Yeah, after buying 5 year bonds to resell when the Fed wimps out, we get all of this data saying they can wimp out. I feel like the sanitation engineer. ![]()

Did President Joseph Robinette Biden ever define “transitory” when he applied that term to inflation some eighteen months ago? Here is one reason why it’s still an issue, transitory or not. Despite the source, I presume some of the facts listed are actually facts.

Some of the article makes sense

In addition, many people socked away extra savings during the early months of the pandemic, when spending opportunities were limited and the government was distributing multiple rounds of relief payments. While bank balances have come down, Americans are still sitting on a lot of additional cash.

Edit. But they did not mention

Powell’s statements…

Rates moving higher. First the market

- FED SWAPS UPGRADE THE ODDS OF A HALF-POINT MARCH RATE HIKE TO 75%.

and then the Fed comments:

- FED’S BARKIN: HIGH INFLATION MEANS THAT THE FED STILL HAS WORK TO DO.

- FED’S BARKIN: THE LABOR MARKET HAS BEEN UNBELIEVABLY RESILIENT. POWELL: WE WILL BE GUIDED BY INCOMING DATA

- FED’S POWELL: WE HAVE NOT MADE A DECISION ABOUT THE MARCH MEETING AND IT IS DATA DEPENDENT.

- POWELL: TERMINAL RATE LIKELY TO BE HIGHER THAN WE EXPECTED

- FED’S POWELL: THE EXTRAORDINARY STRENGTH OF THE JOBS REPORT AND THE INFLATION REPORT BOTH POINTED IN THE SAME DIRECTION.

A trillion here, a trillion there, pretty soon your can use the USD as wall or toilet paper.

- Biden Budget Would Add $17 Trillion in Deficits Over Decade

- Budget Would Increase Deficit to $1.8 Trillion in 2024

- Seeks 7.3% Increase in Non-defense Spending to $688B

- Proposes $5.5 Trillion in Tax Increases Over Decade

Note that last line, they’re raising an extra $0.5T/year in taxes and still blowing out the deficit on all their spending plans. Speaking of unreasonable assumptions:

- BIDEN BUDGET PROJECTS U.S. DEBT RISING FROM 97% OF GDP IN 2022 TO 109.8% IN 2033

- BIDEN BUDGET FORECASTS ANNUAL GDP GROWTH OF 1.5%, UNEMPLOYMENT AT 4.6% AND CPI INFLATION FALLING TO 2.4% ANNUAL RATE IN FISCAL 2024

Good news! Banking crises are deflationary as all the bank lending and balance sheets have to get deleveraged.

bump

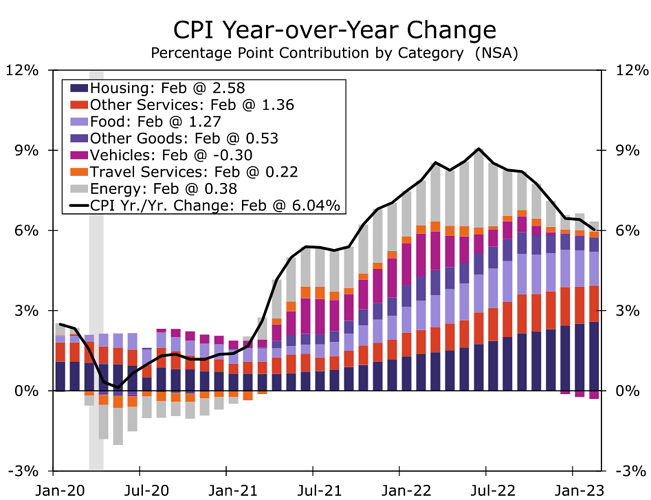

CPI out for Feb’23. 5% annualized for the month (0.4%), 6% annualized for Core.

- US Feb Consumer Prices 0.4%; Consensus 0.4%

- US Feb CPI Ex-Food & Energy 0.5%; Consensus 0.4%

- US Feb Consumer Prices Increase 6.0% From Year Earlier; Core CPI Up 5.5% Over Year

- US Feb CPI Energy Prices -0.6%; Food Prices 0.4%

Inflation commentary

https://wellsfargo.bluematrix.com/links2/html/9142dffa-02e9-420c-9e27-6733b3c0154a

On trend, however, inflation’s improvement remains stubbornly slow. Excluding food and energy, the core CPI rose 0.5%. That pushed the 3-month annualized rate up to 5.2%, barely better than the more backward looking 5.5% year-over-year rate. Goods prices continue to drive what modest improvement there has been in the core CPI over the past year. In February, prices for core goods were unchanged. However, used vehicle prices remain the overwhelming force behind the downdraft, declining another 2.8% in February. With auction prices for used vehicles moving up again over the past few months, this recent tailwind to disinflation looks set to fade and pause the slowdown in core goods inflation over the next few months.

the banking crisis / fears are really lowering rate hike expectations. We had been at 1 or 2 +0.25% increases for this March, now it’s not even clear if they raise at all.

CME FEDWATCH TOOL SHOWS 56% ODDS FOR NO FED RATE HIKE NEXT WEEK, UP FROM 31% ON TUESDAY

I guess xerty is busy, so for anyone not paying attention I’ll provide an update (this happened Wednesday):

- Fed raised rates by 0.25%

- JPow said words: inflation high, labor market tight, banking system resilient, some additional policy firming may be appropriate. Will continue reducing balance sheet.

- Magic 8 Ball said: reply hazy, try again

- 1-mo Treasuries recovered slightly from the Tuesday’s 4.07%, the lowest recorded this year.

A like didn’t seem satisfactory. So ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Nice short (1min) video for visualizing how the Fed’s predicted future interest rates have shifted during the inflation period and now into the banking crisis.

Bonds and stocks have about the same volatility.

This is supposed to show a plot of TLT and VTI.

Extend the chart to the max … which is only 20 years, but …

https://www.google.com/finance/quote/TLT:NASDAQ?comparison=NYSEARCA:VTI&window=MAX

I should have been more precise. Bonds and stock had about the same volatility in 2022 and so far in 2023.

The rationale for 60/40 portfolios is partially that the bonds provide stability. Definitely not true in recent times.