doubling of the standard deduction was good but they also got rid of exemptions ![]()

Warren to Join Senate Finance Committee; Will Introduce Wealth Tax | U.S....

The Official U.S. Senate website of Senator Elizabeth Warren of Massachusetts

doubling of the standard deduction was good but they also got rid of exemptions ![]()

Or are they looking under every rock to increase the amount of taxes collected?

I’m not sure a whopping 26% tax credit would increase the amount of taxes collected. Especially if more people from the lower brackets start contributing.

I also didn’t see any mention about Roths in that article, wonder if those are to stay as an option.

The main consequence of this is that people will pay a lot more state taxes since the 401k deduction currently reduces your state taxable income, which starts with your federal AGI, but a credit won’t do that anymore. See my earlier comments.

I’m not sure a whopping 26% tax credit would increase the amount of taxes collected. Especially if more people from the lower brackets start contributing.

The lower brackets contribute essentially nothing as a % of government revenues, and those in that group who actually save for retirement is a very small fraction indeed.

Eliz Warren gets a seat on the Senate Finance Committee, plans to introduce a wealth tax proposal.

The Official U.S. Senate website of Senator Elizabeth Warren of Massachusetts

wealth tax proposal

“2% on household net worth (all assets worldwide) > $50 million, 6% > $1 billion” [1]

Likely doomed for a constitutional fight, so it could be a while before anything like that takes effect, if ever.

Likely doomed for a constitutional fight

How so? It’s just like property tax

Because according to wikipedia there’s no consensus about constitutionality (case law suggests it may not be and there’s no precedent). And “Unlike federal wealth taxes, states and localities are not bound by Article 1, Section 9, which is why they are able to levy taxes on real estate.[63]”. And if there’s no consensus and so much money at stake, plenty of interest in a legal challenge.

I think that if there’s a hint of unconstitutionality, the odds of this law coming into effect are rather long currently. It’d have to be endorsed enough to get a constitutional amendment like the 16th amendment for income tax or it’s guaranteed to go before the SCOTUS. Considering its 6-3 republican majority, I think it’d take some convincing for them to get even a 5-4 ruling on it. Especially considering how Chief Justice Robert opined during the Obamacare hearings on the issue of direct taxes.

Also in Washington state:

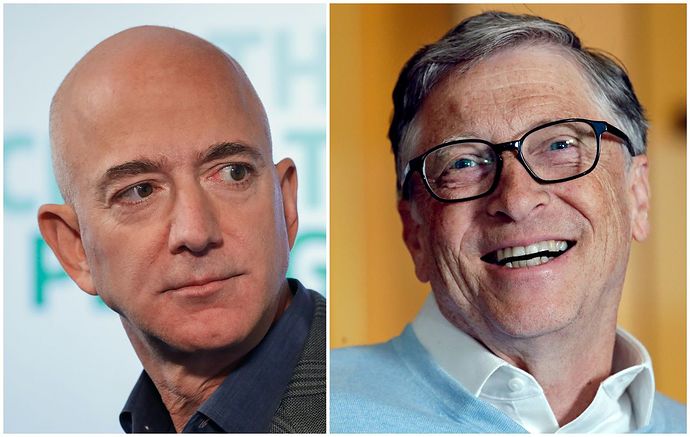

Washington state’s richest residents — including Jeff Bezos and Bill Gates — would pay a wealth tax under a bill proposed by a lawmaker who says she is seeking a fair tax code at a time when so many people are struggling due to the pandemic.

Changing residency to avoid the tax altogether should not be too hard for these billionaires. And even if they did not care about 1% wealth tax, many may be tempted to do it simply to avoid having to figure out the exact value of their worldwide assets just to figure out their state taxes.

We gonna make it hard, with a 40% “change of residency” tax.

Oh, you’re talking about Washington state. I’m sure they’re smart and will think of something.

They have already been tightening the screws on the US taxpayers who might aspire to leave. This started back in 2008 and basically everything you own is MTM as if it’s sold and you have to pay tax on all of those gains/IRAs/etc.

New Address for Mailing Form 8854 The mailing address for Where to File Form 8854, I

I’m sure they would love to add another thing like the CA proposal if they manage to get an IRS level wealth tax where they keep taxing you after you leave for a decade or more.

This started back in 2008 and basically everything you own is MTM as if it’s sold and you have to pay tax on all of those gains/IRAs/etc.

In what imaginary world would it make sense to give a free step up in basis (make tax deferrals permanent) to encourage rich citizens to leave?

In what imaginary world would it make sense to give a free step up in basis (make tax deferrals permanent) to encourage rich citizens to leave?

It’s not free - you pay taxes (and I think associated early withdrawal penalties) on the difference between the original basis and the market value at the time of expatriation.

You do now. That was noted as “tightening the screws” (which is a negative connotation).

In what imaginary world would it make sense to give a free step up in basis (make tax deferrals permanent) to encourage rich citizens to leave?

It wasn’t free - you had to keep filing tax returns for at least a decade more after your left and paying US taxes on everything, possibly in addition to taxes on those same actions / gains elsewhere. It was more like forcing you to stay a US taxpayer for a long time but not forever if you wanted out.

Like many things in tax policy, our short sighted managers / politicians eventually convert most longer term government tax assets (like traditional IRA taxation) into short term revenue boosts at poor prices for them (ie Roth conversion when you feel like it). This is kinda the same thing where they get a one gain (and you get a one time hit) when you leave and then you’re gone.

Mitt Romney has a child tax credit proposal that will also get rid of the SALT deduction, the child and dependent care tax credit, Head of Household status, TANF (the replacement for AFDC, or welfare for parents), and creates a 5% surcharge bubble tax bracket at the $200k/$400k level as a clawback of these benefits, which would be distributed through social security and not the IRS. But that makes it revenue neutral.

Article: https://cdn.vox-cdn.com/uploads/chorus_asset/file/22279576/family_security_act_one_pager_appendix.pdf

Analysis: https://www.niskanencenter.org/wp-content/uploads/2021/02/Analysis-of-the-Romney-Child-Allowance_final.pdf

If the point is to encourage more kids to help pay for Medicare and Social Security when I retire, then that’s great, but there’s no doubt it would be a tax increase on childless people and those taking care of elderly relatives who use the dependent care credit.

Reading the tea leaves on possible tax hikes.

https://www.wealthmanagement.com/high-net-worth/twelve-potential-biden-tax-changes-keep-eye

I think that if there’s a hint of unconstitutionality, the odds of this law coming into effect are rather long currently. It’d have to be endorsed enough to get a constitutional amendment like the 16th amendment for income tax or it’s guaranteed to go before the SCOTUS. Considering its 6-3 republican majority, I think it’d take some convincing for them to get even a 5-4 ruling on it. Especially considering how Chief Justice Robert opined during the Obamacare hearings on the issue of direct taxes.

no chance of states ratifying amendment

Fun fact: 16th amendment for income tax they had proposed a 10% limit and people laughed that it would never get that high… and here we are ![]()