Great points. I am not too familiar with this CU but have heard of them previously. I saw that info on another forum.

I haven’t actually shopped around for a refi (yet). I was making assumptions with them. If shopping and their posted rates look attractive, it still could be worthwhile to call and ask for something more specific.

“Origination charges” contains two line-items on the closing disclosure. Those line items are: (1) % of loan amount / points and (2) origination fee / processing fee. It’s all deductible.

Oddly Zillow is coming up empty in my area. Usually there are a crap ton of brokers but it’s now mostly big players with higher rates - we’re talking 15yr rates in the 4’s.

Going directly to some of the usual suspects (LenderFi, Provident, etc) is yielding much better rates for the same parameters. I wonder if the current situation is spooking some of the smaller correspondent lenders.

I just noticed the same thing with zillow in my area. Rates are 1% or so higher than a few days ago.

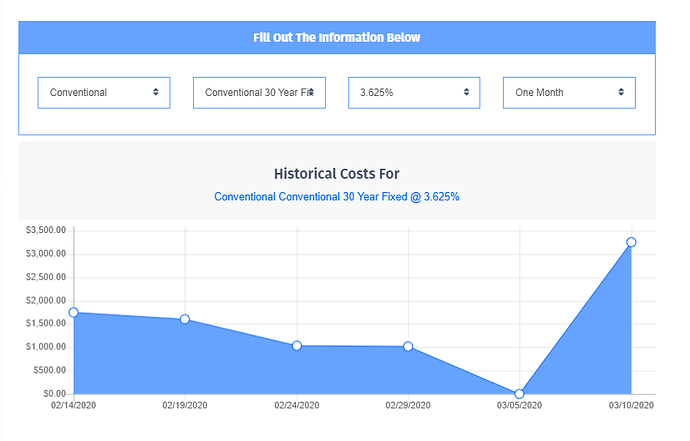

Individual lenders all seem to have strange pricing with the negative rates, i.e. 3.5% will get you -$276, 3.625 will get you -$1,070, 3.75% will get you -$144, 3.85% will get -$907. Sometimes the gap is not so large as you go up, but I don’t recall ever seeing it go down for a higher rate.

Guess I will have to wait a few days/weeks for the dust to settle and hopefully for rates to go back to a more normal situation.

MBS prices are going crazy at the moment - all in favor of lower rates. Mortgage News Daily is saying that this is the biggest swing since the financial crisis.

I suspect lenders are just risk averse and scared about swings - they aren’t willing to lock in anything until things stabilize. It probably depends on the actual lender as well - if your pipeline is full of refis at the moment and you can’t take on additional capacity without risking lock periods expiring, why not jack up the pricing and pocket the difference?

… and Bankrate is now displaying this on rate queries:

“You may find that advertised mortgage rates are higher than expected right now. Market factors have caused a surge in applications, which has exceeded lenders’ capacity levels and therefore impacted displayed rates.”

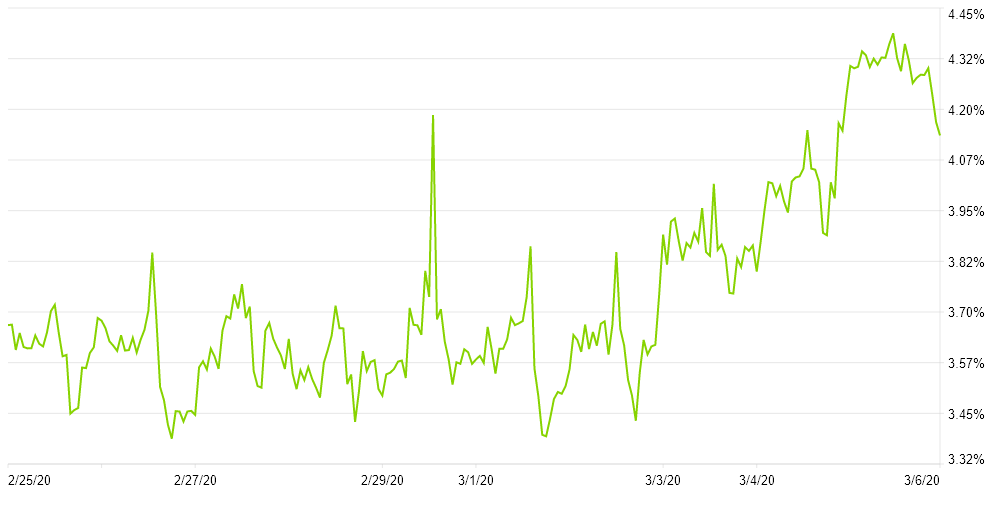

I too have noticed this. It’s evident from the rate chart that Zillow generates – it shot up to 4.3% for 30-yr fixed, even though the actual rates have barely moved.

But I don’t think they’re “spooked”, I would bet on them being overwhelmed by loan/refi applications and they don’t want to pay Zillow to get any more leads at this time. The other thing I noticed about the Zillow chart is that it has become more jagged, probably because some of the cheaper lenders have only had their rates visible during morning or business hours:

I’ve noticed this also on an investment loan, the fees are jagged, not linear as one might expect.

I don’t exactly know how the lenders insure themselves against rate swings. The “lock” protects the consumer from the rate going up. A “float down” may be offered to allow the consumer to lower their rate if it moves down significantly during the lock period. I’m guessing lenders have some kind of insurance, leverage, or they simply try to charge enough to swallow any difference. Anybody know?

Wasn’t the other day when I looked (at Box anyways). But now it is, for residential. Rates are “normal” at lower rates up until you get to ~$0 lender fees. Then fees actually go up. And you don’t get to negative cost until 4.75% (for the fee that was 3.625% the other day…)

They must really not want to do no-cost or negative cost loans. I’m just speculating, maybe they were getting a lot of chargebacks and the industry is deciding to collude to prevent chargebacks against other lenders. Just increasing profits because demand is too high doesn’t seem to explain it – because they didn’t increase the fees at the lower rates.

OTOH, demand’s probably crazy for refinances. And the lenders are probably sending most people to work from home too (and inspecting that to increase).

Crazy chart ($156k <75LTV refi).

I’ve noticed the crazy changes as well - we saw rates falling, put in an application with our local CU, and then rates jumped by a good amount overnight. We contacted our loan officer from our last refinance 4 years ago and he confirmed the huge demand is causing rates to go up. This is when knowing someone is going to be super helpful.

In our case, our loan officer is ensuring everything is ready for a lock so that when rates drop again we can lock with no delay.

The silver lining is I think the low rates are likely here to stay for a while considering it’s hard to see the current slump getting better soon. Once they are not as swamped with new refi, rates may return to normal vs. treasury yields.

A great article from MND on the current rate environment: Mortgage Rates Are Taking an Utter Beating (Relatively)

tl/dr: Investors don’t want to buy MBSes when the refi risk on them is so high. With full loan pipelines, lenders are under a ton of pressure right now to close loans AND get investors to buy the locked loans.

Great article. This explains the nature behind mortgage rates and MBSes. Investors are less willing to buy MBSes at low interest rates when people refi out of them so quickly and they end up losing money, or at least don’t get their expected return value. This decreases the demand for the week’s supply of MBSes the banks must sell, plus the fact there are so many more loans going through the banks.

The only way to get investors to buy them up is to increase the interest rate on the loan (for the homeowner). That explains why mortgage rates are increasing this week due to so many more refi’s despite the fed cut, which does not seem very intuitive that mortgage/refi rates increase in a declining rate environment.

Wouldn’t a low interest rate make it less likely for the new loan to get refinanced again?

Yes, but investors probably thought that when they bought their last round of notes and they are probably wanting to make up for their real or perceived loss of income from this latest refi bout. I’m not an MBS investor but I suspect when returns are locked in so low they may have other better places to put their money with shorter terms.

The other way I could see is if the low rate environment persists for a long while. People won’t constantly refi to a new lower rate like in an environment with rates tumbling I’d think.

I’m at 3.5%. I didn’t see a good refi deal before the virus and I still don’t see one now without having to pay a point.

For me (with my numbers and in CA, 30-yr at no cost or negative cost), between the last two weeks of January and March 3rd there were many days at 3.375, a few days at 3.25, and one day (March 3) at 3.0.