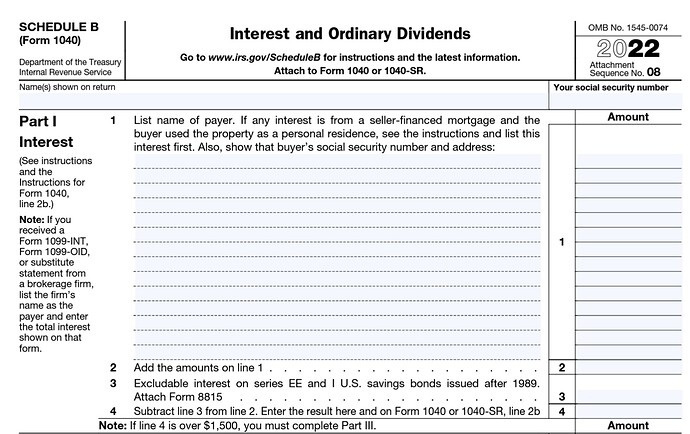

Can I just fill out a second form?

This is an automatically-generated Wiki post for this new topic. Any member can edit this post and use it as a summary of the topic’s highlights.

Instructions for Schedule B say

H&R Block fills the first line with “See attached worksheet(s) for detail.” and the total amount, then attaches an “Interest Income” worksheet with details.

OK I’ll figure something out. I guess they care about the total on 1040.

TurboTax will generate a line on there that says “see attached” with a subtotal. You could probably aggregate them all on a single line, and they wouldn’t care as long as it matches or exceeds whatever was reported to them.

Free Fillable Forms just generates a second “additional interest” sheet (that doesnt look like an official IRS form). It totals that sheet, and lists that total on one line on Schedule B Line 1 as “additional interest” so that it is included in the amount on line 2.

I would NOT fill out 2 Schedule Bs.