Yeah they’re commenting on the year/year change, which is kinda dumb IMO. I only look at the annualized monthly change. Otherwise it’s messy with whatever was happening to energy prices 13 vs 12 months ago mixed into what’s going on now.

Fed comments

- FED’S DALY :CPI DATA WAS AS EXPECTED, GOOD NEWS FOR FAMILIES, AND BUSINESSES

- FED’S DALY :JULY CPI DOES NOT VICTORY IS OURS ON INFLATION

- FED’S DALY: THE CPI DATA CAME IN LARGELY AS EXPECTED.

- FED’S DALY: WE ARE COMMITTED TO GETTING CORE INFLATION DOWN.

- FED’S DALY: BY BRINGING DEMAND BACK IN LINE WITH SUPPLY, WILL GET BROADER INFLATION RELIEF.

- FED’S DALY: FED STILL HAS ‘MORE WORK TO DO’ ON INFLATION

- FED’S DALY: THERE’S A LOT MORE INFO COMING IN BEFORE SEPTEMBER MEETING, AND BEFORE THE END OF YEAR.

- FED’S DALY: WHETHER WE RAISE RATES OR HOLD, IT’S PREMATURE TO SAY

- FED’S DALY: I SEE SLOWING IN THE ECONOMY, BUT NOT THERE YET.

- FED’S DALY: THE ECONOMY FEELS LESS FRENZIED, BUT IT’S STILL HARD TO FIND WORKERS.

more

- FED’S DALY: INFLATION DATA IS IN RIGHT DIRECTION.

- FED’S DALY: IF CORE SERVICES EX-HOUSING STALLS OUT, THAT WOULD BE INFORMATION AND CONTACTS SAY INFLATION IS TOO HIGH.

- FED’S DALY: TO SUPPORT HOLDING RATES WOULD WANT TO SEE PATH OF INFLATION COMPLETELY DOWNWARD

- FED’S DALY: I AM SUPPORTIVE OF THE RATE HIKE WE TOOK IN JULY.

- FED’S DALY: THE KEY IS GOODS PRICE INFLATION, WHICH IS COMING DOWN, AND SHELTER PRICE INFLATION, WHICH WE PROJECT IS COMING DOWN

- FED’S DALY: TO SUPPORT HOLDING RATES, WE WOULD WANT TO SEE PATH OF INFLATION COMPLETELY DOWNWARD.

and the punchline

- FED’S DALY: WE ARE A LONG WAY FROM A CONVERSATION ABOUT RATE CUTS.

- FED’S DALY: WILL EXPECT WILL HAVE THAT CONVERSATION NEXT YEAR, WILL DEPEND ON THE ECONOMY AND PATH OF INFLATION

Nice work if you can get it and you can get it if you try …

The union says the deal would improve the average top rate for delivery drivers to $49 per hour. At that rate, working 40 hours a week would pay just shy of $102,000 annually.

“But that’s not including overtime,” Stutzman pointed out. “It’s also not the important part we’re missing here.

“One of the other things that a lot of people don’t take into consideration is our medical insurance and our pension.”

He says UPS pays between $11 and $13 an hour toward pensions of full-time employees. If the hourly pension contribution is $12 and that’s paid out for 2,080 hours, that would come to an additional $24,960 a year in pension contributions. For its part, UPS says it contributes more than $23,000 a year to each full-time employee’s pension plan.

As for medical insurance, Stutzman doesn’t give an estimate — but a survey commissioned by the Kaiser Family Foundation found the average annual premiums for employer-sponsored health insurance in 2022 were $7,911 for single coverage and $22,463 for family coverage.

“You can quickly see that it would actually take about a $170,000 a year job to replace this one for me,” Stutzman said.

He added that, “while the media is making it a little more profound than it really is,” he acknowledges he works for an “amazing“ company.

The media keeps pimping “$170,000” to rile up those burger-flippers.

That seems like an extremely generous pension. I’m a little jealous they haven’t replaced pension with a 401k, like all the other private employers.

The wage increases themselves aren’t that big over time though.

Good article on the possible effect of the Brics alliance on the dollar. Conclusion seems to be that the dollar will remain the reserve currency

https://www.reuters.com/markets/currencies/what-is-brics-currency-could-one-be-adopted-2023-08-23/

Brazil’s President called on Wednesday for the BRICS nations to create a common currency for trade and investment between each other, as a means of reducing their vulnerability to dollar exchange rate fluctuations.

Officials and economists have pointed out the difficulties involved in such a project, given the economic, political and geographic disparities between Brazil, Russia, India, China and South Africa.

Building a BRICS currency would be a “political project”, South African central bank governor Lesetja Kganyago told a radio station in July.

“If you want it, you’ll have to get a banking union, you’ll have to get a fiscal union, you’ve got to get macroeconomic convergence,” Kganyago said.

“Importantly, you need a disciplining mechanism for the countries that fall out of line with it… Plus they will need a common central bank… where does it get located?”

The greenback’s share of official FX reserves fell to a 20-year low of 58% in the final quarter of 2022, and 47% when adjusted for exchange rate changes, according to International Monetary Fund data.

However, the dollar still dominates global trade. It is on one side of almost 90% of global forex transactions, according to Bank of International Settlements Data.

De-dollarising would need countless exporters and importers, as well as borrowers, lenders and currency traders across the world, to independently decide to use other currencies.

The purpose of this BRICS expansion is more political than economic, and China is the one behind it. Most of the new members are in dire financial situation. For example, Argentina and Egypt are the two largest IMF borrowers. Argentina is broke: just this week it got $7.5B from the IMF. About half of that will immediately go back to the IMF as payments for existing loans (basically rollover debt). Most of the balance will go to paying for bridge loans Argentina got from Qatar, China, and a regional Latin American development bank. Argentina has close to 40% poverty, devaluated the currency 20% two weeks ago, and is a corrupt country. Come to think of it, corruption might be an admission requirement in this organization.

another example of handing out free money causing inflation, the food stamp expansion edition:

the World Bank … “found that a one percent increase in per-capita food stamp benefits increased grocery store prices by 0.08 percent.” Biden officials’ expansion has led to a 15% increase in grocery prices, according to a new study (Anna Moneymaker). “Put another way: Food prices increase by one percent for every 12.5 percent increase in food stamp spending,” the study said.

I don’t see the words you quoted in the article you linked.

It’s from a link in that linked article:

which first reported on the study.

But elsewhere…

Overall spending on the program more than doubled between 2019 and 2022, going from $4.5 billion in 2019 to $11 billion in 2022

The expansion is projected to cost US taxpayers more than $1 trillion over the next decade, according to the Congressional Budget Office.

I’m usually pretty good at math, so how can a $11B/year program be projected to cost $1-trillion over 10 years?

It looks like a typo. If you look at the data from congressional budget office at the link, the guvmint is projected to give away about $125 billion per year,

I’m thinking that $4.5B, $11B, and $8.6B (in March 2023) must be per-month numbers, not annual.

But … the department of labor, often cooks the books and revises data later. Today the stock market is up sharply while interest rates are lower.

U.S. employers in February posted the fewest job openings in nearly two years but the number of people quitting rose as the hot labor market continued a gradual slowdown.

Employers advertised 9.9 million job openings, the lowest level since May 2021, the Labor Department said Tuesday in its Job Openings and Labor Turnover, or JOLTS, survey. Openings remain below the record 12 million advertised in March 2022 but well above the pre-pandemic level of about 7 million.

Edit. Regarding Biden DOL cooking the books

And yes, today’s downward revision continues the recent trend of every single data point in the Biden administration being revised sharply lower in subsequent month(s), in a coordinated propaganda attempt to make the economy look stronger, then quietly revise it away when everyone forgets.

I do not know what the double reverse jujitsu thinking is about this, but all the major stock indices are slightly higher. And TLT, the ETF holding 20 year treasury bonds is up i.e. interest rate down

Inflation is so bad that the green energy projects heavily subsidized by the Biden Blowout Spending bill (“inflation reduction act”) has the green energy companies asking for even more subsidies to adjust for the inflation the bill has caused (or perhaps failed to reduce).

https://www.wsj.com/articles/green-energy-nyserda-renewable-subsidies-rate-payer-bailout-b807ccb3

large offshore wind developers are asking for an average 48% price adjustment in their contracts to cover rising costs. The Alliance for Clean Energy NY is also requesting an average 64% price increase on 86 solar and wind projects.

The IRA includes federal tax credits that can offset 50% of a project’s costs. But renewable developers say their costs are increasing faster than inflation and that the projects will “not be economically viable and would be unable to proceed to construction and operation under their existing pricing,” says Nyserda.

The current subsidies are already driving up the budget deficit

https://www.cnn.com/2023/09/06/politics/federal-budget-deficit/index.html

Related news?

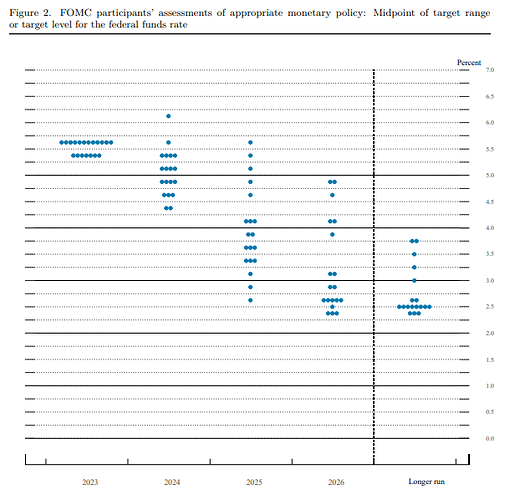

FOMC - Fed held steady, but a small majority saw possibly 1 more hike (vs none).

- FED KEEPS INTEREST RATE UNCHANGED AT 5.50%

- FED: 12 OFFICIALS SEE ONE MORE HIKE THIS YEAR, 7 SEE ON HOLD

- Fed Officials Expect to Hold Rates Higher For Longer in 2024, 2025 Than in June Projections

- Fed Officials See 3.3% Inflation at End of 2023, 2.5% at End of 2024, 2.2% At End of 2025

- Fed Officials See 3.7% Core Inflation at End of 2023, 2.6% at End of 2024, 2.3% at End of 2025

- FED SAYS INFLATION REMAINS ELEVATED, CENTRAL BANK REMAINS ‘HIGHLY ATTENTIVE’ TO INFLATION RISKS

- FED PROJECTIONS IMPLY ONE MORE 25-BASIS-POINT RATE HIKE THIS YEAR AND 50 BPS OF RATE CUTS IN 2024, VERSUS 100 BPS OF 2024 CUTS IN JUNE PROJECTIONS.

- US RECESSION RISK STILL ELEVATED AMID UNCERTAIN GROWTH PROSPECTS.

Not sure if this is going to help long term rates any or not? Looking more and more like it’s time to skip the high short-term rates and lock in a longer term.

Now I know the meaning of Wall Street-jargon “dot-plot”