Agreed. The silver lining about those Chase Freedom categories is that they do not overlap with the Discover categories for Q1.

Updated for Citi Q1/Q2 2020

I found the links on the CITI Dividend card to sign up for the next quarter did not work (Firefox and Chrome both tried). Chat did not have authority to sign me up. A phone representative could.

I will try to use much of the $300 that can be earned on groceries, so I will not have to bother with them the rest of the year (amusing case where a bad web site leads to more spending, at least in the short run).

Possibly may have to get signed up for Amazon for quarter afterwards, and then spend just enough on gift cards to use the part of the $300 left over.

yes for years I have 2 Dividend cards. can never sign up online but as you state…wasted time on phone and rep. But rep signed me up. They are a bit different then Disc and Chase… you can do all of the bonus (300.00 for the year during any q. ) Did 300.00 bonus on each card for years but got screwed out of 18.00 last year. Would not post the final 18.00 so only got 282.00. Other card got the 300.00. Waste of time talking to them. My time was worth more then 18.00. Pretend not to know what I am talking about. HUCA 3 reps same thing.

Check out the ABOC 5% card. Not true 5 but pretty close. They have utility bills 1st q… So just overpay for 1500 and get 75.00 back. Other q. are ok but not great. Card is free. I will use the utility cat at ABOC to free up my USBank cash plus for other 5% cats.

[quote=“barrytuneup, post:105, topic:2029”]

ABOC

[/quote]I believe ABOC stands for Amalgamated Bank of Chicago. From reviews their quarterly offers are generous (and you apparently do not have to remember to sign up for them or make phone calls)). However, review say that to get full value you have to use them for travel (see ABOC Platinum Rewards Review: 5X Back in Rotating Bonus Categories - NerdWallet). What has been your experience with them, and the value of the points, and ease of redemption.

Their offer for this quarter is

“Recurring payments (including utilities, cell phone plans, cable, insurance payments, streaming services and subscription services).” This more generous than US bank’ utilities since it covers several other categories." The offers for the next quarters seem broader than the competition.

I also notice they have a small signup bonus $150 with $1200 required spending, which I probably could cover with utilities in the first quarter), and a 0% on purchases for the first year.

Also on their UNION strong card “Beginning on Jan. 1, 2020, the introductory 0% APR on balance transfers is being extended to 18 months, with the same 3% balance transfer fee as before. The no-interest period for new purchases will remain at 12 months.”

For cash back credit on card…thats why I said the 5% is not really 5% but close. For every maxed out cat…75k points = 57.00 for credit to card. Chase/Disc/Dividend all will be 75.00. But for a MSer…this is a great no fee option. Im going to use it starting tomorrow for the utility cat and max it out with a 1500 payment to NYSEG… Amazingly their web sites are very bad. Still have not changed to the 1/1/20 cat on their site. Still have the old cat showing thru 12/31. But with the bonus its great!! happy new year! to all.

How are they if you try to get travel with our points, which is apparently the best use? Their categories appear to include more items than the other cards, such as having insurance this quarter as well as utilities.

we do not travel… only via car!! so dont know about their travel redemption… Sorry

You probably have access to their Rewards Web site, so it may be possible to see what they offer.

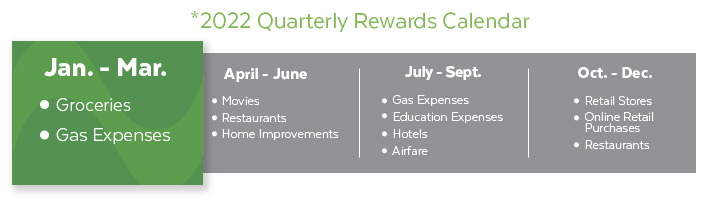

Nusenda Rewards for 2020 have been made public. They are again providing rewards for the third quarter for educational expenses, something not included in most card programs

I applied on the ABOC Union card and was rejected because I had too many cards already. I could imagine others being rejected on the same basis.

Chase Freedom Q2: Grocery, gym, fitness.

https://www.chasebonus.com/ registration starts 3/15

I again could not find a way to sign up for 5% with my CITI Dividend card. The stated link does not work. Anyone know a way without phoning in?

What about the link in your account when you log in? Or the link they send you in email?

They cancelled my card last month (after converting it to a TY card a few months ago), so I don’t have one anymore…

They cancelled my card too. I lost some 20k+ TYP. Then they sent several emails saying my new replacement card is on its way!

I can’t login to the TYP website, but they said I could call back in and still redeem for 60 days (4/24). I need to call in and wait the hours on hold (assuming their call center is still open for TYP).

That said… I misspoke/typed. They didn’t cancel my dividend card – that one doesn’t have TYP. They cancelled the rewards+ or whatever that they replaced some other TYP card, which they had replaced my Forward with, which they had replaced my MTVu with. All involuntary replacements.

The dividend card does not have TYP, so if they closed your dividend card you should not have lost TYP. The dividend card has a cash balance.

I started with a Dividend card which I converted to Forward which they converted back to Dividend which they again converted to Rewards. Then as a “thank you”, they closed my account.

Was there any explanation for these card cancellations? They repeatedly suggest I convert to another card, which suggests they want to get rid of this card. The non-functioning sign up part of their web site could be a hint they do not wish to put resources into maintaining it, or possibly a devious strategy to discourage people signing up for 5% on the quarterly categories.

I would like to keep mine because of the 5% on certain quarterly purchases. I used it in the last quarter for groceries to get 5% back, as an aid to not exceeding the $6,000 limit on 6% for an Amex Blue.

My other recent use was primarily to keep it active because (if I recall right) they can take your accrued rewards if you do not use it for a year.

Mine was exactly 24 months inactive. So, probably avoidable. I had stopped using it though from all the forced conversions, plus Citi cut all the tertiary card benefits last year. I was actually trying to activate the rewards+ they had just sent me from the last conversion, to only use that card on <$5 purchases (since it rounds up to next 10 points on every purchase). It was really still a marginal card even for that use though, not worth my time for 10 cents.