I agree, the Fed rate is going to have to actually go up before we see any meaningful move in liquid rates.

I reported my Alliant Visa lost on Feb 12. Replacement arrived around 2/23. (* I say around because I use a PO Box and only check it 1-2 times per week).

Both Alliant’s savings and checking interest rates have held for March. The rates are unchanged from February.

Well I’m definitely not on a shutdown list.

I got a call from Alliant this afternoon. I have a 2 year $100k CD maturing there on Sunday that I opened at the start of the pandemic as a hedge in case rates tanked to near zero (which they essentially did).

They tried very hard to get me to renew it. Evidently they have a private rate sheet that’s available to select clients. Access to that required a call to some advisor located in LA, which I declined.

I’m not sure what to do with the cash in these times. My take is that putting it in the market at this point seems wrong since the full impact of the sanctions on Russia have yet to be felt by the west. On the other hand, the fed seems poised to raise rates. I think I am going to hold onto it for a bit.

You won’t be able to put all $100k in, but I-Bonds are worth a look.

That would’ve been worth hearing them out, even if just to see what kind of “special” rates are available. I’ve always wondered just how much extra you can get above quoted rates, if you position yourself just right.

I once got a similar-sounding offer from Washington Mutual (a few months before their demise) after cashing out my 100K CD (0% BT money which I needed to pay back the CCs). Turned out they wanted me to talk to their in-branch “investment advisor,” who showed me past results (!) of some uber expensive front-and-back-loaded mutual funds.

I’m a little disappointed with Alliant. This past week they made a large error with my savings account. I called in and spoke with a supervisor who was, while not disrespectful, cool and rather distant. She tried to resolve my problem with their back office, failed, and promised me a call back within 48 hours.

They never called back. The problem was finally put right, something I discovered only this morning, three days later. They did not bother to credit me with the interest I lost because of their error.

I want to post more detail but I’m instead going to be a bit guarded. Sorry.

The bottom line takeaway is that Alliant’s website becomes somewhat unreliable during the overnight, in the wee small hours of the morning. I’m talking about when you use the website during those hours to conduct business as opposed to merely checking your balances. As specific as I’m willing to be is this:

Shortly after midnight, Alliant’s IT does not know with certainty what day it is. It is better, if avoidable, not to conduct business with them at that time. Wait, if you can, until say after 4:00 am . . . when you should be safe and not encounter the sort of trouble I did.

Incidentally, before somebody pipes up with this, everything I do at Alliant rests on Central time. Period. So when I mention “what day it is” I’m within a context of what day it is in Chicago. And I took the trouble to confirm with the supervisor that Alliant operates on Central time, as I thought, not on (for example) Pacific time. So I knew what day it was in Chicago, and they did not.

Yes Alliant CU has gone downhill from the CU of the old time when I first discovered it.

Now I’m wondering about whether I can actually add another ACH account. The answer is No. Even if I suggest closing out a few old accounts. My problem is back in the day, Alliant didn’t care how many different ACH accounts we had. I have many…

Back in the day, I had 3 separate personal accounts. When Alliant started closing peoples accounts, I felt pretty safe. Then I made a mistake and transferred funds out before account was balanced. Right away 2 of the accounts were closed. No explanation.

But I also had a Trust Account and they didn’t touch it. They did put a hold on ACH transfers for a period of time. Finally I’m pretty much in good graces again. I have no limit on ACH transfers, well just the normal. $25K out, $100K in.

I’m in agreement with others about liking Alliant overnight transfers. Savings .55% rate. But just stay on their good side!

What will happen?

One week from Thursday is the end of the first quarter. We will have Alliant’s decision on April Fool’s Day. End of the quarter is an opportune time for them to reward the faithful.

Will they throw us savers a bone? Something? Anything? Even an upward movement of 0.05% on our savings rate, up to 0.60% APY, would be a show of empathy and caring for besieged Alliant members. A larger boost than that, of course, would be much better. The Fed has moved up a quarter point. Will Alliant follow suit with at least some sort of increase?

The argument on the other side probably acknowledges that Alliant has kept us at 0.55% APY forever. And that rate is higher than many, and has been. So maybe they do not feel as if we have an increase coming . . . . . not yet anyway.

But I certainly would like there to be some upward movement in our savings rate, even a small one. We shall see what happens next week.

What would you do if you were running Alliant and had full responsibility for protecting the company and clients and making sure the company remained solvent?

Well I certainly wouldn’t listen to the peanut gallery.

I’ve been fine with Alliant’s .55% APY, but I generally agree with Shin’s point. I bet there will be a few banks and CUs that inch their savings rate up given the recent fed action. Being a current rate leader, I would speculate that a non-trivial percentage of Alliant’s deposit base is there because of that very fact - they’re a rate leader. It certainly isn’t their customer service which went out the window after Mr. Mooney left. So I think it is in Alliant’s best interest to remain competitive here.

That said, their recent programs make it seem like they are more interested in spending money on attracting new customers. These $200 avocado toast gift cards might lure in the Doctor of Credit bank bonus crowd, but they do little to incentivize those who are after top rates or reward those who have been with Alliant for a long time.

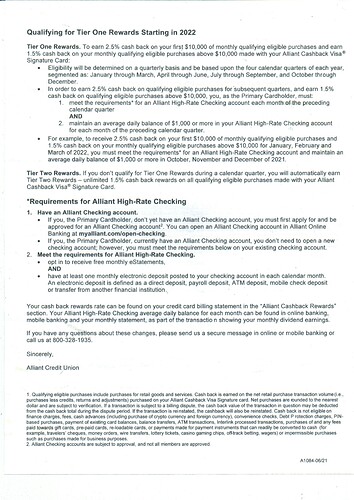

Anyone know the exact details of the Tier One rewards for the Visa Signature? Specifically, it’s not clear from the T&C what a “month” is. Both the website and the PDF say something like: “For example, to earn Tier One Rewards for January, February and March of 2022, you must meet the above requirements in October, November and December of 2021.”

Are the tiered rewards earned in the billing cycle or in the calendar month? If my billing cycle starts on the 14th of the month and I met the requirements for Q4 of 2021, when do I start earning Tier One, 12/15/21, 1/1/22 or 1/15/22?

As expected the rate bumped up slightly to 0.60%. https://www.alliantcreditunion.org/rates

Not a lot. But something is better than nothing. This change caused me to move money into Alliant from Ally, because Ally stood pat.

Good question. I had to go back to the beginning of the deal in an effort to respond. I didn’t move the required amount into checking until the last gun fired. So when was that exactly?

I boosted my checking balance up to the $1000 required minimum on first of August of 2021. And of course that balance has been maintained ever since. So my take is Alliant is evaluating by the calendar month, and not by the billing cycle month. Hope this helps. ![]()

So did you start getting 2.5% on Jan 1, since you were too late for Q3 cut-off?

FYI, they don’t require a “minimum”, they require an “average daily balance”. I believe one could keep $0 for 60 days and $3000 for ~31 days to make the cut.

Ugh. It’s not a calendar month for Tier One. Met the requirements for Q1 by 3/31, spent a few bucks (could not wait, was curious, and just a few bucks) between 4/1 and the April statement (13th?), got only 1.5% back.

Sorry you were not rewarded at 2.5%. I’m trying to recall the original terms of the Alliant offer . . . and I’m having difficulty doing so. But it might be that, while you must maintain checking at a grand for three months, it might not be on basis of a “calendar quarter”.

I can recall reading those original terms a couple of times. I remember there was a grace period going in where everyone was given presumption of having met the terms up to a certain point. After that you actually had to make sure your grand was really in checking. I read the terms until I thought I understood them, and then I just complied with the terms as written. That was easier for me than trying to dope out Alliant’s rationale. Compliance worked for me and I’ve never had a problem earning my 2.5%. Just collected another $250 this morning, in fact, and have no complaints. I spend, Alliant pays.

Sorry, @scripta. That appears now to be in error.

I went into my files and dragged out the original letter I received (last summer) from Alliant. I have scanned the portion of the letter which I think applies to your situation:

With a bit of clicking you can download that which will enable easier viewing. Hope this helps.

It doesn’t help, because it either does not answer my original question, or it answers it incorrectly (it does not define what a month is – calendar month vs statement cycle – when it comes to eligible credit card spend).

The example says: “to receive 2.5% cash back on your first $10,000 of monthly qualifying eligible purchases … for January, February, and March of 2022, you must meet the requirements for Alliant High-Rate Checking account and maintain an average daily balance of $1,000 or more in October, November, and December of 2021”.

I met the requirements for High-Rate checking and maintained an average daily balance >= $1,000 for January, February, and March. So, following that example, I should receive 2.5% cash back on my first $10,000 of purchases in April, May, and June. The April statement just closed, and although I have not read it yet, the cash back already appears on the Alliant cash back page, and it corresponds to 1.5% of my April purchases.