Cross post from inflation, for this good set of charts and macro discussion

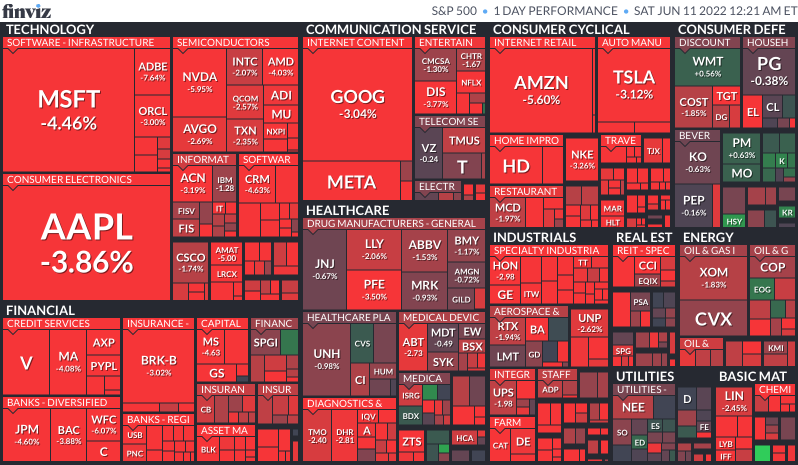

Basically, his claim is that as real interest rates rise, equities become less attractive. The P/E ratios that were inflated by TINA thinking and zero interest rates are unwinding. Credit risk measures, unlike some prior overleveraged crashes, are holding up fairly well, so that this is a valuation driven bear market, not a crash.

@xerty, no offense toward you in the following comments. I read only 1 or 2 of these kinds of things a year, and it’s nice to have a look at them more frequently. However, it sounds to me like they’re rehearsing for Sesame Street (if that’s still a thing).

The above is how I felt until getting further into the charts. Some are quite good - particularly the Piper Jaffray manufacturing forecast. Also the crypto update is a gem. I could read it several times, repeating the same chuckles. Please continue to post these as you see fit.

I thought this was common knowledge. Don’t tell me everyone has been oxygen deprived from a couple of years of mask wearing?

True, but aren’t most bear markets valuation driven? To my knowledge, in my lifetime, the only over-leveraged crashes were in 2000/01 (over-leveraged/valued tech stocks) and 2008/09.

Another gem from the report:

Economic growth is likely to fall as central banks tighten.

And a funny evaluation of a couple of cryptos. I looked for @meed18’s, but couldn’t remember the name.

SANDBOX: Gaming token used by people buying virtual land, possibly to plant tulips on

LUNA: Whatever it was, rest in peace

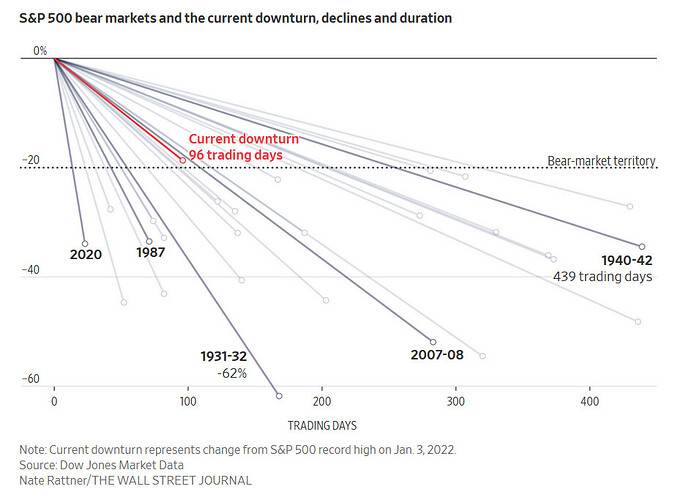

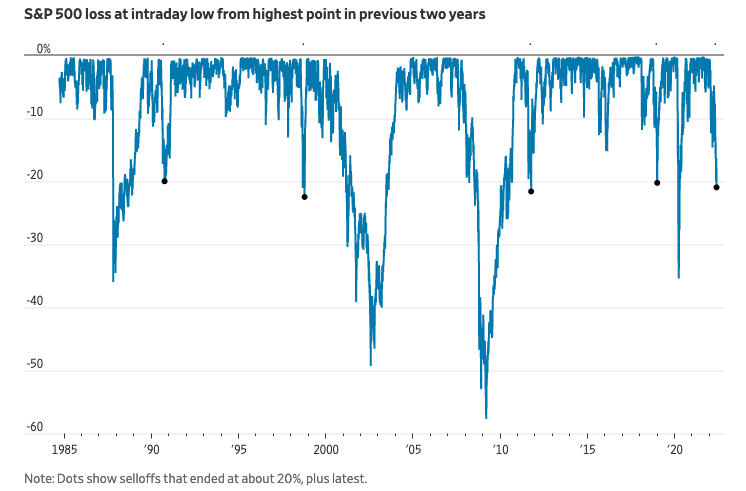

In the past 40 years, the S&P 500 has bottomed out with a 20%-or-so peak-to-trough decline four times, in 1990, 1998, 2011 and 2018. Another four times it had far bigger losses, as true panic took hold.

The common factor in the 20% drops was the Federal Reserve. Each time, the market bottomed out when the central bank eased monetary policy, with the stock market’s fall perhaps helping push the Fed to take the threats more seriously then it otherwise might."

And the Fed’s not close to being done…

Mine was USDC. It is still currently pegged to $1, so no losses there. But I’m completely out at the moment. Too spooked by what happened with UST and Stablegains, which I had my money in for a month before determining it was took risky and pulling it all out back in December and putting it into Voyager instead (Stablegains used UST to make its money, Voyager does not). Stablegains is now defunct and their depositors lost most of their money, depending on when they got out, if they were able to.

There but for the Grace of God go I. I didn’t pull out of Stablegains because I knew how they made their money and it seemed more risky than Voyager. I pulled out because they were an unknown upstart startup and Voyager was more established, publically traded, and had audited financial statements that looked similar to a bank. Stablegains paid 6% more than Voyager. Every month when I got my 9%, I would get somewhat sad that I wasn’t getting 15% from Stablegains. But I just didn’t want to risk them running off with my money. I had no idea the actual principal would disappear without them stealing it.

What is that other dot next to 2007-08? Also, what is the dot below 1940-42? WHY AREN’T THESE LABELED?!?!?!

This was the original WSJ article for that chart. The rest wasn’t super interesting

Well it won’t help stocks go up, but it’s something the SEC can do well - make arbitrary rules, this time about ESG advertising.

Nobody cares if the “ESG fund” actually does any ESG-things, they just want to feel better about themselves and brag about it. Otherwise, you wouldn’t see ESG indexes kicking out the (no longer supporting Democrats) Elon Musk’s TSLA and letting in Exxon!

Interesting that materials are about 8% down. I would have thought they would go up.

It’s not a “tech sell-off.” It is a massive repricing of abstraction. We had a bubble in dreams.

Dimon speaks out:

Beginning late last year with high-flying tech names, stocks have been hammered as investors prepare for the end of the Federal Reserve’s cheap money era.

“Right now, it’s kind of sunny, things are doing fine, everyone thinks the Fed can handle this,” Dimon said. “That hurricane is right out there, down the road, coming our way.”

There are two main factors that has Dimon worried: First, the Federal Reserve has signaled it will reverse its emergency bond-buying programs and shrink its balance sheet. The so-called quantitative tightening, or QT, is scheduled to begin this month and will ramp up to $95 billion a month in reduced bond holdings.

The other large factor worrying Dimon is the Ukraine war and its impact on commodities, including food and fuel. Oil “almost has to go up in price” because of disruptions caused by the worst European conflict since World War II, potentially hitting $150 or $175 a barrel, Dimon said.

Shin, was this the situation back in the early 70’s? If you knew this will be again like the 70’s, how would you prepare?

TIA for words of wisdom and experience.

I like your foresight, but I’m pretty sure this isn’t going to be anything like the 70’s.

Whereas FDR took us slightly off of the gold standard, Tricky Dick did the full monty in the early 70’s. Thus, our debt and deficits, despite a decade long war were minimal in the 1970’s, both in quantity and via various ratio and percentage metrics. Cranking up the interest rates had much less of an effect on the debt than it will today.

Additionally, Ronald Wilson Reagan inherited very high tax rates (top marginal rate of ~70%). He cut them, which helped to stimulate the economy and get it out of the brutal recession (10+% unemployment) caused by Volcker’s inflation taming high interest rates. Whoever is in charge at the White House doesn’t have as many ways to stimulate the economy.

I really cannot remember at that level of detail. But clearly there are important differences between now and then. Most significant, in my view, is today’s outsized $30T debt. I’m not certain even Chairman Volcker, whom I admire very much, would have been able readily to deal with such as that.

What I’m doing this time is watching events in an effort to gauge when inflation might be peaking . . . . and not too long thereafter presumably interest rates. And that is when I plan to jump in with both feet.

But when that inflection point might occur, given the turbulence in today’s world, I have no clue. You watch. You pay attention to events. You wait. And you hope for the best.

See - problem solved. They just revalue every $1000 old Evil Trump Dollas to be $1 New Biden Bucks and your debt goes from $30T to $30B overnight ![]()

Good catch, xerty. Correction made.

God, I’m surely losing it. Reminds me of Biden. But fortunately I’m not POTUS!! Nor should anyone my age be POTUS.

More specific Dimon comments, from an employee event

At the Wednesday JPM dinner, Jamie was asked about his concerns around the economy after the articles cited him calling for an “economic hurricane.” He reiterated his concern about rising rates, Quantitative Tightening and the impact on the economy, but he went one step further by saying something to the effect of: “** I will be generous and suggest there will be a 20% chance the Fed can pull off a soft landing, but I don’t think it is that high. There is a 30% chance of a recession. There is a 30% chance of a bad recession and there is a 20% chance of something worse than that. ”