which lowered our yields here too??

Tentative-Auction-Schedule.pdf

15.05 KB

which lowered our yields here too??

Or maybe like the Wall Street guys on TV say the bond market was oversold. Whatever the heck that means.

The stock market also had a 2% increase in the S&P 500. They were oversold too?

I hear ya. Interest rates aren’t shooting up. They were held down for too long, too fast. Free money pay back time…

I suspect many people are taking the Bank of England’s actions as a sign of what may happen here if rising rates slow down the economy. Despite the Fed’s tough talk, I believe this will happen, thus driving down rates and driving up metal prices.

UK had an unprecedented intervention by their central bank in their treasuries market. Apparently their pension funds were highly leveraged and long these, due to some accounting quirk that tried to avoid accounting “losses” in favor of real ones. When rates rose, and their long bond positions fell, they nearly all were going to get margin calls and have to blow out of their bonds and this could trigger cascading selling. This was a good explanation-

https://www.bloomberg.com/opinion/articles/2022-09-29/uk-pensions-got-margin-calls

Other coverage

https://www.wsj.com/articles/the-return-of-inflation-makes-deficits-more-dangerous-11664366538

at one point on Wednesday morning there were no buyers of long-dated UK gilts. “It was not quite a Lehman moment. But it got close.” …

“If there was no intervention today, gilt yields could have gone up to 7-8 per cent from 4.5 per cent this morning and in that situation around 90 per cent of UK pension funds would have run out of collateral,” said Kerrin Rosenberg, Cardano Investment chief executive. “They would have been wiped out.”

More broadly the issue is that rate hikes are making the financial system unstable in cases where the country already has large budget deficits / debt.

The main stream financial press and most Wall Street pundits are ignoring the huge debt with their business as usual predictions. Combine that with European energy situation and the possible nuclear war over Ukraine and it’s amazing the stock market has not sold off more.

https://www.cnn.com/2022/10/05/investing/premarket-stocks-trading/index.html

The US Treasury — backed by the US government and considered the safest of bonds — is experiencing what JPMorgan analysts describe as a “structural absence of demand.”

JPMorgan strategists, led by Jay Barry and Srini Ramaswamy, write that the three main buyers of US government debt — the Federal Reserve, commercial banks and foreign governments — have significantly eased up on their purchases.

Using Federal Reserve data, they found that commercial banks’ collective holdings have fallen by $60 billion over the last six months compared to the same period last year, after growing by more than $700 billion between 2020 and 2021. Foreign governments’ official holdings have dropped $50 billion over the past six months. The Federal Reserve, meanwhile, has dropped its Treasury holdings by about $180 billion so far this year as a part of its monetary tightening program to fight inflation and cool the economy.

The move by the Fed was expected. At the onset of the Covid-19 pandemic, growth slowed and the Fed began purchasing $120 billion in government backed bonds each month as a way to inject money into the economy. Now, the central bank has reversed course.

Still, overall, the drop in demand for Treasuries is extraordinary.

“The reversal in demand has been stunning as it has been rare for demand from each of these three investor types to all be negative at the same time,” wrote Barry and Ramaswamy.

Why? Although hindsight is 20/20, it would make sense that banks would buy bonds during the height of the Chinese Virus from China, since no one could secure loans because:

It also seems like common sense that governments worldwide have spent a lot of money on Virus from China lockdowns, Virus from China testing, Virus from China recovery, or the perfectly safe and secure Virus from China vaccine, distribution, and delivery. Those governments have also received significantly less tax revenues (or whatever Socialist/Progressive countries/states call them). Consequently there is less money available to buy U.S. bonds.

Further exacerbating the issue is the strength of the U.S. dollar, which I concede may not have been easy to portend.

More warning signals about the bond market

The latest bout of global financial volatility has heightened concerns about regulators’ continuing failure to resolve liquidity problems with US Treasuries – the debt that serves as a benchmark for the world.

It’s getting harder and harder to buy and sell Treasuries in large quantities without those trades moving the market. Market depth, as the measure is known, last Thursday hit the worst level since the throes of the Covid-19 crisis in the spring of 2020, when the Federal Reserve was forced into massive intervention.

With rising risks of a global recession, escalating geopolitical tensions and the potential for further defaults by developing nations – not to mention ructions in a developed economy such as the UK – investors may not be able to rely on Treasuries as the reliable haven they once were.

“We have seen an appreciable and troubling deterioration in Treasury market liquidity,” said Krishna Guha, head of central bank strategy at Evercore ISI. Regulators “really haven’t delivered yet any substantial reforms,” he said. “What we are seeing at the moment is a reminder that the work is really important.”

When the Treasuries market broke down amid a panicked rush into dollar cash in March 2020, the Fed swooped in as buyer of last resort. And while it now has a backstop facility allowing the exchange of Treasuries for cash, volatility, if extreme enough, could still force the Fed into action, observers said.

That’s particularly awkward now, when policymakers are not only raising interest rates but actively shrinking the portfolio of Treasuries. So-called quantitative tightening is supposed to be playing an “important role” in tightening monetary policy, as part of the central bank’s battle to contain inflation.

“The biggest nightmare for the Fed now is that they have to step in and buy debt,” said Priya Misra, global head of rates strategy at TD Securities. “If the Fed has to step in – when it’s in conflict to monetary policy – it really puts them in a bind,” she said. “That’s why I think regulators need to fix the market structure.”

Hmm … what would be the simplest reform to increase market liquidity? Maybe not spend so much that you have to borrow so much. The resulting demand outstripping supply would not only resolve a liquidity issue, but also drive down auction rates.

Nah! That’s too simple. Let’s create a “working group”, giving them a budget of 10MM, and 5 years to come up with a plan which will so complex and out of date that it will be useless. Yeah, that’s the ticket.

Reminded of a recent clip I saw from Robin Williams on that topic from years ago. Nicely done - well worth a quick watch.

https://twitter.com/OccupytheFeds/status/1578029073091022849

Arvind Narayanan, a senior portfolio manager and co-head of investment-grade credit at Vanguard, said the finances of corporations are “weakening incrementally” from very strong levels, which he anticipates will continue through the rest of 2022.

“The critical issue is the degree to which third-quarter earnings results and forward-looking guidance from companies surprises to the downside relative to expectations,” Narayanan said in an email interview.

The money manager, who helps oversee Vanguard’s $7.3 trillion in assets, is among a growing number of analysts raising concern about how rising interest rates, market volatility and slowing economic growth will hit the corporate bond market. A Bank of America Corp. survey found that a record share of investors expect credit spreads to widen over the next three months, while analysts have marked up default forecasts as financial conditions tighten.

or raise rates more?

I thought retail investors (like myself) are stepping in to buy treasuries. I’m sure that’s not near enough, but does that mean rates could go to 4.5% for 2 yrs soon?

does that mean rates could go to 4.5% for 2 yrs soon?

I suspect they’ll go there for most of next year, and then depending on how inflation goes, maybe stay there for as long as it takes.

yeah terminal rate is key for market timers like myself. I know it’s virtually impossible for stocks, but how about for locking in high bond rates? Did anybody here do it during the 80’s teens rates?

I did. I recall buying a 10 year 14% CD in an IRA in the early 80’s. My money quadrupled by the time it matured. Shorter-term CDs Yielded about 17% but I decided to buy the long-term.

yeah i want to set it and forget it too, vs laddering etc.

With the institutional buyer void for Treasuries, will rates continue to go up?

There will be a five year tips auction announced on October 13 and the auction held on October 20. Although the bond market is closed today, Columbus Day, The tips ETFs are being traded today and they are dropping in price so the yield is going up. According to the Bloomberg website, the real rate for the five year tips is now 1.77%. That’s getting close to where you stay even with inflation even after taxes.

Auction schedule

15.05 KB

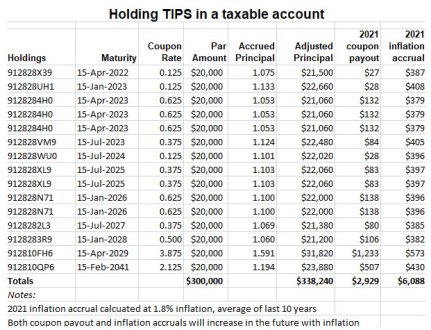

Here’s a discussion about holding tips in a taxable account including the dreaded phantom OID income problem. As the author mentions, it is not a huge problem especially if you have income from other sources to pay the tax on the OID.

An issue that the author does not mention is that tips interest and OID is not taxable by the state. That makes a big difference in high tax states like my California. If you hold the tips in a retirement account then you’ll have to pay state tax on the total withdrawal.

By David Enna, Tipswatch.com A couple years ago, just as my wife and I were both retiring, we went through a rigorous financial planning exercise with an hourly-fee adviser. We were in sync on almo…

Meanwhile across the pond The bank of England is still doing quantitative easing

The BoE said it would buy up to 5 billion pounds of index-linked bonds a day, the same as its maximum for normal bonds.

It hopes that its action will reduce the risk of pension funds being forced to sell index-linked and other bonds which could create a self-perpetuating loop of sales as prices fall further.