I’ve always kept a bit more than the bare minimum legal coverage required on my car insurance. However, I’m reconsidering dropping to the bare minimum. I’ve never been in a single car accident and don’t drive often.

Most importantly, I have few seizable assets, should I be involved in an accident and sued. Most of my money is in retirement accounts. My checking account has a few thousand in it. And my 15 year old crown vic is worth very little on the blue book side. I own no real estate.

Currently, have no garnishable wages but that may change so I would like to consider wage garnishment as a possible reason in the future to have higher coverage at that time.

My goal isn’t to stiff a legitimate person out of money if I damage them or their vehicle, it is to deter someone from faking excess injury to get more money out of the deal.

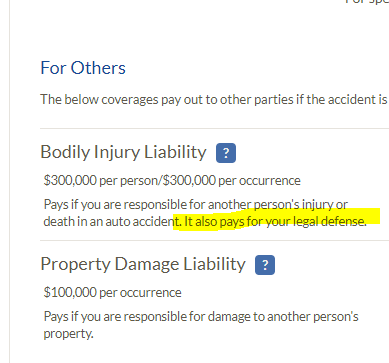

I’m preparing to shift my finances into an early retirement extreme mode where I live at a bare minimum level of expenses and I can save $160 per year by going from my current $100k/$300k coverage down to bare minimums for property and bodily injury coverage. Part of me thinks that $160 is cheap to not have to worry about hiring my own lawyer, but even if I do $1M of damages and only have $15k of coverage, it’s my understanding the insurance company still has to hire an attorney. But perhaps the attorney will just say “f it, here’s your $15k, anything more, take it up with my client”

Or does the insurance-provided attorney have to fight the case to the same level of diligence, even if the final verdict is likely to be 100x what my coverage allows?

I expect many to argue that $160 is cheap insurance to raise it up to 100k/300k, but if that’s true, how do I know it’s optimal? Maybe I should be paying another $50 per year and go up to $250k/$500k? Maybe I should pay another $200 a year on top of that for a $1M umbrella policy? The arbitrary 100/300 that I have been using the last year isn’t necessarily optimal. It just seemed like a decent position offhand at the time when I set it up.

I also expect an argument that if I cause $100k of damages to someone, I shouldn’t plan to pay out $15k and then declare BK on the rest. I owe it to that person that I injured to make them whole. However, what if I keep my $100k coverage and actually cause $200k of damage to someone? I don’t have the $100k out-of-pocket to make them whole, so in that case even though I “did the right thing” by having a high coverage, I stiffed someone.

What if I got a $1M umbrella plan but caused $2M of damage to a bus full of kids? I don’t have the extra $1M to cover them out-of-pocket. At some point, all of us have the ability to do damage greater than our insurance or cash savings can compensate for, and we have to accept that ethical risk. I agree that $15k is very low, but how do we determine what’s the right level?

Finally, the old adage I’ve always read is to have insurance to cover all of your assets. So if you have $100k in cash in the bank, get a $100k policy. If you have $1M in cash, get a $1M umbrella policy. I find that silly because what’s stopping you from doing $2M in damage when you have a $1M umbrella and then losing all of your $1M in assets on top of the umbrella payout?