Including bonds so interest rates down. 2 year treasury 4.8% down from 5.1% yesterday. I am sticking with my t-bills. Still yielding about 5.3% with no state tax.

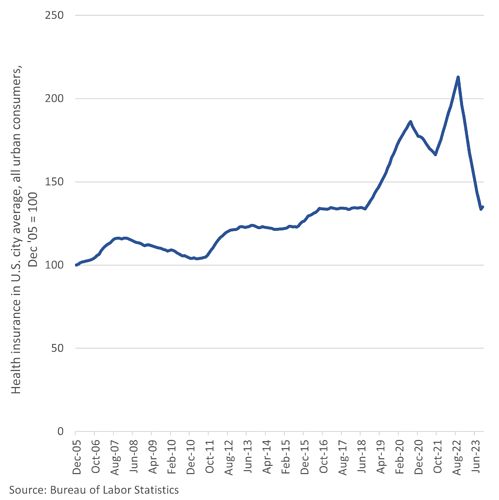

Following up, here’s another article on the weird annual health insurance inflation adjustment in the CPI, which contributed to last months lower reading. I posted about the changing approach last year in the above post.

What BLS is essentially trying to measure is the difference between what the insured pays in premiums and the value of the benefits he or she receives from the insurance. Let’s say you pay $5,000 per year in premiums, and you receive total benefits of $4,500 over the course of the year. The $500 difference is called net premiums, and BLS measures it by looking at the retained earnings of health insurance companies. This is an indirect method of measurement and it has some serious flaws because many factors can affect retained earnings besides premiums received and benefits paid.

which seems reasonable enough if you’re an economist, but covid kinda threw this stuff for a loop.

Several factors, including inflation which ate into the profit margins at health insurance companies, then combined to cause a collapse in retained earnings. Thus, retained earnings were falling even as consumers were paying significantly more for health insurance relative to the benefits they received. That meant the health insurance component of CPI was due to fall off a cliff despite people shelling out more cash.

Playing around with the CPI is the Achilles’ heel of inflation indexed bonds like tips and I bonds. The government has many incentives to keep the number low.

There are many shenanigans as pointed out in the article. See this one.

https://www.bls.gov/cpi/quality-adjustment/home.htm

The hedonic quality adjustment method removes any price differential attributed to a change in quality by adding or subtracting the estimated value of that change from the price of the old item. Hedonic quality adjustments for rent and owners equivalent rent are used primarily to adjust for the age of a rental unit, and for utility adjustments.

November CPI is out. there’s still a little inflation, slightly higher than people were hoping. Core CPI is still pretty high, around 3.7% annualized.

- CPI 0.1% MoM, Exp. 0.0%

- CPI 3.1% YoY, Exp. 3.1%

- CPI Core 0.3% MoM, Exp. 0.3%

- CPI Core 4.0% YoY, Exp. 4.0%

- FED SWAPS PRICE IN SLIGHTLY HIGHER ODDS OF 2024 RATE CUTS

There’s a lot of Wall Street money riding on sooner and faster cuts by the Fed. I’m still investing in six month t-bills.

The stock market is unchanged. They probably think they can live with a 5% plus funds rate.

Pretty much looks like a nothing burger for the markets. Both CPI and Core CPI at or close to expectations. Probably signals what they expected which is Fed sitting tight without much reason to move one way or the other.

I’m with you on the 26-wks T-Bills. You could make a lot worse decisions with your fixed income investments at the moment than the guaranteed ~5.4% they’re returning right now.

They are also state tax free, which makes a big difference with my ~10% marginal state income tax rate here in California.

Someone tell the WashPo Union to read their own front page - inflation is no problem, quit your whining and get back to work. Nevermind the cooling inflation hasn’t caused prices to drop to pre-Biden levels since that would require deflation.

I read a similar economic piece the other day I can’ remember where (also using the word economic for that article was a stretch but anyway). It was a note that despite inflation having cooled off, prices have still not decreased from their peaks. I wondered what kinda of sad excuse for a financial writer had turned in that article and who idiotically accepted it. It’s almost like if some folks are hoping for deflation.

But I cannot comment on the merits of the WaPo union’s complaints. The bean counters and upper management are in charge of selling subs and ads to a liberal audience and publish whatever to push a pleasing narrative. But they could totally at the same time have not given their workers raises that somewhat kept up with inflation over the last couple of years. But yeah the combined optics are not great LOL.

The Biden regime mob got to Powell

One day after the Fed’s bizarre, unexpected pivot, many are struggling to wrap their heads around what happened: what exactly changed in less than two weeks for Powell to go from telling the market it was "premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease " to suddenly warning that rate cuts are something “that begins to come into view, and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today."

…

Almost 60 years later, Powell decided not to “call the shot as he saw it” just two weeks ago, and instead of being shoved against the wall by Biden’s thugs, to instead capitulate what little credibility the Fed had just so Biden’s odds of getting reelected in 2024 were ever so fractionally higher…

I don’t think much has changed between the statements. And the statements are marginally different as well if you read between the lines of the first one.

Right before the part of the initial statement saying it was premature… he also said this:

“Like most forecasters, my colleagues and I anticipate that growth in spending and output will slow over the next year, as the effects of the pandemic and the reopening fade and as restrictive monetary policy weighs on aggregate demand.”

That followed his mentioning that during the last 6 months period ending in October, core inflation was 2.5% annualized compared to an ideal goal of 2%.

In other words, the tea leaves said pretty clearly - as identified by markets that the Fed were actually saying: “We don’t want to guarantee that we’ll definitely not hike rates again - you never know -, but, we, like everyone else, expect not to have to. That said, it’s a bit too early to state firmly exactly when we’ll start cutting rates.”

Now he just acknowledged what everyone knew which is the Fed are discussing when to cut between March and May for the first cut, and maybe what will cause them to slow or accelerate that agenda.

For what it’s worth, breakfast cereal has seen a crash in price. At Walmart, many of the “Mega” sized boxes had been in the $6.25-$6.98 range, and are now down to $5-$5.50.

The stuff I buy, Nabisco bite-size shredded wheat, is up about 10% from couple of years ago. Used to be about four dollars now it’s about $4.40.

Other items are also about 10 or 15% higher over that time. Small bags of frozen vegetables like broccoli or cauliflower are about $1.15 now used to be $.98.

I dont recall exactly what it was, but these cereals had been below $5 a couple years ago. So my comment is that the price is coming down, not that it’s back to the levels of the “before” time.

Same weight as before? Some of my favs have seen weight/volume shrinkage, a different mechanism to increase prices.

Congratulations, but I live in the healthy South. My breakfast food of choice has seen, at a minimum, a doubling of the the price. For example, Dr. Pepper 2L was very regularly on sale for .99 until the Spring of 2023. It is now rarely on sale, and even then, the sale price is bragged about as 3 for $6.

Consequently, Lipton and Red Ball have become my breakfast friends of choice. ![]()

Speaking of red bull for breakfast, this is hitting people where it hurts. Not mentioned is that California fast food restaurants have to pay $20 per hour minimum wage due to a new law passed by the democrat controlled California state government.

First of all calm down, since this $20 wage doesn’t start until April 1st and only applies to national fast food chains (“National fast food chain” means a set of limited-service restaurants consisting of more than 60 establishments nationally that share a common brand, or that are characterized by standardized options for decor, marketing, packaging, products, and services, and which are primarily engaged in providing food and beverages for immediate consumption on or off premises where patrons generally order or select items and pay before consuming, with limited or no table service).

This won’t hurt your smaller mom & pop joints, or even big chains that operate separate brands with < 60 locations each.

Groceries is where it hurts. Nobody has to eat at national fast food chains. Except Chipotle. Everyone must eat at Chipotle.

Bullcrap. How the hell will any mom and pop place hire decent help for even $15/hr, when that help can get $20 doing the same work at a “chain” restaurant? And that isnt even considering other low-skill service/labor intensive jobs that now have to compete with $20 to keep their own operation staffed.

This is no different than a random worker being able to “chose” not to join the union, but still being subject to the union pay scales and work rules. It’s a charade to pacify those unable to think things through. A means of punishing those who dare try to make it on their own rather than rely on the benevolence of the state, while masking the punishment and deflacting blame for the results.

And that’s the rub. Why are these fast food workers so deserving of being singled out for a special high wage? You said it - it isnt remotely an essential industry, yet we’re now mandating wages that only further limit what such business owners can do to attract customers in an attempt to succeed.

Why does California have to be the leader of the day for raising a pay scale $20? Yes I agree $7-10 per hour for waiting tables is pretty bad.

Hard to make a decision on this issue, since I have a 16 year old nephew who just got a job at McDonald’s. I don’t know how much pay he’s getting, but he’s really excited about getting a job.

I also go along with keeping Chipotle’s workers contented ![]() . Love it…

. Love it…