I can see HHI of $90K in Seattle, or most California cities not being sufficient for a comfortable life. Rent prices have gone thru the roof.

It’s above the median for all cities outside the Bay Area. I suppose you could argue that the median person is not living a comfortable life. But it’s probably because the median household is spending too much elsewhere, as Shandril suggested.

Your source has a median income in San Diego area around $25K/year, and Los Angeles around $21K/year. Hard to imagine living on that in those cities, or almost anywhere.

So much for the free market.

BIDEN CITES ‘MOUNTING EVIDENCE OF ANTI-CONSUMER BEHAVIOR’ BY OIL AND GAS COMPANIES, ASKS FTC TO ‘IMMEDIATELY’ FURTHER POTENTIAL ILLEGAL CONDUCT - LETTER TO FTC

BIDEN SAYS GAP BETWEEN PRICE OF UNFINISHED GAS AND PRICES AT PUMP IS WELL ABOVE PRE-PANDEMIC AVERAGE, WHILE OIL AND GAS COMPANIES BOOSTING PROFITS

BIDEN ASKS FEDERAL TRADE COMMISSION TO BRING ALL THE COMMISSION’S TOOLS TO BEAR IF WRONGDOING FOUND

FTC COULD BEGIN ‘OPEN STUDY’ INVESTIGATION ON HOW COMPANIES SET GAS PRICES - WHITE HOUSE

FEDERAL TRADE COMMISSION IS CONCERNED ABOUT THE ISSUES RAISED IN WHITE HOUSE LETTER ON RISING GAS PRICES AND IS LOOKING INTO IT - SPOKESPERSON

U.S. REDUCES STOCKS IN STRATEGIC PETROLEUM RESERVE BY 3.2 MILLION BBLS IN LATEST WEEK - EIA

U.S. STRATEGIC PETROLEUM RESERVES OF CRUDE IN LATEST WEEK AT LOWEST LEVEL SINCE JUNE 2003 - EIA

WHITE HOUSE: NOTHING TO ANNOUNCE ON STRATEGIC PETROLEUM RESERVE

U.S. NEXT-DAY NATGAS PRICES AT THE NORTHWEST SUMAS HUB ON WASHINGTON-BRITISH COLUMBIA BORDER JUMP BY MOST SINCE FEBRUARY FREEZE AFTER ENBRIDGE REDUCES SUPPLIES FORM BRITISH COLUMBIA

WHITE HOUSE: FTC SHOULD IMMEDIATELY LOOK INTO GAS PRICES

WHITE HOUSE SAYS FTC HAS AUTHORITY TO LOOK AT HOW COMPANIES SET GAS PRICES

He does realize that this is the only way that electric cars will gain mass market adoption? He should be cheering this possibility.

That’s individual. Try household, in the “Income Percentile by City Calculator” section.

The way you cook it.

Done anyone outside of a couple of lefty toonies believe that Biden can cite anything? If so, here’s proof that he couldn’t do so as a law student 60-odd years ago. There is also evidence that he continues to lack that skill, although he’s had lots of failures, the most recent being the build better but plan.

As for Biden saying anything, who is doing the mumble/stumble intrepretation?

And finally the White House doesn’t say anything, much like uncle Joe. I suspect anything coming from a White House spokesit isn’t coming from the President.

Truer words . . . . . .

That’s arguable depending on definition of comfortable.

If you look at the highest median Household Income in this list (very nice link btw) which is San Jose at $74k (for comparison $55k in SF) or second highest Bloomington at $66k, these are well below $90k. Median means half the households in that area earn less than that. $90k in these areas is likely around 60th percentile or so. And that’s in the highest COLA areas in the country.

Thus, claiming that at least 60+% of households in the country need to go to Salvation Army to make ends meet on $90k income seems not only alarmist to me but probably deliberately misleading to push a narrative. That’s not to say that inflation does not hurt low-income families but it just distorts for hyperbole the definition of what is a low-income income IMO.

I wasn’t on board with such narrative but it’s true that he did not even do that much of a victory lap after getting the infrastructure bill over the line. So that made me wonder if the WH is simply restricting all his speaking opportunities to pre-empt gaffes and appearance of incompetence.

Either way, not exactly a great look for a President, especially considering the need to change the narrative from negative news this fall. If Obama or Trump had gotten a significant bill like this done, they’d never have failed to hammer home the fact that it was their doing.

P.S.: But let move on from this since it’s unrelated to inflation.

I didn’t read them saying 60% of households would need to go to the salvation army. I read that inflation is going to deplete the savings of any family that is making $90k/yr. While I don’t necessarily believe that. I do think inflation is going to deplete a lot of savings over the next several months. So the point is legitimate, even if the exact figures aren’t really based in anything provable.

That was in the very same part of the article though… You had the Salvation Army budget, right before the quote about “pandemic poverty”, right before the $40-90k income bracket of people having depleted savings. Hard to not connect these points when made back to back.

“The Salvation Army is planning to serve more meals than in 2020’s record year, and will need around 50% more funding to meet the buoyed demand, Hodder said. He expects rental and utilities assistance to lead the pack of requested aid. “We’re fearful of what we’re calling ‘pandemic poverty,’” Hodder said. For those making $40,000 to $90,000, financial cushions will be drained in the next two to three months.”

There’s no question for me that it was alarmist and written with hyperbole for agenda purposes. Family income way above median household income is supposed to lose their cushion savings in 2-3 months due to 6% annual inflation? What did they have as savings? Assume a monthly bill of $1.5k in food and utilities. 6% annual rate of inflation in 3 months would equate to prices going up maybe $20-30/month (1.5-2%) on that $1.5k bill. That means their savings were $100? That’s no cushion. That’s living paycheck to paycheck IMO.

You must not regularly go to the supermarket

Over the last year, my grocery spending hasnt gone up much. As long as you factor in the overstock I’ve built up of certain items, in anticipation of shortages and/or price increases.

Those damn chicken wings though, +50% is painful for what I consider to be an essential. And yes, the local stores still have plenty of wings in stock, they’re just a terribly inefficient use of freezer space to buy too much in advance.

Our grocery bill hasn’t gone up dramatically, but we don’t buy a lot of processed food or meat. We buy a lot of store brands which haven’t seemed to gone up much so far. I have notice less selection/items on the shelves at times, but prices seem on par.

As for turkeys, I was making my list for shopping this weekend and locally they are advertised for $0.49/lb with $25 purchase. About the same as last year except for maybe the $25 purchase requirement. That is just at the store I shop at. I have heard ads for similar pricing at other stores, but not sure about the other purchasing requirement. (We live in TN).

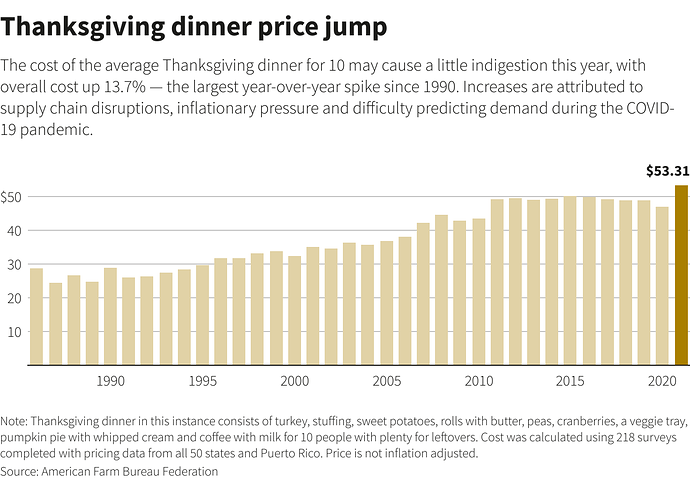

I was laughing to myself yesterday while discussing the cost of Thanksgiving with a relative. They saw an article (not sure which one, but I read a similar one on Yahoo with the chart below). They were complaining about how it costs so much and how it is hurting them and everyone. The article shows $54 or so as the cost for 10 people for the meal. I laughed because I know they spend much more than that once or twice a week eating out for their family of 4. So I guess it is all about perspective or where you get your news/opinions.

We have $.29/lb turkeys this week. I think they put a limit of 2 on them, which is the only difference between now and past years.

I dont think I could make a dinner that costs $54, and I generally cook those boneless 3lb turkey breasts that cost 10x as much as whole turkeys. Plans changed so I am not, but I had been planning to make a full dinner for a classroom of 10 year olds, and wasnt going to spend anywhere close to $50 total.

To reward the nieces and nephews whose names you’ve been using for your financial shenanigans? ![]()

The financial shenanigans is my reward for all the crap I do for the nieces and nephews… ![]()

Only weekly. If I spend $10 more weekly, that’s the most. It’s basically buried in the random fluctuation of grocery bills for me.

Some items have gone up slightly. Nothing’s cheaper than a year ago for sure. But many items are exactly the same price. Looking at the chart for the Thansgiving Dinner cost, $53.31 compared to about $50 in 2015-2016, that’s about 6% up… over 5-6 years.

My point basically that sure things are slightly more expensive than last year. Last year, prices were so low due to low demand that some people worried about deflation. Now we’re just correcting prices vs. last year. Otherwise, this seems about in line with general trend of inflation over the last 30 years. Looks like it was about $25 in 1991, $53.3 in 2021 comes to an annual inflation of 2.5%. Much less if you only take the last 10 years since it was already virtually around $50 in 2011.

So if correction of this small a magnitude is enough to through people off budget, they’re living paycheck to paycheck and this is a shock to their system but for me I’ve barely noticed anything … yet.