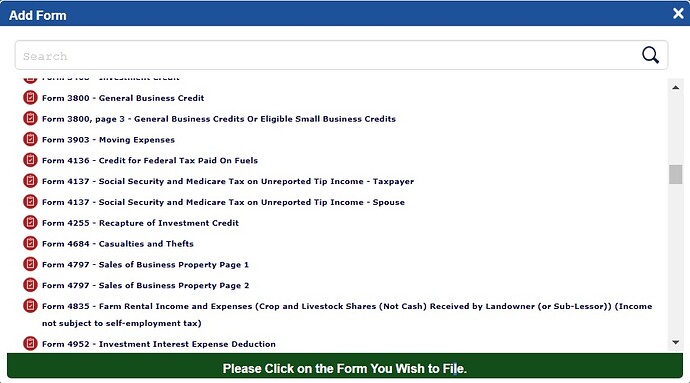

It’s missing from the list of choices.

This is an automatically-generated Wiki post for this new topic. Any member can edit this post and use it as a summary of the topic’s highlights.

This isn’t reddit, try googling first.

Did not think I had to Google something that the IRS could have clearly mentioned in that list of forms. I put the amount for depreciation of property put in service before 2022 on schedule C line 13 without that form so I’m I screwed?

You can always amend your return, right?

When you saw it missing from the list, you could’ve googled it just as easily as starting this thread asking someone else to google it for you?

I put the amount for depreciation of property put in service before 2022 on schedule C line 13 without that form so I’m I screwed?

If you can enter the numbers from the form onto the return, you can print the return and mail it along with a 4562. I’m not sure if you e-file, if mailing the 4562 separately would get it all put together correctly or not - I’d think it should, but…

Nothing to amend, the numbers are still the same.

Logged back into the IRS iFile site to bring up the return I submitted earlier today thinking I’d find that form and submit it. Went to schedule C and there is NO Add button for form 4562. Reading the directions for the form, I don’t think I even need to submit one. Says,

When to attach Form 4562. You must complete and attach Form 4562 only if you are claiming: •Depreciation on property placed in service during 2022;

•Depreciation on listed property (defined later), regardless of the date it was placed in service; or

•A section 179 expense deduction.

If you acquired depreciable property for the first time in 2022, see Pub. 946. Listed property. Listed property generally includes but is not limited to:

•Passenger automobiles weighing 6,000 pounds or less;

•Any other property used for transportation if the nature of the property lends itself to personal use, such as motorcycles, pickup trucks, etc.; and

•Any property used for entertainment or recreational purposes (such as photographic, phonographic, communication, and video recording equipment).

I’m claiming depreciation on R.E. placed in service before 2022.

I’m not going to do any research to refresh my memory, but I believe this is correct - form 4562 establishes the depreciation you are entitled to each year, so as long as you havent added any new depreciating property your depreciation amount was already established on prior year returns.