Still crushing Alliant month to month for 3%

They can’t seem to even make it to 2% (LOL)

Alliant is still my favorite when it comes to overnight ACH’s…

Very True

Well, it’s the 1st of the month, and (as i expected) Alliant raised it’s rate! Savings account went from 1.95% apy to an even 2.0% apy… Alliant finally makes the 2% apy group…BREAK OUT THE CHAMPAGNE!

I’m generally an Alliant fan. Have been a member for more than ten years and Alliant is one of my hub accounts.

But I’m tiring of running into unpublished arbitrary limitations at Alliant. This time, once again, it happened to me with bill payer. Last time they got me with their $30,000/day payment limit. But, OK, I have been working around that one ever since without complaint and “making it work” anyway.

Just now they socked me again with a new one I never saw coming. Are you aware there is a completely arbitrary $20,000/day limitation on payments to any single payee at Alliant? Where is that published? If it is, I missed it. Only discovered this limitation at moment I was actually seeking to schedule the payment, too late to put things right.

I would like to know who it is at Alliant making up such annoying limitations . . . . so I could give that person a piece of my mind.

Alliant has boosted the interest rate for Alliant savings to 2.1% APY.

Say 2.10% apy…it sounds better…lol Glad to see them make the move

Received an email asking for SSN & DOB of my AU, stating that the bank is “required” to obtain it and then use it for CRA reporting. I suspect this is a new policy.

Reporting for AU would be a negative and undesirable, so I’m inclined to ignore the email and find a reason to not provide the info (many people don’t even have a SSN) in case they act on it. Anyone have experience with this or suggestions?

I had to provide this information for my wife when adding her as a joint member to my Ally checking account last year. As far as I know it’s a legit new CRA reporting rule to collect this info for joint or AU account members.

We also had to create a separate user profile for her to link banks that are in her sole name for ACH transfers. When trying to link her other checking accounts under my profile Ally rejected the linked accounts but of course it worked OK with her profile. We never had any of these issues with our old joint bank account with Chase. I don’t know if Alliant has the same linking issues though.

Between Player 2 and myself, we’ve probably opened 10 accounts (savings, credit card) in the last year and it seems to have become more often than not lately that they required sending in one or more pieces of documentation like this. She just had to send copy of driver’s license and a W-2 to join NFCU. The latter could have been most anything that documents the address. But … the driver’s license already does that, doesn’t it? Still had to send both. I suspect this diligence is related to the Equifax breach.

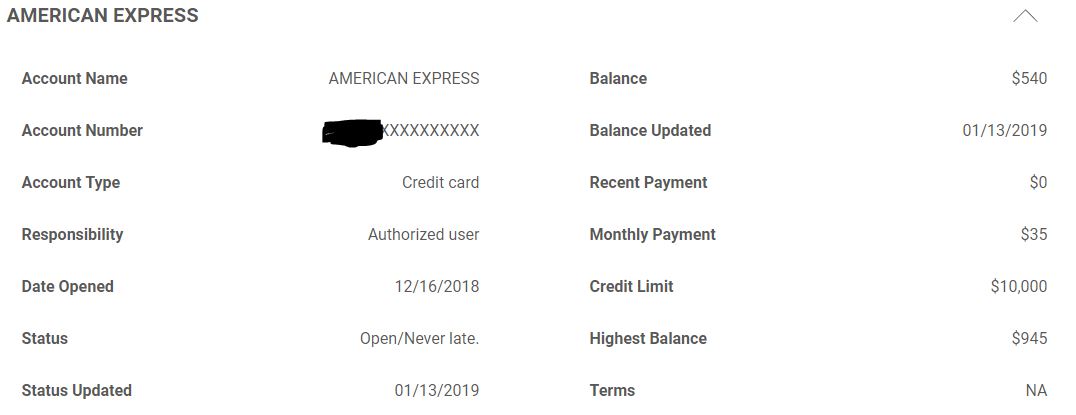

Agreed. I was added as an AU for Player 2’s Amex Blue Cash Preferred and it was reported as a new card for me.

If you meant the physical card, agreed. I had not seen mine in decades so had to get one for some account. If you literally meant the number, I can’t see how there would be any significant number without one these days since you have to have one to have income or to be claimed as a dependent (if you are eligible for a SSN).

I understand that this information is needed for JOINT accounts or to join a CU.

In this case it’s just an Authorized User of a CC who isn’t responsible for the CC and is not a member of the CU.

I meant the number, not the card. My AU could be an illegal immigrant, or even a citizen with no job, income, or parents who applied for an SSN for the child. My AU doesn’t have to have income, because they’re not responsible for the credit card balance. OK, “many” probably not millions, but tens of thousands. I did some searching online and found quite a few large banks who don’t ask for SSN for AU, which implies there’s no law or regulation requiring it. So it could be a bank policy, however misguided.

Do you mean that it didn’t report the original account opening date for you?

My mistake, I thought you were adding them to the bank account. I agree, they shouldn’t need DOB for an AU. Some lenders may ask for a SSN of the AU so they can report card activity to the bureaus but that should be it but most can report it without you having to provide it to them.

Much of the time an AU is added strictly for the purpose of having reporting history added to their reports so it is usually seen as a good thing that if it does.

I think you’re right. In efforts to comply with increasingly strict “Know your customer” regulations, different banks are doing different things.

No, they reported the account as just opened. although it is indicated as status of authorized user. I haven’t bothered to figure out if it is included in my average age of accounts or not.

Anyone have any info or opinions on how the scammer got a hold of Alliant’s member contact info? Received this email this evening from Alliant.

A scam has recently been identified in which a caller, pretending to be from Alliant’s Member Care Center, is calling Alliant members and attempting to obtain debit card PINs.

If you receive a call from someone saying they are an Alliant Member Care representative who needs your debit card number or PIN, hang up and do not provide the information.

The caller, who appears to be calling from our phone number, will give you a reason why your PIN is needed. For example, the person may tell you that Alliant needs to reissue your debit card, but to do so you must provide your debit card number and PIN.

They may just be calling random numbers hoping to hit an Alliant CU member. Just like when the calls threaten you owe money to the IRS and you are going to jail. They don’t know you owe money, they are just hoping to hit someone who does or at least is scared they might.

That seems like a long shot. Everyone deals with the IRS, I’d guess that a vast majority of randomly called people wouldnt even know what Alliant CU even was.

Remember, any merchant data breech likely exposes your name and phone number along with the credit card info. And if you know the card number, you know who issued it.

I am a bit surprised that Alliant hasn’t gotten out in front of this question. It seems so obvious. I may call and see what they say.

Perhaps someone hacked into the system of one of those affiliates that send out junk mail.

If that happened, we’ll probably never find out. But there are ways to protect yourself before it happens ![]() .

.