You can’t really control the property tax appraisal of your house. That’s why gentrification is a big deal. If property values double, the property taxes double.

Over 65 (who have guaranteed income) and some other special classes also get frozen taxes, driving up everyone else’s who are in less secure financial situations.

fair enough I was quoting an article and highlighted a part

I’d still buy small to relatively control (unless Tiny homes get to more expensive than McMansions) I think we should tax spending/assets vs income., Which is one of my predictions that will happen more in the near future. Unfortunately they’ll probably not replace income tax but on top off.

Come to California! We have Prop 13 (1978), which limits property tax / assessment increases to 2% per year (value resets when sold), and Prop 19 (2020), which allows the following people to keep their property tax basis: (1) children who inherit a parent’s or grandparent’s home and make it their primary residence, and (2) anyone over 55, disabled, or a victim of a natural disaster, who sold their primary residence and purchased or built another within 2 years of the sale. It’s even clever enough to allow for home upgrades (i.e., if you sold a house for $500K in which you had a tax basis of $100K and bought the new one for $700K, your new tax basis will be $300K = 100+(700-500)).

How preposterous to let old or disabled people keep their homes. A socialist’s paradise! ![]()

![]()

It makes sense in a vacuum. Except they’re the only groups of people with a guaranteed income (that also is guaranteed to grow at inflation), even if they didn’t bother to save over the many years they had an opportunity to do so… Well, I am being inaccurate. Children also have a guaranteed income from federal refundable tax credits (that is likely to continue to grow), but it’s much less than can cover full household living expenses.

The 2% increase in CA makes more sense (aligns somewhat with recent overall CPI) than in some other states (TX, for example) that completely freeze the property taxes on over 65. The transfer to new properties you describe also seems more reasonable than transferring a percentage (TX), which in your example results to $140k basis in the new.

OTOH, the inheritability of the benefit doesn’t seem to make much sense and seems like it really can break things fast. But it doesn’t seem much different than federal carveouts that exempt business inheritances (and massive estates/“farms”)?

Again, all true. But do not discount Red China’s intense desire to possess Taiwan:

WASHINGTON (AP) — The American military is warning that China is probably accelerating its timetable for capturing control of Taiwan, the island democracy that has been the chief source of tension between Washington and Beijing for decades and is widely seen as the most likely trigger for a potentially catastrophic U.S.-China war.

Luckily the new admin’s stance is so far less pro PRC and pro Putin, and we’ll hopefully climb back in world leadership, rebuild alliances, and organize a mutual effort to deal with that. It’s anyone’s guess where we’ll be in 4 years, we might regress even further instead of improving. It might be too late, though.

UK has shown it couldn’t really do anything all on its own to protect HK. It would take a cooperative effort to stand up to China.

“According to 2020 data, the overall average annual premium for homeowners insurance is $1,477 based on a home with a dwelling coverage amount of $250,000.”

So thats roughly 0.6% of the value /year

Tax is 1.1%

Annual median home prices : Historical US Home Prices: Monthly Median from 1953-2024

Mortgage rates over time : Mortgage Rates - Freddie Mac

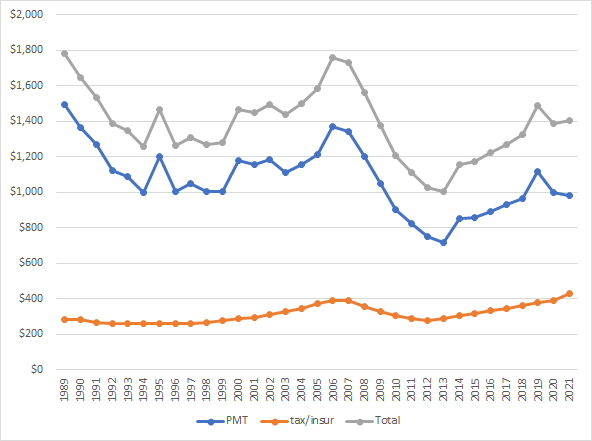

Add it all up :

The blue line is the original chart showing just the mortgage payment. The organge line is the taxes plus insurance over time based on inflation adjusted home values. Gray line is the total.

Gray line is VERY similar in trend to the blue line. It just slopes up a little more.

Anecdotally, my first home was about $150k bought in 1998 with 8% mortgage rate. Thats about $1060 payment. Inflation adjusted to today it would be $1725/mo

The same exact home is worth ~$400k today and with 2.75% mortgage payment would be ~$1630

That is regressive and will make inequality worse - poorer people spend greater %age of their incomes than richer people.

Circles back to some combination of income and wealth tax being ideal. But wealth tax is somewhat problematic to actually implement (the details and some possible side effects).

I think it does make sense. If the “child” is no longer a child and has their financial affairs in order, it’s not likely that they’ll move to the inherited house just to save a few bucks on property taxes. It’s intended to not make homeless those who are still young or do not have their financial affairs in order. The tax basis is only retained while the inherited property is their primary residence.

But that’s a reduction in overall social mobility. It’s giving a large (and ever growing as the valuations get further and further from actual), unfair advantage over other kids who didn’t have a rich homeowner leave them a property as an inheritance. The poor get poorer and face rising housing costs (since less are shouldering the tax burden), while the well-off get an extra government safety net to prop up their spawn’s social and economic position?

Thought I might jump into this conversation, but decided that I don’t want to get “tossed about again”. ![]()

I can’t tell if you’re being facetious, since by that definition any inheritance is unfair. This just makes the inheritance of a primary residence slightly more valuable than without (by the way we had other propositions before 19 that already had most of these benefits, 19 just improved upon them). There is also a cap now that did not exist before: “Value limit of current taxable value plus $1,000,000 (as annually adjusted)”, which I think means the difference cap is $1MM, or approximately $10K/yr maximum potential property tax savings.

I’m not following the “since” – housing prices do not increase because fewer people are shouldering the tax burden. Also remember this is property tax that goes directly to the local county, most of which is spent on K-12 and other local services.

And I don’t really know how “well-off” a person is if they decide to move into the inherited property (and that’s assuming they’re not a child whose parent(s) just died). I suspect not that well-off.

Gonna throw out my thoughts:

- Mortgage rates will inch up, which will cause some buyers to pause and/or drive inventory levels up. However, I think we will continue to see a heavily constrained inventory levels for the foreseeable future while tampering price increases to a certain degree.

- Commodity increases - rolled steel and other commodities are increasing exponentially. We are seeing price increases across the board, which I believe will lead to further price increases to consumers.

- Travel - in the US, I think we will see a resurgence in travel and vacation destinations. Everything in this workflow (airfare, hotels, car rentals) should see an impact. Vaccine rollout and distribution has been incredible compared to other countries and places like Florida are “open” for incoming tourists.

I’m not so sure about that - if Biden gets his legislation through Congress and it’s as popular as it appears to be now, there may not be the anger needed to change Congress.

And/or (more likely to me) the R’s roll out a bunch of Trump wannabes that drive huge D turnout against them in Senate races (at a minimum) thus allowing the Senate to stay D, and possibly the House if the gerrymandering this year is not bad enough to put the minority in power. The latter is the big question mark on the House IMO.

The real question is which way the R’s go as a party - if it stays the party of Trump with candidates intent on spreading falsehoods and anti-everything that’s based on science/reality, they’re going to be a permanent minority.

Yes I meant a combo. Property being a form of wealth tax which addresses most valuation issues

Jobs - many, especially on the low end of the economic scale are still out of work

Unemployment has been steadily dropping over the past 12 months.

Job openings in the USA are currently at a 20 year high.

And thats even with the pandemic still stifling the economy. Plus we’ve got more bonus freebie unemployment payments that are disensentivizing many people from returning to the workforce.

Boomers are continuing to retire and immigration has been curtailed.

Its anyones guess but to me it seems the jobs outlook is pretty good for the next 1-2 years.

Job openings in the USA are currently at a 20 year high.

Lots of $2/hr positions?

Lots of $2/hr positions?

not that bad but bad enough that you’d make more on UI