4-week T-Bill 3.670% → 3.895% APR (3.966% APY)

Re: SFGI – To clarify: Is only one linked account allowed? With Alliant savings I pay directly my rent, one external credit card, and supplemental health insurance. Can you make such withdrawals from SFGI?

Re: Checking – Alliant’s is only 0.25%. Amex has 1% checking with little or no restrictions. Anyone with experience or recs for interest checking that has no major requirements?

I had used Paramount Checking and had no issues with it. It currently pays 3% and has no major requirements. However, it does not reimburse ATM fees, if that is important to you.

I switched to using a Fidelity account for checking. By default your money is automatically put into the MMF SPAXX, which currently pays 3.83%. But you can also manually purchase other Fidelity MMFs which pays more. The manually purchased MMFs are automatically liquidated to meet debits.

How many external accounts can I link?

You are limited to one external account that is linked at account opening.

Can you do transactions where it pulls from the vendor?

Don’t think so. That’s the same as external pull.

How do you set this up so that you get the higher rate? When looking at the fidelity cash management online it shows 2.2% based on deposits to member banks, how do you specify to do the MMF instead?

That’s for the brokerage account, not cash management account.

Just to make sure I understand this correctly, you can use the fidelity brokage account just like a checking account? Set up automatic payments, bill pay, etc, and they will liquidate MMF funds to cover the debits?

If correct are there any downsides to this besides lack of FDIC insurance? Seems better than the interest barring checking accounts out there?

Yes, the Fidelity brokerage account can function just like a checking account. I did use the CMA before, but now I instead setup a separate brokerage account for use as a checking account.

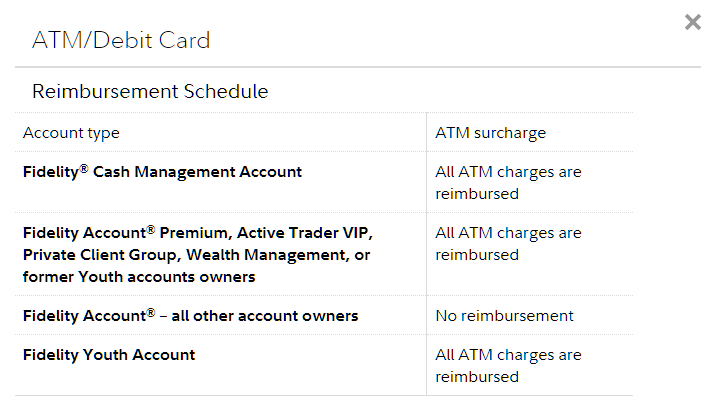

The downside to using the Fidelity account vs the CMA is that to get ATM fee reimbursements for the brokerage account, you need to have qualification status with Fidelity.

See the following Cash Management Features by Account - Fidelity

And yes, the MMFs will be automatically liquidated to cover any debits, whether in the CMA or Fidelity brokerage account.

In my Fidelity account, I put my cash into FZDXX (currently paying 4.26%). You do require a $100k initial investment, but you are not required to keep this amount once you get into the fund.

can you buy this w/ IRAs etc? link. Fido has the worst web site IMO

$10K min for IRA

Darn Fido site, All my accts say “There are no new core positions to select”. Core is FIDELITY GOVERNMENT CASH RESERVES paying 3.8%… Probably not good for IRAs

Guess I’ll have to call or can I “sell” core and buy FZDXX online?

FZDXX is not available as the core. Just buy it.

will do. Tax on FIDELITY GOVERNMENT CASH RESERVES paying 3.8% shouldn’t make a difference in IRAs right?

Not sure I understand the question. Assuming you want to hold cash, might as well hold it in one that pays higher interest rate.

Ivy Bank Indexed Savings was 3.84% now 4.03%

Western Bank MM was 3.50% now 4.25%

Bank Purely Index MM was 3.46% now 3.90%

iGo Banking Index MM was 3.46% now 3.90%

TIAA Bank MM was 3.00% now 3.35%

CommunityWide Hi Rate Monthly was 2.00% now 3.50%

Self Help CU MM was 1.89% now 2.14%