Domestic drilling? Oil independence is overrated, especially with our friends like Mohammed “Bonesaw” bin Salman Al Saud.

[the] decision will shrink the amount of land available for lease in the National Petroleum Reserve in Alaska

Domestic drilling? Oil independence is overrated, especially with our friends like Mohammed “Bonesaw” bin Salman Al Saud.

[the] decision will shrink the amount of land available for lease in the National Petroleum Reserve in Alaska

Why keep our wealth at home, when we can instead pay inflated prices to pad other countries’ pockets when refilling our strategic reserve?

Why use up a strategic asset, when we can use somebody else’s and save ours for later?

Later? Oh, you mean when the real threat, global cooling, asserts itself?

Har har… no I mean as a strategic military and infrastructure asset, where saving more of ours for later guarantees access at a later date, if it isn’t absolutely necessary to use it now.

Actually global cooling is a genuine existential threat. It has happened, and fairly recently. While the world survived it was VERY rough going and many perished.

So your point about having energy in the ground, in reserve, is not entirely crazy.

See the book, the moral case for fossil fuels by Alex Epstein. The author documents that we (the United States) have hundreds of years worth of fossil fuels of different kinds that are accessible economically.

Beyond that, we have virtually unlimited nuclear energy.

Various CEO and Fed inflation commentary

The following text was just posted over at depositaccounts.com by poster P_D. Everything which follows is his work:

A key difference between the Reagan/Volcker and the Biden/Powell fiscal/monetary environments in a stagflation scenario

I’ve been forecasting a high probability of eventual stagflation for over a year based on the Biden administration’s fiscal and overall policy announcements and subsequent mismanagement of both. In light of that I think it’s useful to compare the Carter administration’s stagflation scenario and the Reagan/Volcker strategy to combat it, to the potential (and seemingly inevitable now) Biden administration’s stagflation scenario so we can have some idea what to expect when the dust settles. In particular what are the key differences in the policy environments between the two that might make the economic outcomes different?

There are several, including the massive difference in federal public debt to GDP ratios between the two administrations – About 31% for Reagan and a third world socialist-like 126% for Biden. But here is one that is less publicized and is among the most important.

Volcker raised rates in Reagan’s fiscal environment of massive deregulation and tax cutting.

Powell is raising rates in Biden’s fiscal environment of massive new regulation and tax increases.

The Reagan/Volcker combo resulted in the longest period of economic growth and prosperity in modern times.

Let’s just say don’t expect that to happen again under Biden/Powell unless something intervenes to quickly reverse fiscal course.

I think Powell has pretty obviously been holding off the real rate increases until after his Senate confirmation because he knows that throwing the economy into a tailspin before the confirmation would not have been a good look for his chances. Consequently I think he is woefully late to the game and between his need to now raise rates with nosebleed acceleration to avoid inflationary Armageddon and the Biden administration’s progressive fiscal coup, we are in for a wild ride. The equity markets have apparently finally begun to come to the same conclusion.

Party change in the congressional midterms is the only hope I see on the horizon although the Biden administration seems hell-bent on violating separation of powers and overstepping its constitutional authority by legislating from the executive branch with the highest average annual number of executive orders issued in 60 years. Hold on to your wallet.

Crude is BACK UP over $100.

Natural gas is WAY BACK up!

The inflation tiger is baring its teeth and showing renewed life.

The Strategic Midterm Reserve isn’t working on Biden’s ratings. Time to do Something.

So…what else is the FTC suppose to be doing, that the Democrats want to keep them distracted from?

Wouldnt such a probe start and stop at the market price of oil? Sure there may be some random stations taking advantage of the perceptions to gouge customers, but most gas prices are pretty competitive and not out of line - profit margins on gas sales are still really low relative to normal retail expectations.

—-

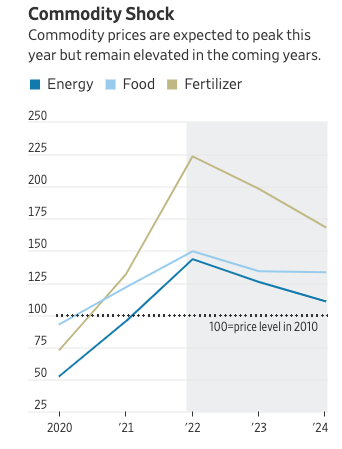

The World Bank expects commodity prices to remain elevated for years to come as the war in Ukraine alters how commodities are traded, produced and consumed around the world.

Note: Price indexes in nominal U.S. dollars. The numbers for 2022-24 are forecasts.

In its latest Commodity Markets Outlook report, the multilateral bank said that energy prices will soar 50.5% this year from last, after nearly doubling in 2021. The World Bank expects energy prices to then fall 12.4% in 2023. Food prices are projected to rise 22.9% this year before declining 10.4% next year. Food prices rose 31% last year.

Inflation forecasts from today

And the government working on lowering gas prices, maybe. This was the policy a month ago

and here we are

https://twitter.com/TeamPelosi/status/1519436231234387969?s=20&t=8E96LRCb7nhz569bhGXQKQ

More Fed missteps

New data from the Bureau of Economic Analysis shows that prices continue to rise at breakneck speed—and much faster than the Federal Reserve has projected

Although Fed officials have revised up their projections for inflation considerably, they have not meaningfully changed their course of policy from what was announced last December. It is now clear that those plans were made with very optimistic projections of inflation in mind. Those projections have since been shown to significantly underestimate the extent of the problem

and

https://finance.yahoo.com/news/filling-diesel-u-never-more-155011006.html

Be prepared to pay up and pay dearly.

Nymex natural gas rapidly approaching the magical $8/MMbtu level. Just five more cents to go.

These are remarkable times in which we are living. But how average people are making ends meet is beyond me. At least we’re coming out of winter; that is a help. But replenishment of stored natural gas must go forward now for next winter. And the gas companies will not be selling that stored natural gas at a loss come fall.

Commodities worked in the 70s I think. Oil gold, maybe BTC. RE with a fixed rate mortgage is a decent inflation hedge.

This article provides data and examples for how (and why) various assets typically perform during stagflationary environments. Bonds and growth stocks tend to have the most trouble.

Above my attempt to keeps posts on topic.

Someone made a stagflation ETF.

So at least you can see what they own and think might do well. No endorsement!

Guys I am genuinely stunned. NYMEX natural gas has blasted through the $8 barrier and is well on its way, at $8.32 currently, to the nine dollar level. This takes me back to the beginning of this century and “peak gas”.

But wait, there is more . . . . all bad:

NYMEX crude is also, once again, on the rise and sits well above $100.

With energy costs ascending like this, continuing inflation is assured.