Those lofty goals were obviously created by the Dept. of Education - setting “standards” that make sure everyone is left behind.

some recent Fed commentary

- FED’S LOGAN: WOULD HAVE BEEN OK WITH A JUNE RATE INCREASE

- FED’S LOGAN: THE FED BALANCE SHEET OUTLOOK SHOULDN’T AFFECT RATE OUTLOOK.

- LOGAN SAYS MORE FED RATE HIKES ARE LIKELY NECESSARY

- FED’S LOGAN: TREASURY ACCOUNT REBUILD LIKELY TO COME FROM OVERNIGHT REVERSE REPO.

- FED’S LOGAN: ‘VERY CONCERNED’ AS TO WHETHER INFLATION WILL COOL QUICKLY ENOUGH

- FED’S LOGAN: THE HOUSING MARKET MAY HAVE BOTTOMED OUT.

- FED’S LOGAN: I AM SKEPTICAL ABOUT LAGGED IMPACT OF PAST FED RATE HIKES.

- FED’S LOGAN: THE HOUSING SECTOR REBOUND MIGHT THREATEN PROGRESS ON INFLATION.

- FED’S LOGAN: THE JOB MARKET AND INFLATION ARE BOTH HOTTER THAN EXPECTED IN 1H 2023

- FED’S LOGAN: I DON’T SEE THE FED BALANCE SHEET DYNAMIC CAUSING LIQUIDITY PRESSURES.

- FED’S LOGAN: JOB MARKET, INFLATION BOTH HOTTER THAN EXPECTED IN FIRST HALF 2023LOGAN: SKEPTICAL ABOUT LAGGED IMPACT OF PAST FED RATE HIKES

- FED’S LOGAN: WE ARE SKEPTICAL ON THE LARGE CONSEQUENCE OF RATE-HIKE LAG EFFECTS.

- FED’S LOGAN: TIGHTER CREDIT IS DUE TO TIGHTER POLICY, NOT BANK STRESS.

- FED’S LOGAN: MORE-RESTRICTIVE POLICY ID NEEDED FOR THE FOMC TO REACH GOALS.

- FED’S LOGAN: MORE FED RATE HIKES ARE LIKELY NECESSARY.

- FED’S LOGAN: A CHALLENGING AND UNCERTAIN ENVIRONMENT ENABLED THE JUNE PAUSE.

- FED’S LOGAN: THE PROCESS OF REBALANCING THE ECONOMY IS SLOWER THAN EXPECTED.

- FED’S LOGAN: IT’S IMPORTANT FOR THE FED TO DELIVER ON JUNE RATE OUTLOOK PROJECTIONS.

- FED’S LOGAN: I SEE NO SIGN OF AN ABRUPT WORSENING IN LABOR-MARKET CONDITIONS.

In a related development, the two year treasury note interest rate is above 5% and the ten year rate is above 4%

Edit. For the CD fans, the five year interest rate is 4.4%, noncallable and no state or local income tax.

The inversion continues. I think that what it portends will take longer than normal to arrive, but arrive, it will.

- FED’s LOGAN< Talk 90% less, and someone may pay attention when you do speak. You will also have 90% less opportunity to sound like a fool.

Some news

https://www.cnn.com/2023/02/14/politics/interest-payments-federal-debt/index.html

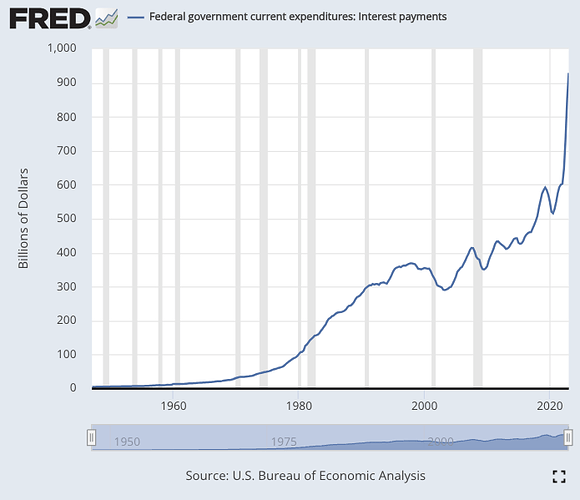

Like many Americans, the federal government is shelling out a lot more money to cover interest payments on its debt after a series of Federal Reserve rate hikes over the past year.

The Treasury Department paid a record $213 billion in interest payments on the national debt in the last quarter of 2022, up $63 billion from the same period a year earlier

Probably more complicated but simply multiplying by four implies $852 billion interest per year

More news

Since I thought the lead was hokum, I read the article to see where they fessed up to the actual numbers. Apparently, they’re correct, although they don’t say how much has been loaned or withdrawn.

The SECURE 2.0 Act that passed at the end of 2022 created six new ways to access retirement accounts penalty-free before age 59 ½, according to Parrish. The goal was to motivate workers to contribute more by making it easier to tap those funds if needed without penalty.

So the best idea to get people to save more is to make it easier to get it out? D.C. is full of expletive the brainiacs that we deserve, especially since we voted them in.

To put this in perspective, interest on the national debt was 10% of government spending in 2022.

Social Security 20%

Defense 12%

Medicare 12%

Interest 10%

https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending

Fed comments ahead of CPI this Wed.

- FED’S MESTER: THE FED’S POLICY IS LESS RESTRICTIVE COMPARED TO HISTORY.

- FED’S MESTER: THE FED WILL NEED TO TIGHTEN SOMEWHAT FURTHER TO LOWER INFLATION.

- FED’S MESTER: FED RATE HIKES HAVE BEEN MODERATING ECONOMIC ACTIVITY.

- FED’S MESTER: BUSINESS LEADERS’ WORRIES OF RECESSION HAVE DECLINED.

- FED’S MESTER: DEMAND FOR LABOR STILL OUTSTRIPPING SUPPLY.

- FED’S MESTER: WAGES PRESSURES REMAIN TOO HIGH TO GET INFLATION BACK TO 2%.

- FED’S MESTER: CORE INFLATION GAINS ARE TOO HIGH AND TOO BROAD BASED.

- FED’S DALY: US ECONOMIC MOMENTUM CONTINUES TO SURPRISE

- FED’S MESTER: THE FED IS CLOSER TO THE END OF TIGHTENING CAMPAIGN THAN ITS START.

- FED’S MESTER: INFLATION IS STUBBORNLY HIGH AND STALLED PROGRESS ON CORE PRICES.

Interest payments on the national debt well be $1 trillion in 2023

https://twitter.com/profstonge/status/1677676163622133761?s=20

Inflation was +0.2% monthly for June, both Core and total CPI, which corresponds to a ~2.5% annualized rate.

https://www.bls.gov/news.release/cpi.nr0.htm

CPI MoM For June 0.2% Vs 0.3% Expected; 0.1% Prior

CPI YoY For June 3.0% Vs 3.1% Expected; 4.0% Prior

Core CPI (YoY) (Jun) 4.8% vs 5% Est.

Core CPI (MoM) (Jun) 0.2% vs 0.3% Est.

- US CPI YOY ACTUAL 3.0% (FORECAST 3.1%, PREVIOUS 4.0%)

- US CORE CPI MOM ACTUAL 0.2% (FORECAST 0.3%, PREVIOUS 0.4%)

- U.S CORE CPI (MOM) (JUN) ACTUAL: 0.2% VS 0.4% PREVIOUS; EST 0.3%

- U.S CORE CPI (YOY) (JUN) ACTUAL: 4.8% VS 5.3% PREVIOUS; EST 5.0%

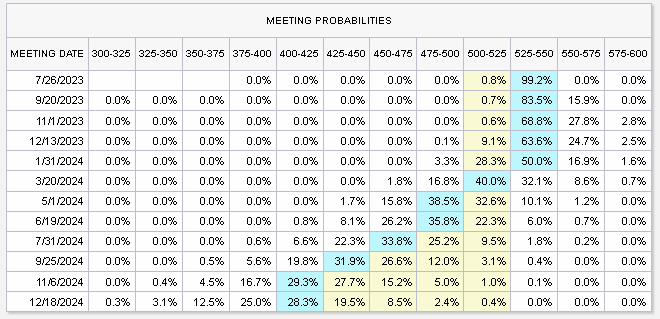

Lower inflation so maybe fewer rate hikes needed -

- US SHORT-TERM INTEREST-RATE FUTURES RISE AFTER INFLATION DATA, AS TRADERS PARE EXPECTATIONS FOR FED RATE HIKES AFTER JULY.

- FED SWAPS PRICE IN LOWER ODDS OF SECOND RATE HIKE THIS YEAR

From my post above by David Enna of tipswatch

Helicopter Ben weighs in

LOL it doesn’t take a genius to read the chart!

I’m not a genius, but the way I read the chart it is forecasting a substatial probability of a rate increase later this year. That is not what Ben said.

Don’t know what you’re looking at. The blue cells are highlighted to show the highest probability for each meeting. A .25 increase next Wednesday, no action for the next 4 meetings, and decreases after that.

Looking at the 550-575 column, there are probabilities of up to to 0.28 over the next few meetings. Ben predicts 0 chance.

Not according to the article you posted, where he said: “It’s possible this increase in July might be the last one.” Possible and might, not definite.

Whatever. I do not think Ben is right and neither is the consensus that there’s a 1-0.32 = 0.68 probability that the fed will cut rates by March 2024. But that is what makes a market. I am keeping my fixed income duration short and mostly buying six month T-bills. We shall see if that pays off.

In the meantime, the United States continues to run huge budget deficits and interest on the national debt is skyrocketing