Maybe…

Huge run up in bond prices (drop in interest rates) today. The 10 year bond interest dropped from about 3.95% to 3.70%. TLT, the 20 year treasury bond ETF, is up about 3.5% today.

this was supposed to be useful for Fidelity users wanting to buy treasuries, given treasuries are very competitive with other “cash” but not quite so risk-free things like banks ![]()

It is too wordy for my taste, but I suppose it’s useful if you’re a beginner.

Here’s another explanation that’s more direct

The four week treasury bill rate for today’s May 11, 2023 auction was 5.723%

https://www.treasurydirect.gov/auctions/announcements-data-results/

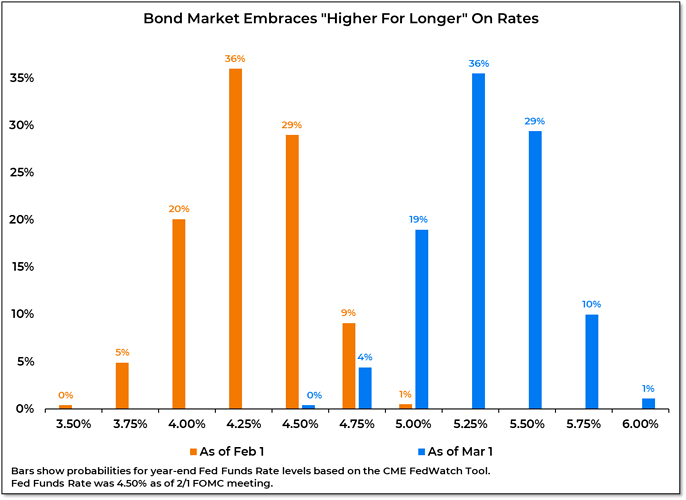

It looks like the bond market is predicting low inflation.

Despite a huge US government deficit

According to this article, the treasury will increase its issuance of bills and bonds. Investors should factor this into to their buying plan as their holdings roll over. I continue to hold a lot of short term bills.

https://finance.yahoo.com/news/traders-brace-102-billion-wave-100001923.html

This is exactly the consequence we were talking about when the fed started their campaign on interest rates.

At some point, the cost of debt service is going to balloon and the fed will have no choice but to pause rate hikes. Perhaps we are at that point now.

Was this the last time we had a posting from shinobi? It was when you guys were all involved with bonds.

To bad, never heard another word from him. ![]()

Regardless of the interest rate, the United States budget deficit is skyrocketing.

The Treasury Department said Thursday that the budget gap from October through June was nearly $1.4 trillion — a 170% increase from the same period a year earlier. The federal government operates under a fiscal year that begins October 1.

This downgrade should get somebody’s attention…

https://www.cnn.com/2023/08/01/business/fitch-downgrade-us-debt/index.html

As was mentioned in the other thread, you can get your daily dose of Shinobi/Kaight over on Ken’s site. For example: https://www.depositaccounts.com/community/ask/54275-question-alliant-credit-union-help.html

That is a question you can help him out with, Patty!

I tried to respond but I’m not a member of Ken’s site and it’s too much trouble to join. But I think ![]() you’re right that kaight sure writes like shinobi. Also all the questions about Alliant CU, it’s got to be shinobi…

you’re right that kaight sure writes like shinobi. Also all the questions about Alliant CU, it’s got to be shinobi…

Makes me wonder if they are actually the same person why the “sign off” on fragiledeal.

Who knows!!

It should, but what are the odds that CNN, PMSNCB, or any other mainstream media, including financial media, will lead with this. You’re right that it is a big deal and should be big story. Sadly, it won’t be on 90% of the news sources that most Americans see.

Is it just me, or do those two things seem at odds with each other?

Debt, i.e. government largesse with money raining for anything and everything, is being used to keep the economy firing on all cylinders. Eventually the punch bowl will be removed, but not before the next election cycle.

US credit rating downgraded to AA+ from AAA, citing higher debt costs, higher spending, and idiot politicians.

I am not seeing any large effect. Interest rates are about the same. The Standard & Poor’s 500 dropped a little over 1% but it has been going up and it was due for a correction. Also, the jobs report came in with a large increase and, in today’s upside down market, that’s not good news because it means the Fed will not cut rates.

- The Fitch Ratings downgrade of the United States’ long-term credit rating ultimately doesn’t matter, JPMorgan Chase CEO Jamie Dimon told CNBC on Wednesday.

- “It doesn’t really matter that much,” because it’s the market, not rating agencies, that determines borrowing costs, Dimon told CNBC’s Leslie Picker.

- Still, it is “ridiculous” that other countries are rated higher than the U.S. when they depend on the stability created by the U.S. and its military, Dimon added.

Effects won’t be seen until governments start thinking the USD is not the reserve currency of the world. There have been attempts by the Chinese to denominate transactions in currencies other than the USD, but most have been small potatoes, or had derivatives tied to the USD.