If they arent being prosecuted for stealing $900 worth of stuff, I cant see them being prosecuted for talking about stealing $900 worth of stuff…

$900 being taken by one person may not get prosecuted, but as an organized crime syndicate (![]() ) they’re taking a significant sum. Also they wouldn’t need to arrest all the participants, just the leaders / organizers. That should also have the appropriate chilling effect on the whole thing.

) they’re taking a significant sum. Also they wouldn’t need to arrest all the participants, just the leaders / organizers. That should also have the appropriate chilling effect on the whole thing.

Zerohedge on today’s jobs report. The BLS is once again cooking the books. The stock market apparently did not believe the report either because in today’s upside down world, it should’ve dropped. Instead, it was up big.

After last month’s stunning payrolls report, when in our post-mortem we revealed not only a year full of monthly downward data revisions, but also collapse in tull-time jobs and surge in part-time jobs, as well asalso the worst unadjusted August payrolls since the great recession, we thought that nothing could shock us any more. And then we got the September jobs report.

We won’t spend too much time dissecting the report since regular readers are all too aware of the same old “upward goalseeking” tactics used by the BLS, so here are the highlights.

I don’t think it’s going to help long term rates, except in the short term. I’m not sure what you’re defining as longer term, but I’m keeping my powder dry for anything longer 5 years. My fixed portfolio, including TIPS, currently has a maturity of:

60 months – 8%

48 - 60 months – 6%

36 - 48 months – 10%

24 - 36 months – 10%

12 - 24 months – 26%

0 - 12 months – 40%

I don’t want to say that I’m “hoping” for higher inflation, but I’m betting on it with my wallet.

Or risk your pension in case one of them is a VC. That was the intent, and in some cases, the result of the last few years of reporting the “correct” side of stories. It’s not pretty, but was easily predictable, and will increase for years to come.

There are probably very few cities (outside of FL and TX) that aren’t at least 10% short of staffing of law enforcement personnel.

Oil up some on Middle East war, but probably not nearly enough the way that’s likely to go. Iran has admitted to helping in the Hamas attack, planning, approval, etc, so it will be interesting to see if the Biden admin, who just gave them $6B for helping keep the price of oil down, will do anything to sanction them. Given it would further raise global oil prices, my bet is on “no”.

Needless to say, we don’t have much of our SPR left for actual strategic geopolitical instability.

lots of nice macro charts in this JPM writeup, stocks, valuations etc. Inflation pg 28, rates 33.

Don’t know how trustworthy the numbers are. I was particularly interested in what they call “federal finances” on p. 20.

The JPM chart says the United States debt to GDP ratio in 2023 is 98%. The St. Louis Fed says it’s 120%.

Apparently, these are congressional budget office CBO estimates and they are making some bogus assumptions. They assume the 10 year treasury rate in 2023 is 4% dropping to about 3.5% in future when we know it’s closer to 5%. And the Fed is saying the fed funds rate is “higher longer”.

Lots of possibilities for SHTF. The Israelis know that they have to take out the Iran nuclear program sooner or later. Why not now?

Will there be a war between the Sunnis and Shias?

The United States has a senile president whose handlers made some terrible appointments. As an example they reappointed Robert Malley from the Obama team to be the chief negotiator with Iran. Malley is basically under house arrest for espionage.

See this from the left wing CNN

This is amazing with credit card interest rates now 20%+

Why Nearly Half of Higher-Income Households Say They Are ‘More Reliant on Credit Cards Than Ever’

A recent report from Moneywise cited a survey from the personal finance software company Quicken that found “32% of Americans earning at least $150,000 a year are currently living paycheck to paycheck.”

This seems extraordinary, but recent data published by the Federal Reserve Bank of New York show a surge in borrowing, with credit card debt in the second quarter of 2023 eclipsing $1 trillion for the first time. Despite high interest rates, people of all income levels are turning to credit cards to make ends meet. The New York Times recently noted that more than two-thirds of U.S. families now have credit cards, and balances were up more than 16% compared to the previous year.

I didn’t read the article, but have the correct answer(s):

Depending on your (xxx), it’s either

- Trump’s fault, or

- Living beyond your means/lack of self control/lack of common sense/lack of mathematical sense.

![]()

I cant think of better proof of the lack of personal financial literacy being taught in school.

It looks like big 3 car companies have settled with the UAW. The Settlement is disastrous to their competitive position in the world car market.

Compare the return of Toyota stock to Ford over the past year: Toyota up 26% Ford down 27%.

The Fed keeps rates unchanged, as expected…

The only competitive advantage they could now have is potentially on recruiting if there is a shortage of workers in the industry. As a prospective worker - and especially one not particularly motivated to overperform his/her peers -, I’d imagine it’s a good (short term) bet to go work at US automakers.

Of course, if labor costs at US manufacturers outpace their competitors at Toyota or Tesla, they’ll face the same old dilemna of competing on price or quality. Last time US auto manufacturers had to make that choice, taxpayers ended up having the bail them out. Odd to me that so many people would cheer on these union wins when it’ll end up costing them billions (in bailout or more expensive cars, pick your poison), while also helping foreign manufacturers rise to even bigger market shares. Personally, I’d feel better if this kind of Bidenomics Koolaid also came with assurance to taxpayers that they won’t ever be on the hook to pay for another US automaker bailout like the $10B+ blown on them in 2009. I can choose to buy from other manufacturers but it’s harder for me to choose not to bail them out.

Not to be repetitious, but … I’m shocked, shocked to find spending going on here.

You’re conclusions are spot on. I only wish that more people had your opinion / sense.

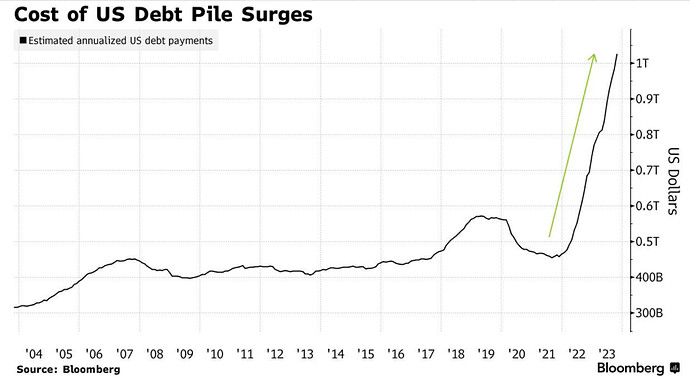

Note that the Y axis is offset by about $300 billion. They did not need to do this. The actual data are bad enough. Interest doubled in about 2 years.

Oct inflation lower than expected, markets up. Flat vs small increase expected

- U.S CPI (MOM) (OCT) ACTUAL: 0.0% VS 0.4% PREVIOUS; EST 0.1%

- U.S CPI (YOY) (OCT) ACTUAL: 3.2% VS 3.7% PREVIOUS; EST 3.3%

and core CPI still at ~2.5% annualized for Oct, but better than feared.

- US CORE CPI MOM ACTUAL 0.2% (FORECAST 0.3%, PREVIOUS 0.3%)

- US CPI YOY ACTUAL 3.2% (FORECAST 3.3%, PREVIOUS 3.7%)

markets

- TRADERS ERASE VIEW THAT FED COULD RAISE RATES ANY FURTHER, AND ADD TO BETS ON RATE CUTS IN 2024

- FED-DATED SWAPS PRICE IN FIRST 25BP CUT FOR JUNE VS JULY PRIOR.