debt are out of control and will lead to inflation.

Generally speaking, I think the more common way to refer to a tax return is to call them “households.” The federal debt went up $33,521 per household, not per person or per taxpayer.

Per individual would indeed be easier to understand. Per the author’s faulty definition of a taxpayer is not.

Crypto as currency. It’s not perfect, but when hyperinflation hits your county and your banks are all closed, it’s way way better than the alternative.

$2.7 billion per day.

@scripta Do you think this expressing of the larger number in different units is misleading? ![]()

![]()

Not misleading, but it is meaningless. To give it meaning would require some kind of a relatable comparison, such as how much more it is now than in some recent past or how much it is per capita.

The relatable comparison is how most people and operations have to limit themselves to only spend what they bring in, or else they quickly fail. One trillion isnt being conveyed as relative to anything, it’s being noted as an absolute number.

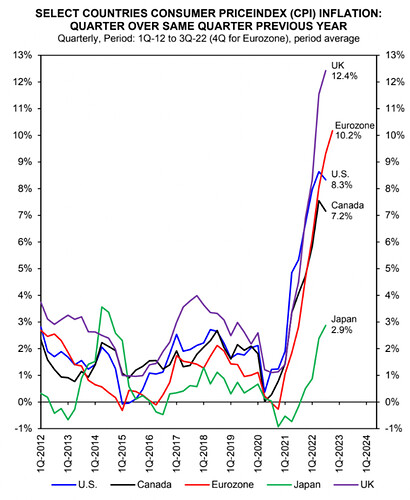

Oct’22 CPI out, not as bad as expected, about +5% annualized rate for the last month

- US Oct Consumer Prices 0.4%; Consensus 0.6%

- US Oct CPI Ex-Food & Energy 0.3%; Consensus 0.5%

- US Oct Consumer Prices Increase 7.7% From Year Earlier; Core CPI Up 6.3% Over Year

- US Oct CPI Energy Prices 1.8%; Food Prices 0.6%

looks like healthcare cost methodology is knocking the core CPI down a fair bit and started just now in Oct. Several sources covering this topic below, don’t really understand it yet myself.

https://twitter.com/GordonJohnson19/status/1591062535586848768?s=20&t=excEQLq9DlrtoOB5lIeq8g

It is indeed weird. Frankly makes no sense at all. More utilization of medical care leads to lower CPI??

Sharif points out, utilization of the healthcare system, somewhat ironically, tumbled during the worst of the Covid-19 outbreak in 2020. “During the pandemic, people put off things like elective surgeries. They didn’t go to the doctor because people didn’t want to be in waiting rooms with other people who might have Covid, right? So there just wasn’t a lot of utilization of healthcare services in 2020,” Sharif explains.

And again, due to the lagged effect, this didn’t really start to show up in the official data until the last year. Now it’s about to flip negative. “Now you have this mismatch again where way more utilization of healthcare than you had in 2021And so then those retained earnings dropped on a year over year basis.”

This, Sharif says, will result in a meaningful CPI drop in the months ahead He forecasts a sequential drop of 3.9% in the October reading.

Good long essay on inflation based on a famous investor, Mark Möbius.

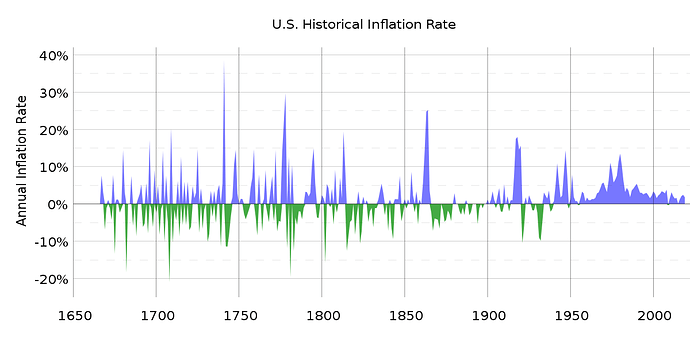

Aside from questioning government CPI measures and their accuracy/ relevance and poor incentive alignment, he talks about how deflation is good and how CPI linked returns may be insufficient protection (due to CPI flaws) during periods of higher inflation. He prefers real estate or stocks of companies with pricing power in unregulated markets. I liked this chart and quote:

“Thanks to the spread of electricity and other such wonders in the final quarter of the 19th century, prices dwindled year by year at a rate of 1.5% to 2% per year. People didn’t call it deflation – they called it progress .” - Jim Grant

Hedge fund commentary from Elliot Mgmt, a large quite successful fund. There’s a ton in there, but on this topic…

The Fed and its peers are trapped, and their actions are wholly reactive

and experimental.

Central bankers and treasury officials promised too much, borrowed too much and — instead of meeting their countries’ obligations — tried to depreciate the currency in which they (or someone else down the road) will have to pay back those obligations (when it is no longer possible to kick the can any further). This reality is as old as the hills, and does not require higher arithmetic to understand. It is a terrible path, and a poor alternative to sound money, sound finances and robust sustainable growth

Strategic Re-election Reserve down to 1984 levels…

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCSSTUS1&f=M