I liked some of these guys market commentary generally, specifically their “bubble” series.

1Q22 FV Quarterly Report (update)

FV - Part III: Apex of a Bubble

—-

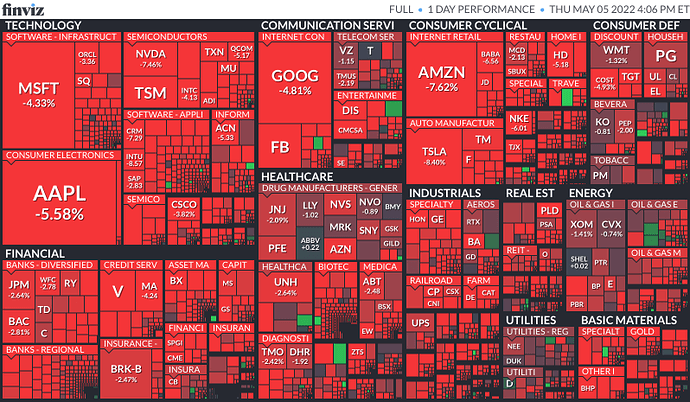

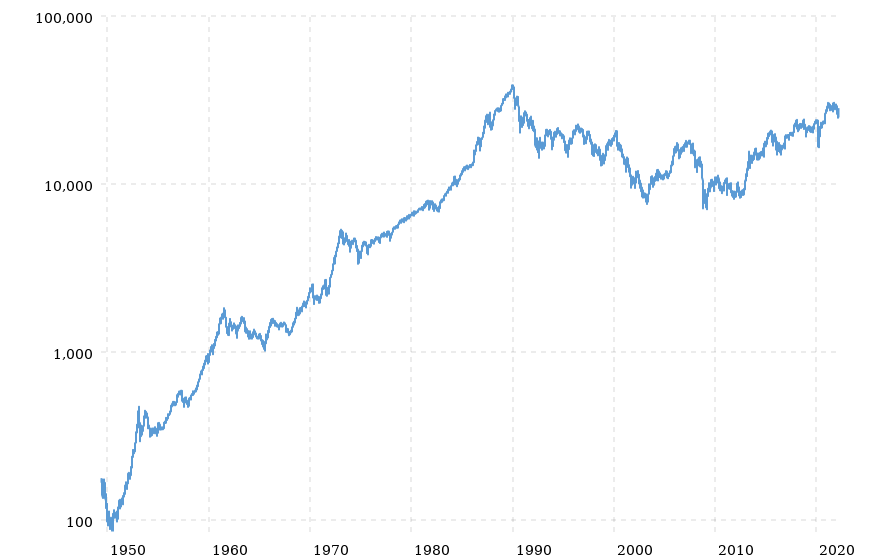

Investors seem increasingly in denial of what is an unequivocally disastrous fact pattern for an equity market that is still trading near all-time high valuations. And despite all the bad news that has come in since September, the worst is yet to come.

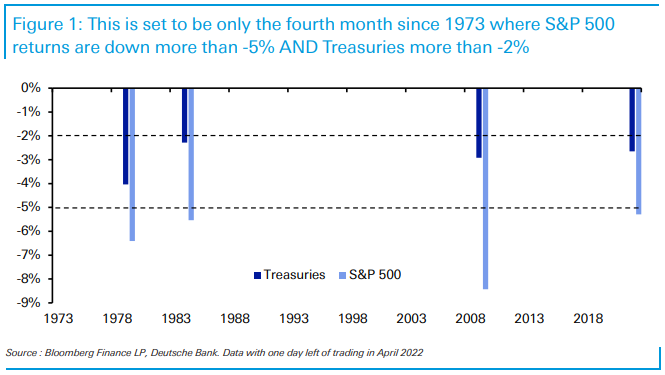

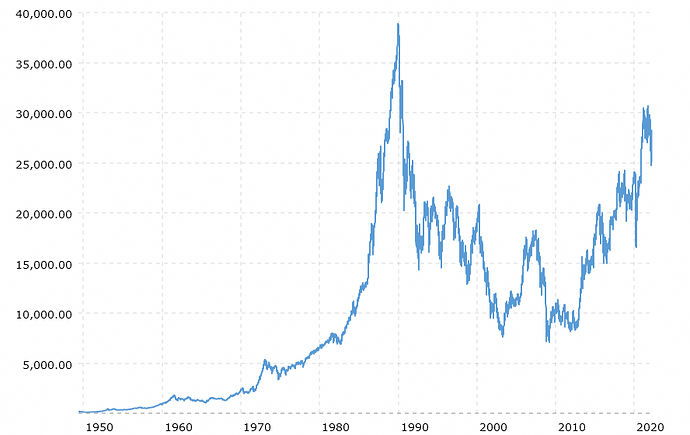

While monetary conditions have tightened, the vast majority of interest rate increases are still ahead of us. The Fed has only just begun one of the sharpest – if not the sharpest – tightening cycles of all time. And the great balance sheet unwind has yet to even begin.

Fiscal policy is contracting as well. Bloomberg’s survey of economists predicts a budget deficit of 5.3% of GDP in 2022. This is an enormous budget deficit – in fact, bigger than all deficits from the start of data in 1968 until the financial crisis. Nonetheless, the deficit in 2021 was 10.8%, so the fiscal stimulus impulse is sharply negative. This 5.5% contraction in spend is unprecedented, several percentage points larger than all pre-covid reductions.

Real yields have soared: the 10y real yield briefly turned positive after being at roughly -1% last September. This creates competition for risk assets which had been priced in comparison to deeply repressed – and deeply negative – real risk-free rates. We expect real yields will continue to increase, as they will need to be substantially positive before inflation can be reined in. Rising rates will likely cause substantial multiple compression.

Furthermore, we expect equities to be pressured by falling corporate profitability. Corporations have benefitted from insatiable consumer demand created by unprecedented government largesse. But that is ending, and demand destruction is coming. High inflation is a tax on the consumer, especially the spikes in the cost of food, energy and shelter. Margins are at all-time highs and have likely peaked. Corporations will be squeezed by rising labor and input cost inflation and many will have difficulty passing those costs through to consumers.

Credit risk metrics are flashing warning signals. Five-year CDS spreads are up 50% since September for both investment grade and high yield credits.

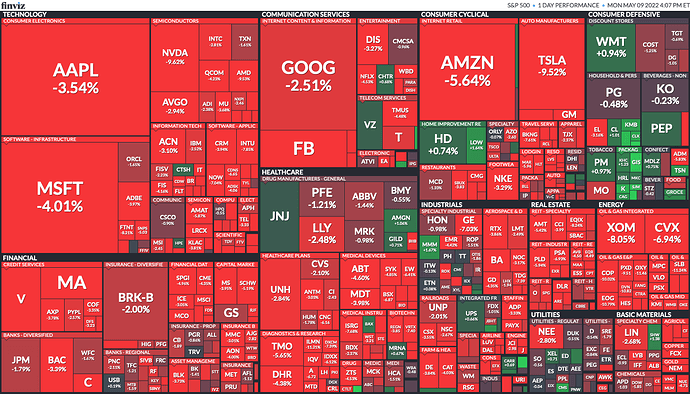

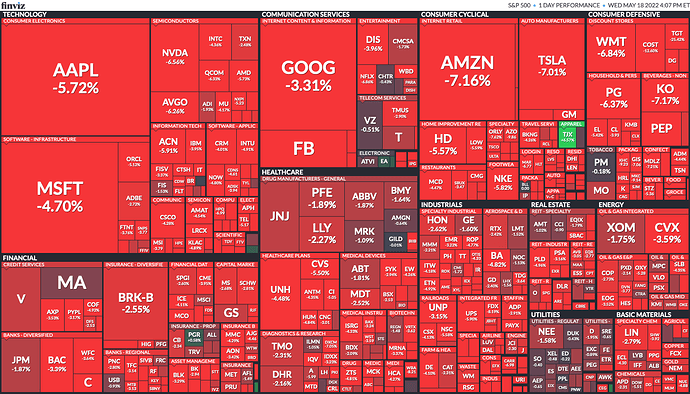

This is all deeply troubling. And equity investors seem to be aware of it on some level. In one survey, they report being more bearish than they’ve been in thirty years. But, given the buoyant S&P 500, they don’t appear to be backing up their words with actions.

We suspect that many equity investors are playing an extremely dangerous game of musical chairs. They know that the music is about to stop, but they are still dancing. They are betting that they will be able to find a seat before the person next to them. Unfortunately, most of them will not.

Investors are poised with their fingers over the sell button. This creates the conditions for a crash. Caveat emptor.