Look, he hit his head a couple of times, so cut him some slack. Oh, and he was the first VP to a black President, so he gets double slack. Additionally, he is the first President with a female VP, so he gets triple slack. I won’t mention the color of the VP for fear of getting a penalty for piling on.

They’re actually filling up the Strategic Oil Reserve. not much, but it’s going in the right direction.

My hat is off to you, sir. I bet you could find a silver lining in a black hole. ![]()

It makes the world go round ![]()

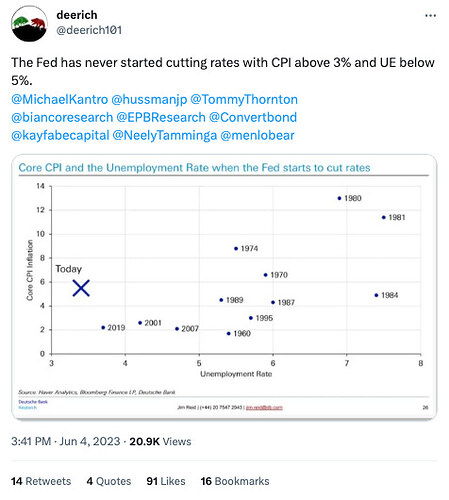

Corollary: so you think CPI will be above 3% and UE below 5% when they start cutting rates? ![]()

Cutting rates is the consequence. The premise is that the effects of the rate increases lag, so the increases will end up pushing the numbers to the other side of those thresholds mentioned.

According to the quoted post, I’m pretty sure that OR would make it a proper corollary.

I wasn’t going for an inverse and I didn’t change the premise – I did the same thing that glitch99 did just below my post and above yours. Xerty questioned the consequence, because apparently he doesn’t think the premise is true. I’m asking whether the premise could become true in time for the consequence.

I can guarantee that the the premise could become true in time for anything. ![]()

May CPI was lower, only 1.2% annualized for the month, thanks to lower energy prices among other things. Core CPI however was still elevated and largely unchanged at 4.9% annualized.

US CPI MoM: 0.1% (Est. 0.2%)

US Core CPI MoM: 0.4% (Est. 0.4%)

US CPI YoY: 4% (Est. 4.1%)

US Core CPI YoY: 5.3% (Est. 5.3%)

FED SWAPS SHOW LOWER JUNE RATE-HIKE ODDS

I do not know how this is related to PCE. I think that’s the measure that’s most closely watched by the FED. Several news report said that the PCE for May is due later this month.

Most pundits attributed the drop of oil price to slow down in China. Looks like the OPEC production cuts are not having much effect.

With the price below $70/barrel, the SPI must be almost full by now. Thank you, Don Giuesppe President Joseph Robinette Biden.

ETA, well it’s almost half full. ![]()

Of course not, they are still selling oil

they drained 1.9mm barrels last week - the 11th week in a row (for a total drain of over 20 mm barrels)…

Fed left rates unchanged today but put forward a hawkish tone for the future.

- FED KEEPS RATES UNCHANGED AS EXPECTED

- FED SAYS HOLDING RATES ALLOWS FOMC TO ASSESS ADDITIONAL DATA

- FOMC: Voted 11-0 For Fed Funds Rate Action

- FOMC: Economic Activity Has Continued To Expand At Modest Pace

- FOMC: Holding Rates Steady Allows Assessment of Policy Impact

- Fed Signals Additional Rate Increases Possible Later This Year

- Fed Officials See 3.2% Inflation at End of 2023, 2.5% End of 2024

- Fed Officials See 3.9% Core Inflation at End of 2023, 2.6% End of 2024

- Fed Officials See U.S. GDP at 1.0% in 2023, 1.1% in 2024

- FED SAYS `EXTENT OF ADDITIONAL’ FIRMING TO HINGE ON ECONOMY

- FED MEDIAN RATE FORECASTS RISE TO 5.6% END-

23, 4.6% END-24 - Most Fed Officials See Rate Cuts in 2024

immediate impacts

- BLOOMBERG DOLLAR INDEX PARES LOSS AS FED PAUSES RATE HIKES

- FED SWAPS PRICE IN HIGHER PEAK POLICY RATE OF 5.35% IN SEPT.

- U.S. 2-YEAR/10-YEAR YIELD CURVE INVERTS FURTHER TO A NEGATIVE 93.7 AFTER FED STATEMENT

Yeah, I promised to pay my bookie, too. ![]()

Interesting insight from David Enna at tipswatch regarding future inflation rates

The decline in the annual inflation rate should continue through June, because U.S. inflation increased 1.37% in June 2022, a shockingly high number. So we should see the official U.S. inflation rate dip below 4.0% in the June report, but after that it should stabilize or potentially rise because year-ago numbers cooled off dramatically from July to the end of 2022.

So while today’s numbers mark a positive trend, in a few months we could see that trend reversing, with U.S. annual inflation inching higher or even moving sharply higher if energy prices reverse.

The higher interest rates were not “caused by the federal reserve”. They were caused by the Fed having to fight inflation due to the reckless government spending.

Additionally, higher interest rates caused by the Federal Reserve are expected to make interest payments on the national debt more costly than they have been in decades, which means even more borrowing will be needed to stay current on those payments.

Powell comments to Congress

- POWELL: IT MAY MAKE SENSE TO MOVE RATES HIGHER, AT MORE MODERATE PACE

- POWELL: WE WILL RETURN TO 2% INFLATION

- POWELL: HARD TO KNOW WHAT RATE LEVEL WILL ACHIEVE FED’S GOALS

- POWELL: WE ARE MOVING BALANCE SHEET BACK DOWN, BUT WON’T GO BACK TO A SCARCE RESERVES LEVEL

- Powell Says US Recovery Is by Far the Strongest of Any Country

- Powell Says Improved Immigration Also Helping to Boost Labor Supply

and on other topics

- POWELL: DONT WANT TO REGULATE SMALL BANKS SO MUCH THAT THEIR BUSINESSES ARE CHALLENGED

- Powell: We Benefit From Having Banks of All Different Shapes And Sizes in System

- Powell Says Dollar Status as Reserve Currency `Very Important’

- POWELL: WE WOULD NOT SUPPORT A CENTRAL BANK DIGITAL CURRENCY FOR INDIVIDUALS

- POWELL SAYS IF WE DID HAVE A CBDC IT WOULD BE INTERMEDIATED BY BANKS

Biden is refilling the Strategic Re-election Reserve, so it must be all fine now right? Check out those numbers of barrels inbound vs outbound.

WASHINGTON, June 30 (Reuters) - The U.S. Energy Department bought 3.2 million barrels of oil for the Strategic Petroleum Reserve, it said on Friday, as the Biden administration slowly replenishes it after sales last year pushed the reserve to the lowest since 1983. The Biden administration will announce on July 7 another solicitation to buy an unspecified amount of oil for the reserve to be delivered in October and November, the department said. The administration has bought 6 million barrels for the reserve this year after selling a record 180 million barrels to fight high oil prices after Russia invaded Ukraine. It hopes to buy at least 12 million in total this year for the reserve.