Saw this today. Won’t be good for the stock.

Oil and Gas stocks are going to be risky short term…they may pan out for long term but are not good income choices for now.

Good Article. Uses ETF’s as opposed to individual stocks which is always safer.

This is not one I can recommend others jump into unless they are willing to wait longterm (possibly years) to reap the benefits. As the author mentions it’s purely speculative however these stocks did tank like everything else in March and if they eventually recover after the pandemic the potential profit is huge. The dividends right now are rather insane (one is over 20% and the other is over 10%) so they may get cut tomorrow for all we know. The points in it’s favor is these are luxury hotels and upscale urban malls…not the ones tanking we see in the news. It’s certainly going to be post pandemic (and possibly post recession) before their stock price returns. I did initiate buys on these two that will execute tomorrow morning (m1finance does buys at 9:30 am once a day unless you are a plus member where you get an afternoon buy as well).

If the market is pricing in a dividend cut then they are sorely mistaken as Altria just came out with strong earnings and raised their dividends.

His point is that for a while now, their growth has been maintained through price increases, not growing their customer base. Eventually, their pricing power will not be able to keep up with customer attrition. The market is pricing in that concern, not knowing if it’ll happen next year or next decade. But it’s going to happen, and their attempts to diversify from tobacco havent exactly been home runs.

The smoking population has been declining since the 1960’s and that stock has still outperformed the S&P500 over that time period. I think that is an overblown concern. Looking at analyst reports they expect profits to grow through 2023.

A bigger risk in my opinion is ESG investing going mainstream and people refusing to buy into sin stocks.

After my recent purchases including 3 I don’t think I mentioned my portfolio stands like this:

Please note this entire portfolio is only 10% of my overall retirement. The 90% is in well diversified etf’s based on m1finance’s “Aggressive 2020” which is intended for folks retiring in 2020. I had to pick that last year because there was no simple way to indicate you are ALREADY retired. If I had to do it NOW I’d have to pick their 2021 plan.

Stocks with a good dividend and growth potential

Holdings

23

Dividend Yield

7.325%

Expense Ratio

0%

Portfolio locations

★

Retirement

Dividend and Growth

Slices (23)

Name

Target

★

T

AT&T

5%

★

C

Citigroup, Inc.

5%

★

F

Ford Motor Co.

5%

★

PEAK

Healthpeak Properties, Inc.

5%

★

SPG

Simon Property Group, Inc.

5%

★

BNS

The Bank of Nova Scotia

5%

★

SO

The Southern Co.

5%

★

VLO

Valero Energy Corp.

5%

★

ABBV

AbbVie, Inc.

4%

★

AYX

Alteryx, Inc.

4%

★

BRX

Brixmor Property Group, Inc.

4%

★

DKL

Delek Logistics Partners LP

4%

★

GIS

General Mills, Inc.

4%

★

HT

Hersha Hospitality Trust

4%

★

KMI

Kinder Morgan, Inc.

4%

★

MAC

Macerich Co.

4%

★

O

Realty Income Corp.

4%

★

STX

Seagate Technology Plc

4%

★

SQ

Square, Inc.

4%

★

STOR

STORE Capital Corp.

4%

★

TTD

The Trade Desk, Inc.

4%

★

WBA

Walgreens Boots Alliance, Inc.

4%

★

WELL

Welltower, Inc.

4%

For anybody currently considering or buying stocks this site looks amazing. I’ve only been playing with it for a few days but it linked to my brokerage via Plaid so no actual user/pass is given to them and showed a wealth of information. It emails you stock “briefs” with info about upcoming events. I am currently on information overload with the site. All of this is free although they do have a plus service that has even more features. They have a referral service but I have no idea what that gives you or me.

Enjoy!

Are referral links allowed on this forum?

No idea. If not, @scripta please remove or I will upon notice. I don’t know what it gives me anyway…probably only useful if i was a plus member. I know on slickdeals you can’t post a referral but you can say “if someone wants to use my referral message me otherwise here’s the regular link…”

I’m not a moderator so I can’t edit your post (but thank you for thinking that I might be). Please remove it yourself.

Sorry for the mixup. Fixed!

For those wanting a simple blueprint to follow consider the following list of 25 Top Ranked Stocks Increasing Dividends For Decades.

#25 . Consolidated Edison Inc (NYSE:ED) — 4.03% Yield

#24 . Telephone & Data Systems Inc (NYSE:TDS) — 3.45% Yield

#23 . T Rowe Price Group Inc. (NASDAQ:TROW) — 2.62% Yield

#22 . Federal Realty Investment Trust (MD) (NYSE:FRT) — 5.55% Yield

#21 . Bank OZK (NASDAQ:OZK) — 4.47% Yield

#20 . United Bankshares Inc (NASDAQ:UBSI) — 5.26% Yield

#19 . Northwest Natural Holding Co (NYSE:NWN) — 3.61% Yield

#18 . Walgreens Boots Alliance Inc (NASDAQ:WBA) — 4.55% Yield

#17 . Essex Property Trust Inc (NYSE:ESS) — 3.88% Yield

#16 . Eaton Vance Corp (NYSE:EV) — 4.06% Yield

#15 . Realty Income Corp (NYSE:O) — 4.72% Yield

#14 . National Retail Properties Inc (NYSE:NNN) — 5.97% Yield

#13 . Black Hills Corporation (NYSE:BKH) — 3.75% Yield

#12 . South Jersey Industries Inc (NYSE:SJI) — 5.09% Yield

#11 . Cincinnati Financial Corp. (NASDAQ:CINF) — 3.06% Yield

#10 . Franklin Resources Inc (NYSE:BEN) — 5.03% Yield

#9 . AT&T Inc (NYSE:T) — 7.02% Yield

#8 . UGI Corp. (NYSE:UGI) — 3.98% Yield

#7 . Old Republic International Corp. (NYSE:ORI) — 5.13% Yield

#6 . New Jersey Resources Corp (NYSE:NJR) — 4.06% Yield

#5 . AFLAC Inc (NYSE:AFL) — 3.17% Yield

#4 . Prosperity Bancshares Inc. (NYSE:PB) — 3.30% Yield

#3 . Chevron Corporation (NYSE:CVX) — 6.08% Yield

#2 . Exxon Mobil Corp (NYSE:XOM) — 8.24% Yield

#1 . People’s United Financial Inc (NASDAQ:PBCT) — 6.74% Yield

I currently own shares in #5, #9, #15, and #18 so some excellent additions for consideration. I’d price shop to see which stock purchase prices are still down and how much…for example PBCT is down 29.33% in last year. Exxon is down 38.20% in last year. Chevron is down 26.96%…etc. So in addition to a great dividend it they have a better than normal upside potential.

This guy does a fantastic job of explaining how he determines the best stocks. Well worth the read as are his other articles.

Here’s a stock to look at. Make sure you note the last paragraph.

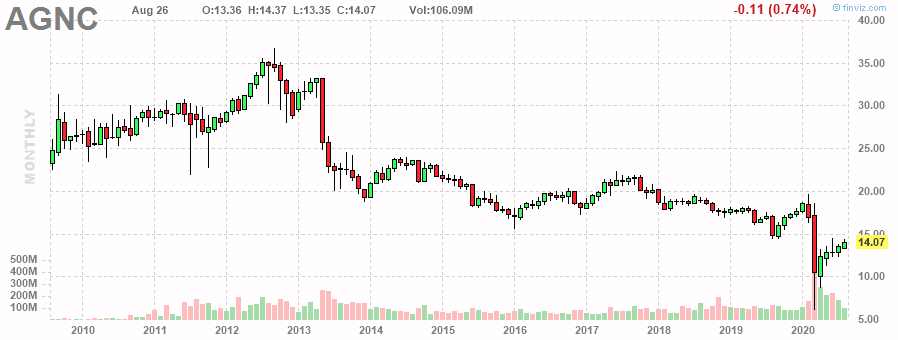

Monthly Dividend Stocks: AGNC Investment (AGNC)

Source: Shutterstock

Dividend Yield: 10.4%

AGNC Investment functions like a REIT but with a twist. It invests in agency mortgage-backed securities on a leveraged basis, funded primarily through collateralized borrowings structured as repurchase agreements — effectively a mortgage REIT.

In easier terms, AGNC has a business model that focuses on borrowing capital at low rates and investing it in higher-yielding securities. Any difference is then distributed to shareholders in the form of a monthly dividend. Since government agencies like the Federal National Mortgage Association (OTCMKTS: FNMA ), or Fannie Mae, guarantee the security of the investments, AGNC stock is a very safe investment.

But how safe is it, really? They’ve always been in the same business (agency-backed securities), and look at the chart. That dividend won’t do you much good if the principal keeps eroding. That’s probably why the yield is so high.

Reit’s have certainly been in a downward slide in the past but the consensus among alot of people is that with the recent economy and stock market people will be returning to stocks that provide dividend income and are tied to real assets such as real estate or infrastructure. Also keep in mind they’ve been paying 10-14% for quite some time. 10% is on the LOW side of their payout history. The last time they lowered their dividend was $0.15 decrease on 12/18/2013. Payout history is available here:

Some factors to consider:

- They pay monthly which is really nice for people wanting income. Obviously I wouldn’t put every dollar I own into any one stock. It should be part of a balanced portfolio. The one I started and posted about now has 35+ stocks in it. I’ve purchased SEVERAL REITS looking at their long term prospects rather than short term covid pains.

Apologies as some of these links are blocked unless you are a seekingalpha subscriber. Typically content is free for around 24 hours before being locked behind the paywall. They usually leave the first paragraph or so, so you can get some idea of whats going on and they list the stocks mentioned at the very top of the article. None of this is an issue for non seeking alpha posts.

[Partially blocked] Assessing AGNC Investment's Results For Q2 2020 (Running On All Cylinders) (NASDAQ:AGNC) | Seeking Alpha

[Available - talks about AGNC preferred shares] How To Increase Future Income Without More Risk | Seeking Alpha

[Written on Aug 7th] from fool article above:

Like just about every mortgage REIT out there, AGNC trades at a discount to book value. AGNC’s current discount is just about 15% as of Friday morning. Historically, mortgage REITs stay close to book value, so it is likely for AGNC’s stock price to approach book value over the next few months. In addition, the company pays a $1.44 annual dividend, which works out to a 10.5% dividend yield. Finally, book value per share should increase as the company buys back stock and earns much more than it pays out. For income and value investors, AGNC Investment Corp. should be worth considering.

This doesn’t even go into how some investor’s sell options a few dollars above their purchase price and rake in the fee’s from those to raise the Yield returned percentage. I have not dabbled with options yet.

I mentioned I’ve added significant stocks to my Dividend and growth pie and decided I’ll share it. About 1/2 the people on seeking alpha are very secretive because they want you to buy their marketplace service to see their whole portfolio’s. A few generously share information however and that’s who I’m trying to emulate. Obviously no guarantee’s but in the year I had the first 16 stocks they went up 35% in value. As I’ve added stocks it’s diluted that although at one point it was up to 45%…it’s currently at 30.70% return. kmi, bns, and vlo have done poorly in stock price but continue to pay an attractive dividend. T, PRU and ENB all pay a 7% return and are doing particularly well overall. There are many articles listing them as stocks for retiree’s. FYI there’s some additional content after his huge list too. ![]()

Stocks with a good dividend and growth potential

Holdings

38

Dividend Yield

7.365%

Expense Ratio

0.06%

Portfolio locations

★

Retirement

Dividend and Growth

Slices (38)

Name

Target

★

ABBV

AbbVie, Inc.

3%

★

ACC

American Campus Communities, Inc.

3%

★

T

AT&T

3%

★

AVB

AvalonBay Communities, Inc.

3%

★

BRX

Brixmor Property Group, Inc.

3%

★

DKL

Delek Logistics Partners LP

3%

![]()

★

ENB

Enbridge, Inc.

3%

★

FRT

Federal Realty Investment Trust

3%

★

GIS

General Mills, Inc.

3%

![]()

★

HT

Hersha Hospitality Trust

3%

★

NNN

National Retail Properties, Inc.

3%

![]()

★

OKE

ONEOK, Inc.

3%

★

PAA

Plains All American Pipeline LP

3%

★

PRU

Prudential Financial, Inc.

3%

![]()

★

O

Realty Income Corp.

3%

![]()

★

STX

Seagate Technology Plc

3%

★

SPG

Simon Property Group, Inc.

3%

★

SPE

Special Opportunities Fund, Inc.

3%

★

SQ

Square, Inc.

3%

★

STOR

STORE Capital Corp.

3%

★

SO

The Southern Co.

3%

★

TTD

The Trade Desk, Inc.

3%

★

WBA

Walgreens Boots Alliance, Inc.

3%

★

WELL

Welltower, Inc.

3%

★

AGNC

AGNC Investment Corp.

2%

★

AYX

Alteryx, Inc.

2%

★

C

Citigroup, Inc.

2%

★

EPR

EPR Properties

2%

★

F

Ford Motor Co.

2%

★

PEAK

Healthpeak Properties, Inc.

2%

★

KMI

Kinder Morgan, Inc.

2%

![]()

★

MAC

Macerich Co.

2%

★

MPW

Medical Properties Trust, Inc.

2%

★

SRC

Spirit Realty Capital, Inc.

2%

★

SKT

Tanger Factory Outlet Centers, Inc.

2%

★

BNS

The Bank of Nova Scotia

2%

★

UMH

UMH Properties, Inc.

2%

★

VLO

Valero Energy Corp.

2%

I’ve also setup A DGI Portfolio (stable blue chips that keep up with inflation), a 8% Growth Portfolio and a Risk Adjusted Rotation Strategy Portfolio in my IRA accounts. The article I used to set them up is now hidden on seeking alpha and I don’t see a way for me to upload a pdf I printed/saved of the article.

Dave Van KNapp publically shares his DGI (DGI = Dividend Growth Investing) Portfolio which is very similar to mine here:

Reviewing My “Mature” Dividend Growth Portfolio - Dividends and Income

The latest research is often rosy. I’ve been watching a few REITs for over a decade, during which they’ve traded 10-15% below book value the entire time, rarely close to book value. I think you are implying that the price should increase to meet the current book value, but I see no reason to expect that. And book value could just as easily go down towards the current price, and the price could drop even more to retain the historic discount.

I’m not knocking your investments or strategy, just providing a contrarian point of view.

This just does not make sense to me. I think it is utterly idiotic to buy back stock. It’s a destruction of value. If they have nothing better to do with the money, they should pay out a larger dividend.