Here is a tentative schedule:

BTW, if you buy T-bills in the secondary market through your brokerage, would you still get the state tax free benefit?

Here is a tentative schedule:

BTW, if you buy T-bills in the secondary market through your brokerage, would you still get the state tax free benefit?

Good eye, for some reason I thought he was talking about end of 2022. I still think his prediction is too pessimistic. The expected rate (based on the link I provided) for end of July is now 0.5% higher than it was 2 weeks ago. If the best 1-yr CD today is 2.9%, and the FED is going up 0.75% tomorrow and another 0.75% at the end of July, how could short-term CDs not be 4% by end of summer?

I’d expect it to not matter. The tax treatment should be associated with the security, not the broker.

For those who care about financial institution health ratings

Here is the latest:

Bauer has now updated their credit union ratings to reflect end of March, 2022 data:

Weiss?

As usual, Weiss still is not offering updated CU health ratings based on the most recent available data.

[quote=“scanchain, post:2797, topic:643”]

And it ended yesterday at 2.85%. I would’ve thought it would’ve risen, to some extent, following a 3/4% rate hike. My first reaction is that the market isnt expecting the Fed rate hikes to have nearly the effect on bank rates as some believe. What am I not understanding, because it feels like there is a significant detail I’m overlooking?

The yields have already been rising in anticipation of the hike. Sometimes the anticipation part overshoots, and I have seen this happening before.

Some CD rates are actually falling!

Connexus

—Updated 6/21/22 ----

**Apparently, Colorado Federal Savings Bank LOWERED the rates because of widespread interest over the weekend. **

Updated (LOWER) rates not so good…

12-month (1.95% APY)

18-month (2.07% APY)

24-month (2.30% APY)

36-month (2.65% APY)

60-month (2.97% APY)

Colorado Federal Savings Bank new CD rates:

12-month (2.41% APY)

18-month (2.40% APY)

24-month (3.00% APY)

36-month (3.20% APY)

60-month (3.35% APY)

**$5k minimum deposit

NOTE: Early Withdrawal Penalty for withdrawals prior to maturity date equals 1 month of interest on Certificate Term of less than 6 months, 3 months’ worth of interest on certificate term of 6 months and one year, and 6 months’ worth of interest for a certificate term over one year.

The mild EWP makes the 60-month CD competitive. If a recession reverses inflation and rates fall in the next year or remain stagnant, you’re still earning 3.35% APY; if rates continue to rise, the loss of six months of interest could be offset by a higher rate offered elsewhere.

Rising Bank 15-month No Penalty CD at 1.75% APY, $1k minimum deposit, early closure only.

NOTE THE FOLLOWING WHICH MIGHT NIX THE INCENTIVE TO OPEN THIS NP CD

*Compounding frequency – Interest will be compounded every three months

*Crediting frequency – Interest will be credited to your account every three months

*Effect of closing an account – If you close your account before interest is credited, you will not receive the accrued interest.

***Only an early closure is allowed and a loss of three months’ interest (accrued but not credited) is possible, depending on when a 15-month NP CD is closed. To avoid a loss of interest, an early closure should be made soon after the 3-, 6-, 9-, or 12-months interest has been credited. Outside of those time frames, the early withdrawal penalty is essentially up to three months of interest, depending when you close it. For example, closing it a day before the interest is credited would result in the loss of three months of interest.

**Apparently, Colorado Federal Savings Bank LOWERED the rates because of widespread interest over the weekend. **

Updated (LOWER) rates not so good…

12-month (1.95% APY)

18-month (2.07% APY)

24-month (2.30% APY)

36-month (2.65% APY)

60-month (2.97% APY)

It seems like for whatever reason, most people are not going for treasuries, which still have rates that are better than the original (not lowered) rates offered by CFSB. Maybe it is because of the mild CFSB EWP or the perceived difficulty of buying treasuries.

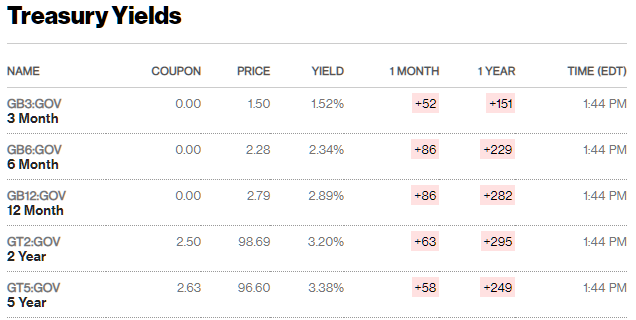

Agree, treasury yields are more compelling.

LOWERED the rates because of widespread interest

Right. When financial institutions get too far out ahead of the prevailing interest rate market they attract more customers than they really contemplated or want. Rate cuts follow.

This is not as much a problem with CDs as it is with liquid money accounts, a reason NPCDs are worthy of consideration. NPCDs are quite liquid, but the rate is locked in.

Good news

The Weiss Ratings health analyses for credit unions, based on end of March 2022 data, have dropped.

Weiss Ratings

Weiss Ratings

The only ratings agency that combines the broadest coverage, strictest independence, complete objectivity, high ethics, and a commitment to safety.

This concludes financial institution health ratings releases for the end of March 2022 go around.

Watch for ratings based on end of June 2022 data to become available in September.

Penfed 5 year cd at 3.5%. Steep early withdrawal penalty, all dividends if <365 days, 30% of total dividends that would’ve been earned at maturity if >365 days. Only open if you’re sure you won’t close early.

It’s a special running through 7/7

https://www.penfed.org/accounts/money-market-certificate

Why would anyone do this when you can get 2.8%-2.9% on 1-yr CD or T-Bill? Everything long-term is a guaranteed loser.

Why would anyone do this when you can get 2.8%-2.9% on 1-yr CD or T-Bill?

When you are a retiree who needs $X annual income, and 3.5% gives you $X+Y, you may jump on the opportunity to lock in your financial security, plus an extra cushion, for the next 5 years. For some [alot?] people, the certainty and security of knowing what you will be receiving is more important than trying to maximize what you will receive. Especially as you reach the point where there’s a decent chance you wont outlive that 5 year term anyways. I have a large stash of funds in one of those GTE 3.3% CDs for another 2 years, that I dont regret for just that reason.

Plus, while I agree with you that long term rates are going to get better before they start getting worse, we all know that the average person struggles to understand the intricacies, and only thinks about how 3.5% is so much better than the 1.75% (or .5%) they have been earning.

Where do you think CD rates will top out this cycle? I’d love to be wrong but I don’t see 4% 5-year CDs becoming commonplace so this offering isn’t bad for right now.

I’m going along with this. Remember a few years ago when a 4% CD was almost impossible to get. I did manage to gather as much free $$s to pick up one before the bottom of these rates ended (never to be seen again).

I’m willing to wait until we see 4% CD’s then I think I’m going to go for one of them. But we’ll see.

When you are a retiree who needs $X annual income, and 3.5% gives you $X+Y… Especially as you reach the point where there’s a decent chance you wont outlive that 5 year term anyways.

This does not make sense to me. Wouldn’t a retiree that lives on such low margins (where 3.5% is OK but 2.8% is not enough) want to draw down their balance instead of locking it in for 5 years?